Bank of America Investment Banking Pitch Book

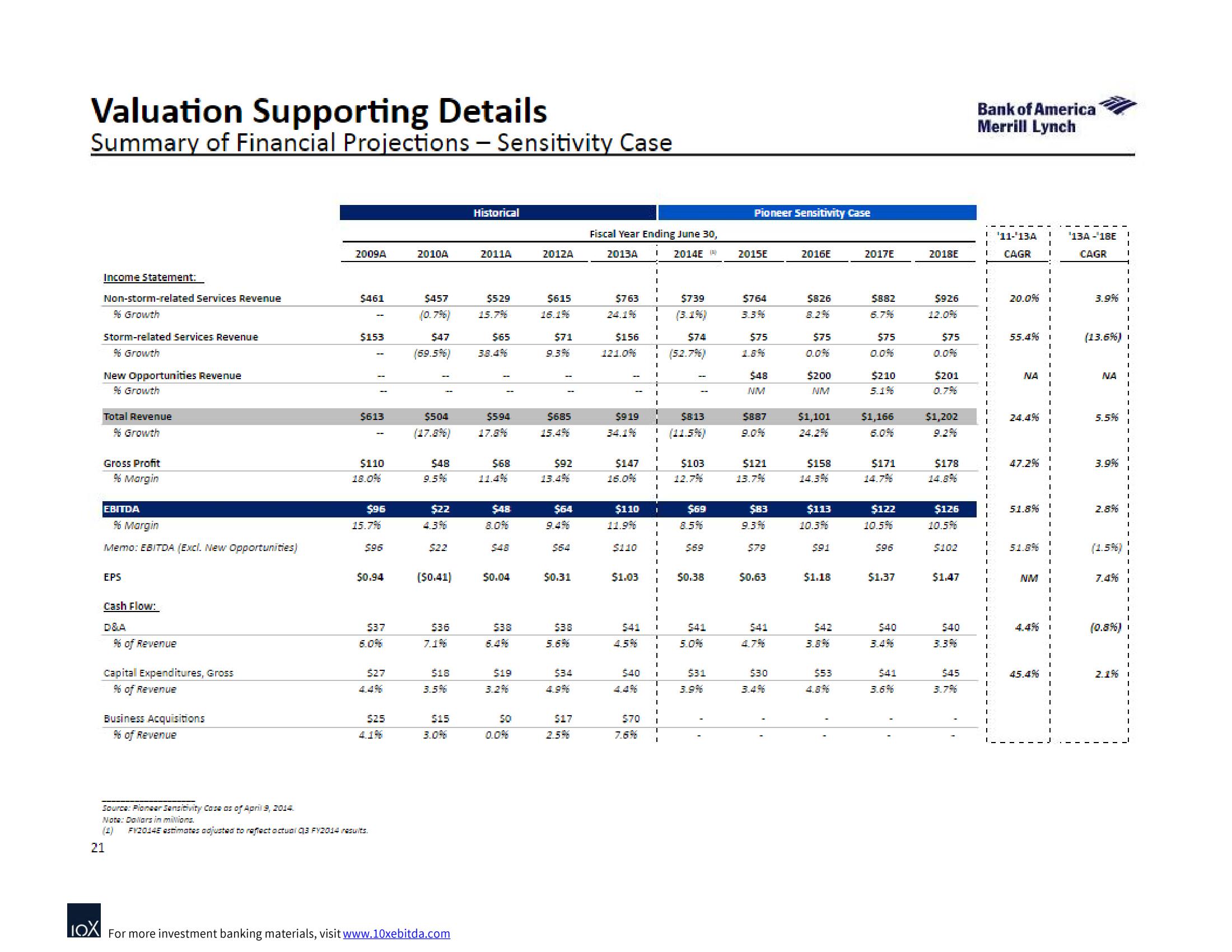

Valuation Supporting Details

Summary of Financial Projections - Sensitivity Case

Income Statement:

Non-storm-related Services Revenue

96 Growth

Storm-related Services Revenue

96 Growth

New Opportunities Revenue

96 Growth

Total Revenue

96 Growth

Gross Profit

% Margin

21

EBITDA

% Margin

Memo: EBITDA (Excl. New Opportunities)

EPS

Cash Flow:

D&A

96 of Revenue

Capital Expenditures, Gross

%6 of Revenue

Business Acquisitions

96 of Revenue

Source: Pioneer Sensitivity Cosa as of April 9, 2014.

Note: Dollars in milions.

2009A

$461

$153

$613

$110

$96

15.7%

5.96

$0.94

$37

527

$25

FY2014 estimates adjusted to reflect actual q3 FY2014 results.

2010A

$457

$504

(17.896)

$48

$65

$47

(69.5%) 3.8.4%

9.5%

$22

4.396

$22

[$0.41)

$36

$18

3.5%

$15

Historical

LOX For more investment banking materials, visit www.10xebitda.com

2011A

$5.29

15.7%

$5.94

17.8%

$68

$48

$48

50.04

$38

$19

50

2012A

$615

16.1%

$71

9.396

$685

15.4%

$92

$64

$0.31

$38

$34

$17

2.5%

Fiscal Year Ending June 30,

2013A I 2014E

$763

24.196

$156

121.096

$919

34.1%

$110

11.9%

I

$147

16.0% I

I

$110

$1.03

$41

540

I

$70

I

I

I

$739

(3.196)

I

I

$74

(5.2.7%)

$813

(11.5%)

$103

I

I 8.5%

$69

$69

$0.38

$41

531

3.9%

Pioneer Sensitivity Case

2015E

$764

3.3%

$75

$48

NM

$887

$121

13.7%

$83

9.3%

$79

$0.63

$41

530

2016E

$826

$75

$200

NM

$1,101

$158

14.3%

$113

10.3%

$.91

$1.18

$42

3.8%

$53

2017E

$882

6.7%

$75

$210

5.1%

$1,166

$171

14.7%

$122

10.5%

$1.37

$40

541

3.6%

2018E

$926

12.09

$75

0.096

$201

0.796

$1,202

$178

$126

10.5%

$102

$1.47

$40

3.396

$45

3.7%

Bank of America

Merrill Lynch

I

'11-'13A

CAGR

20.0%

55.4%

NA

24.4%

47.2%

51.8%

51.8%

NM

4.4%

45.4%

¹13A-18E

CAGR

3.9%

(13.6%)

NA

5.5%

3.9%

2.8%

(1.596)

(0.8%)

2.1%View entire presentation