Pathward Financial Results Presentation Deck

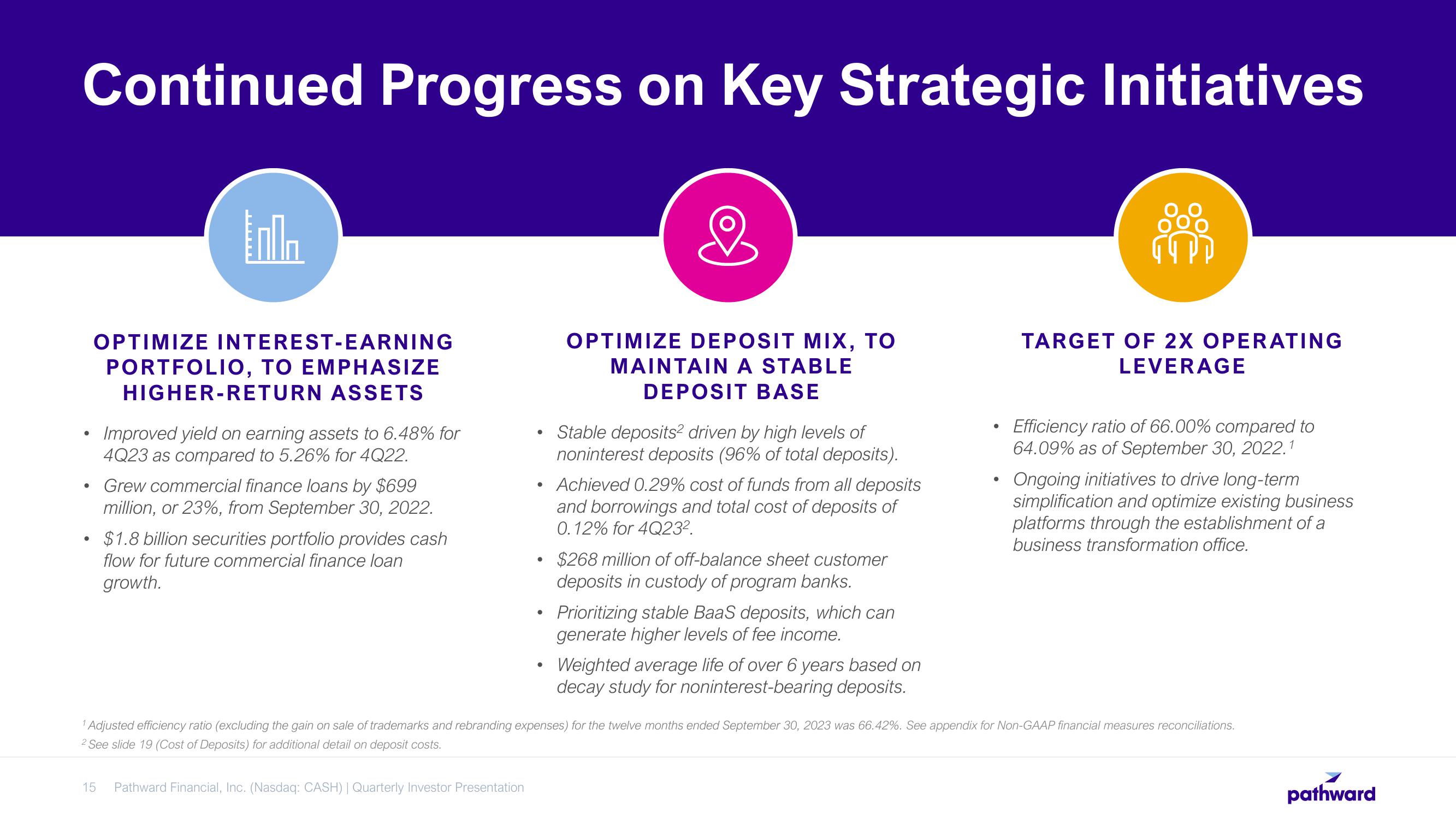

Continued Progress on Key Strategic Initiatives

&

OPTIMIZE DEPOSIT MIX, TO

MAINTAIN A STABLE

DEPOSIT BASE

●

●

●

Inl

OPTIMIZE INTEREST-EARNING

PORTFOLIO, TO EMPHASIZE

HIGHER-RETURN ASSETS

Improved yield on earning assets to 6.48% for

4Q23 as compared to 5.26% for 4Q22.

Grew commercial finance loans by $699

million, or 23%, from September 30, 2022.

$1.8 billion securities portfolio provides cash

flow for future commercial finance loan

growth.

●

15 Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation

●

●

●

Stable deposits2 driven by high levels of

noninterest deposits (96% of total deposits).

Achieved 0.29% cost of funds from all deposits

and borrowings and total cost of deposits of

0.12% for 4Q23².

$268 million of off-balance sheet customer

deposits in custody of program banks.

Prioritizing stable BaaS deposits, which can

generate higher levels of fee income.

Weighted average life of over 6 years based on

decay study for noninterest-bearing deposits.

TARGET OF 2X OPERATING

LEVERAGE

Efficiency ratio of 66.00% compared to

64.09% as of September 30, 2022.1

Ongoing initiatives to drive long-term

simplification and optimize existing business

platforms through the establishment of a

business transformation office.

¹ Adjusted efficiency ratio (excluding the gain on sale of trademarks and rebranding expenses) for the twelve months ended September 30, 2023 was 66.42%. See appendix for Non-GAAP financial measures reconciliations.

2 See slide 19 (Cost of Deposits) for additional detail on deposit costs.

pathwardView entire presentation