a.k.a. Brands IPO Presentation Deck

POST-IPO CAPITAL STRUCTURE

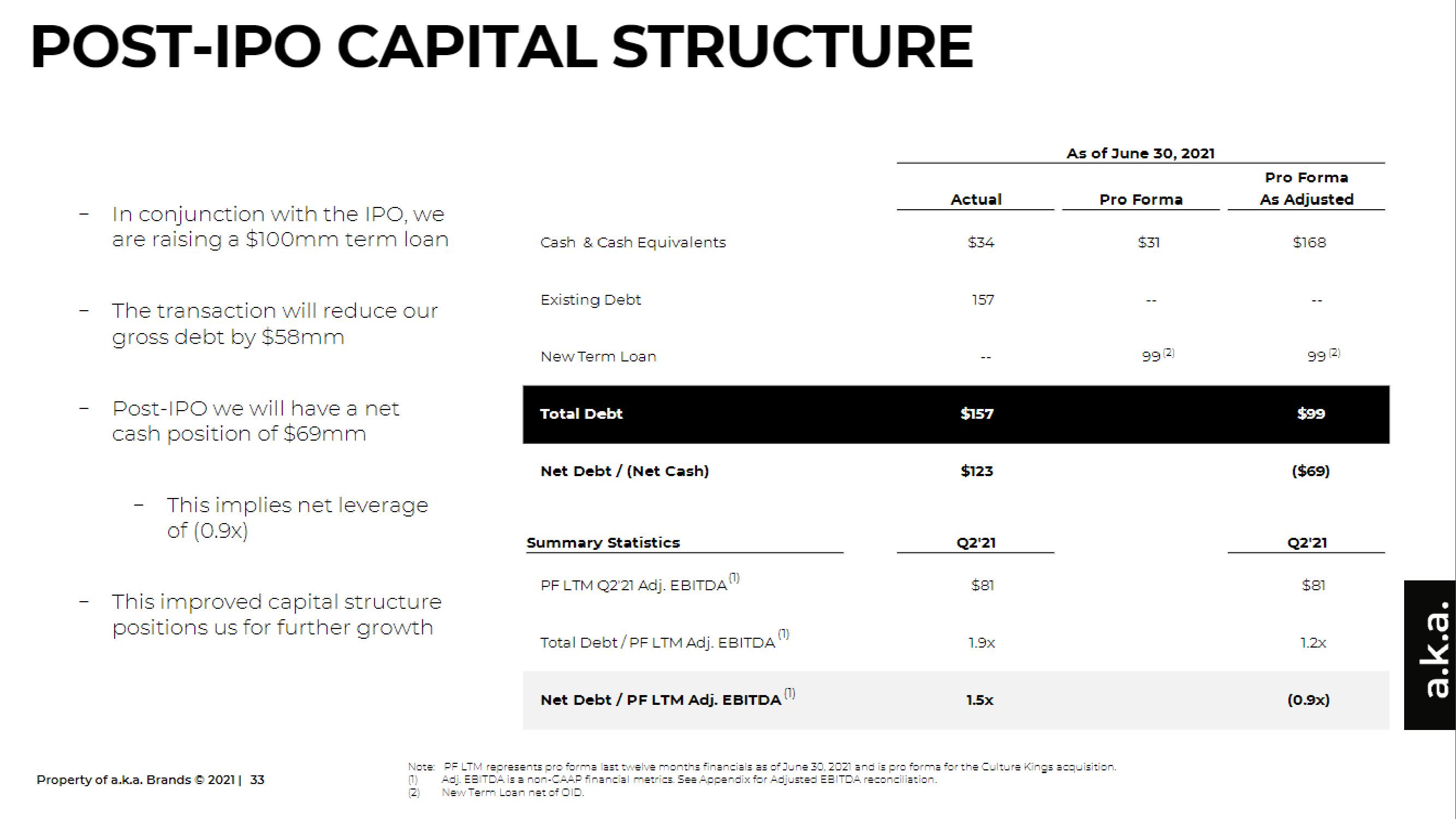

In conjunction with the IPO, we

are raising a $100mm term loan.

The transaction will reduce our

gross debt by $58mm

Post-IPO we will have a net

cash position of $69mm

This implies net leverage

of (0.9x)

This improved capital structure

positions us for further growth

Property of a.k.a. Brands © 2021 | 33

Cash & Cash Equivalents

Existing Debt

New Term Loan

Total Debt

Net Debt / (Net Cash)

Summary Statistics

PF LTM Q2'21 Adj. EBITDA

Total Debt/PF LTM Adj. EBITDA

Net Debt / PF LTM Adj. EBITDA

(1)

Actual

$34

157

$157

$123

Q2'21

$81

1.9x

1.5x

As of June 30, 2021

Pro Forma

Note: PF LTM represents pro forma last twelve months financials as of June 30, 2021 and is pro forma for the Culture Kings acquisition.

Adj. EBITDA. is a non-CAAP financial metrics. See Appendix for Adjusted EBITDA reconciliation.

New Term Loan net of OID.

(1)

$31

1

99 (2)

Pro Forma

As Adjusted

$168

$99

($69)

Q2'21

$81

1.2x

(0.9x)

a.k.a.View entire presentation