Pershing Square Activist Presentation Deck

V. Developing a Response to the

Company

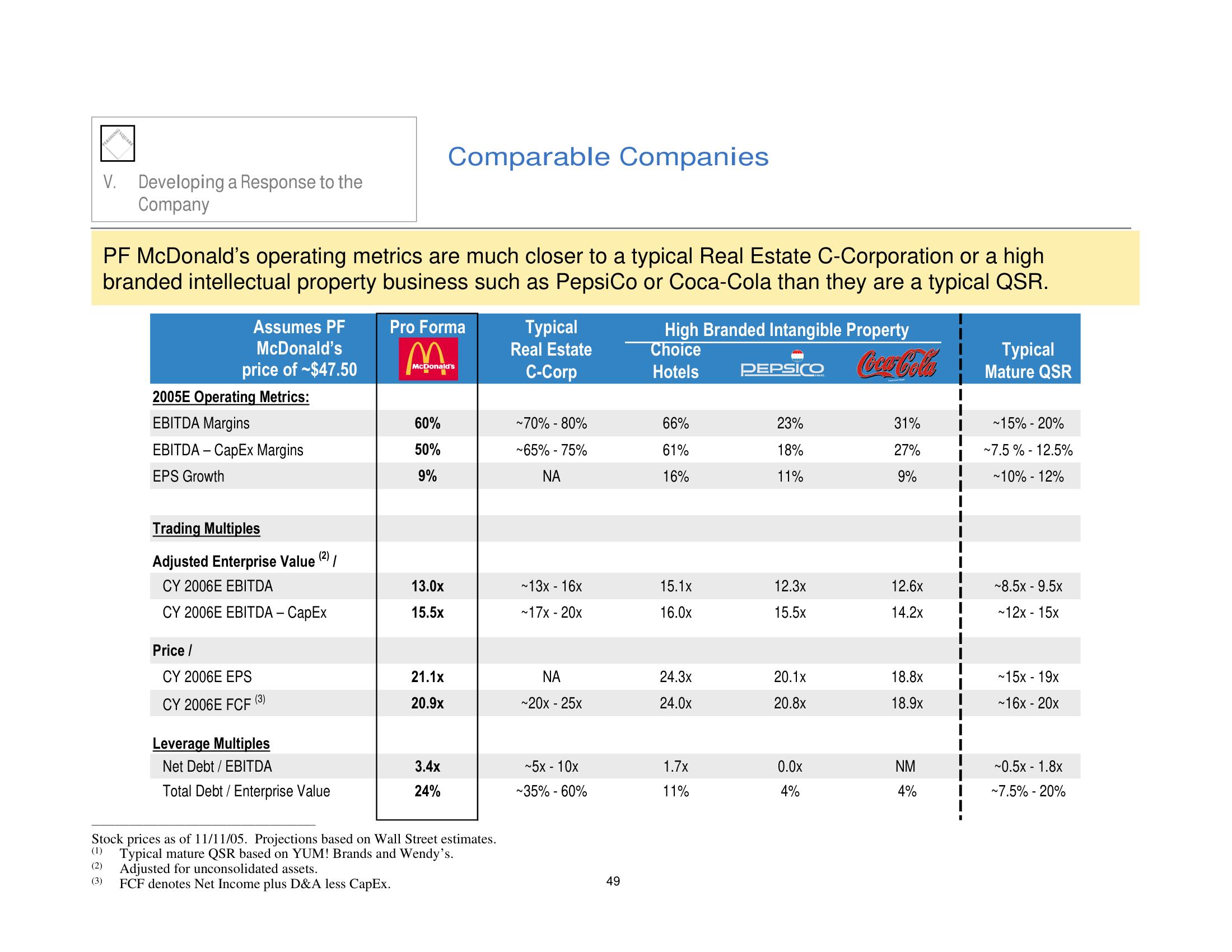

PF McDonald's operating metrics are much closer to a typical Real Estate C-Corporation or a high

branded intellectual property business such as PepsiCo or Coca-Cola than they are a typical QSR.

Assumes PF

McDonald's

price of $47.50

2005E Operating Metrics:

EBITDA Margins

EBITDA - CapEx Margins

EPS Growth

Trading Multiples

Adjusted Enterprise Value (2) /

CY 2006E EBITDA

CY 2006E EBITDA - CapEx

Price /

CY 2006E EPS

CY 2006E FCF

(3)

Leverage Multiples

Net Debt / EBITDA

Total Debt / Enterprise Value

Pro Forma

McDonald's

60%

50%

9%

Comparable Companies

13.0x

15.5x

21.1x

20.9x

3.4x

24%

Stock prices as of 11/11/05. Projections based on Wall Street estimates.

(1) Typical mature QSR based on YUM! Brands and Wendy's.

(2)

Adjusted for unconsolidated assets.

(3)

FCF denotes Net Income plus D&A less CapEx.

Typical

Real Estate

C-Corp

~70% -80%

~65% -75%

NA

~13x - 16x

~17x - 20x

ΝΑ

~20x - 25x

~5x - 10x

~35% - 60%

49

High Branded Intangible Property

Choice

Hotels

66%

61%

16%

15.1x

16.0x

24.3x

24.0x

1.7x

11%

PEPSICO

23%

18%

11%

12.3x

15.5×

20.1x

20.8x

0.0x

4%

Coca-Cola

31%

27%

9%

12.6x

14.2x

18.8x

18.9x

NM

4%

Typical

Mature QSR

~15% - 20%

~7.5% -12.5%

~10% -12%

~8.5x - 9.5x

~12x - 15x

~15x - 19x

~16x - 20x

~0.5x - 1.8x

~7.5% - 20%View entire presentation