Hilltop Holdings Results Presentation Deck

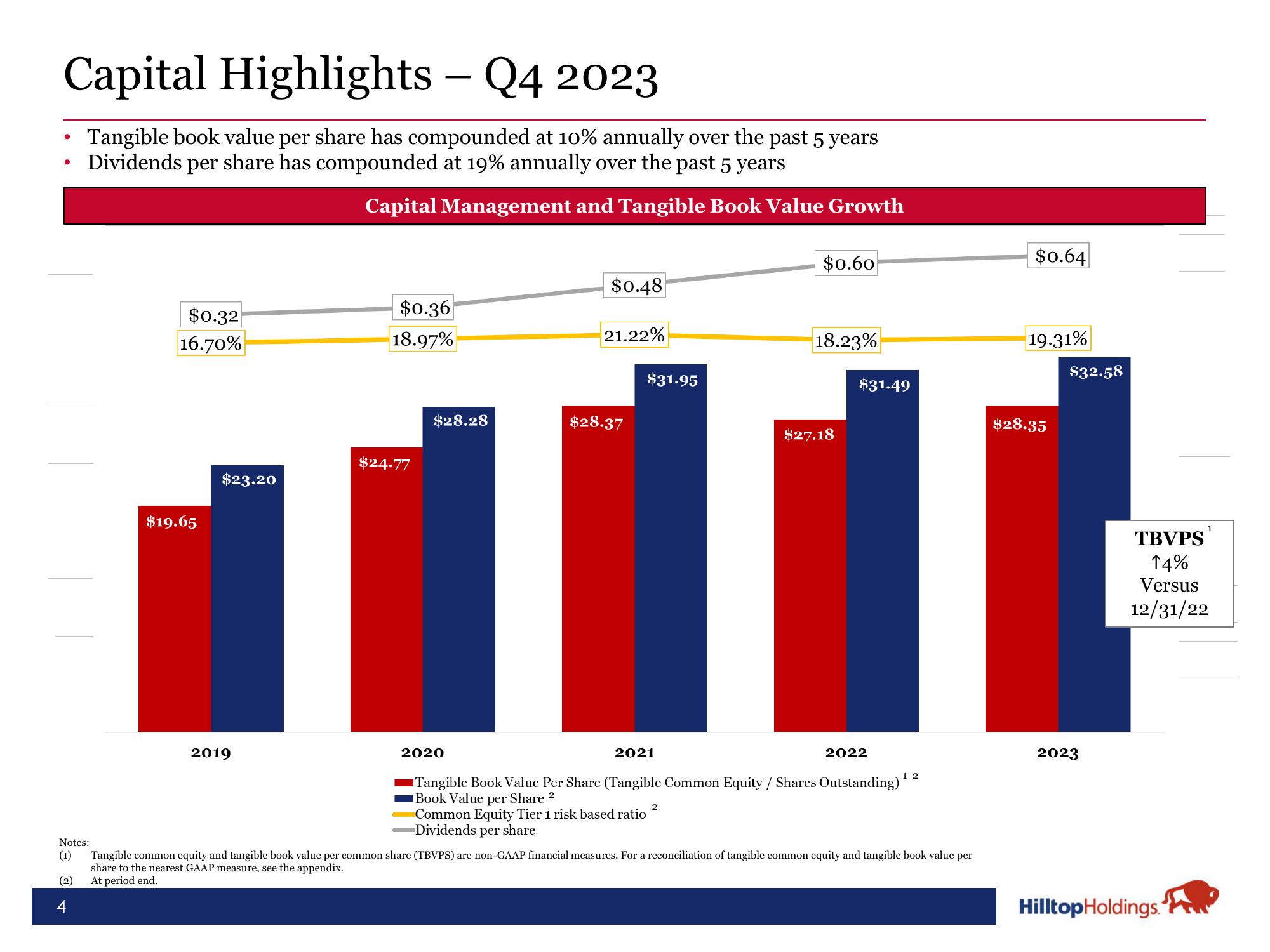

Capital Highlights - Q4 2023

Tangible book value per share has compounded at 10% annually over the past 5 years

Dividends per share has compounded at 19% annually over the past 5 years

Capital Management and Tangible Book Value Growth

●

Notes:

(1)

(2)

4

$0.32

16.70%

$19.65

$23.20

2019

$0.36

18.97%

$24.77

$28.28

2020

$0.48

21.22%

$28.37

$31.95

2021

$0.60

2

18.23%

$27.18

$31.49

2022

Tangible Book Value Per Share (Tangible Common Equity / Shares Outstanding)

Book Value per Share 2

Common Equity Tier 1 risk based ratio

Dividends per share

1 2

Tangible common equity and tangible book value per common share (TBVPS) are non-GAAP financial measures. For a reconciliation of tangible common equity and tangible book value per

share to the nearest GAAP measure, see the appendix.

At period end.

$0.64

19.31%

$28.35

$32.58

2023

TBVPS

14%

Versus

12/31/22

Hilltop Holdings.View entire presentation