Mosaics Strategic Acquisition of CF Industries Phosphate Business

Strategic and Financial Benefits

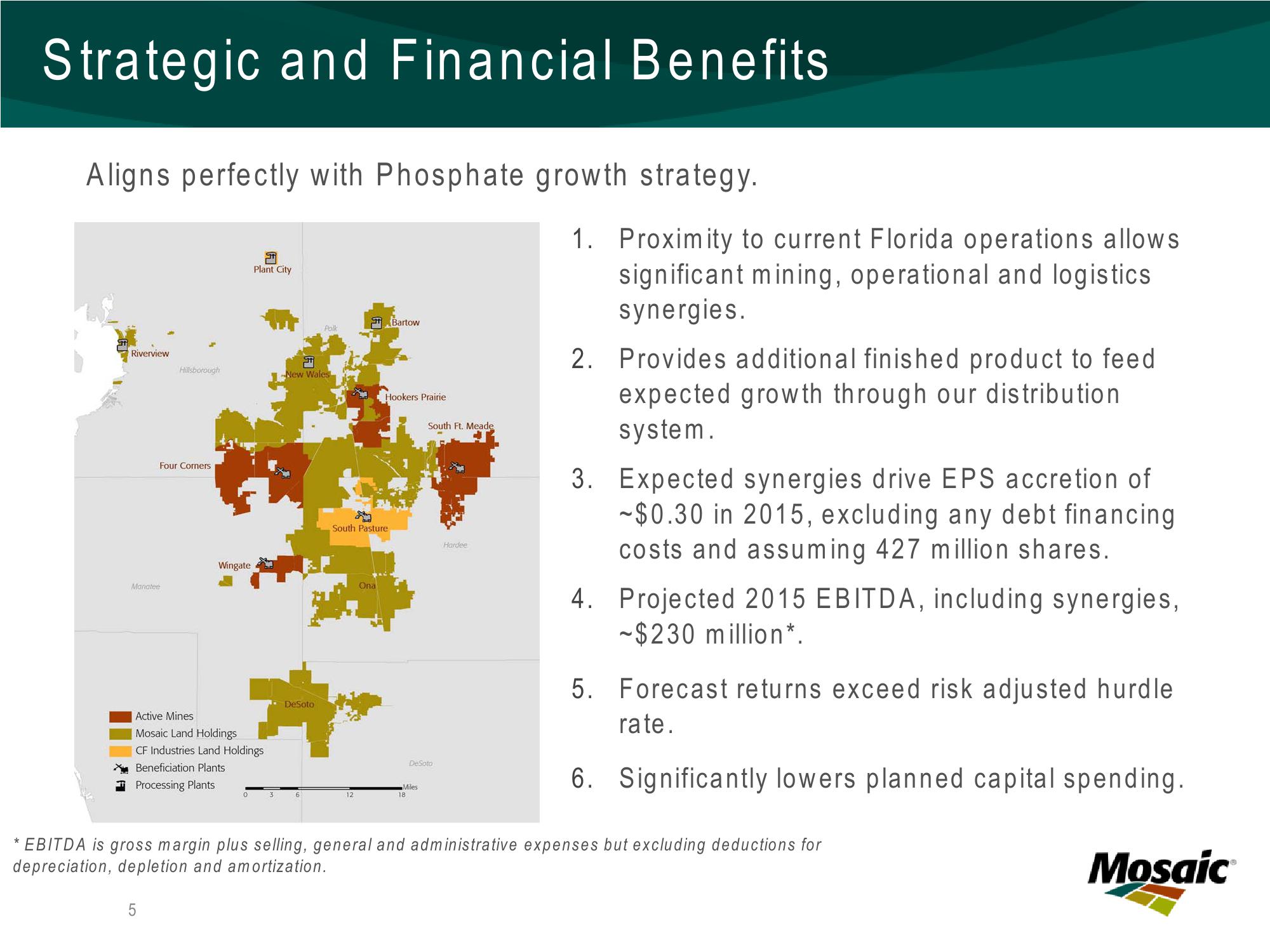

Aligns perfectly with Phosphate growth strategy.

Riverview

Manatee

Hillsborough

Four Corners

5

Wingate

Active Mines

Mosaic Land Holdings

CF Industries Land Holdings

XBeneficiation Plants

Processing Plants

31

Plant City

0

3

Polk

F

New Wales

DeSoto

South Pasture

12

Ona

Bartow

Hookers Prairie

Miles

18

South Ft. Meade

DeSoto

Hardee

1. Proximity to current Florida operations allows

significant mining, operational and logistics

synergies.

2. Provides additional finished product to feed

expected growth through our distribution

system.

3. Expected synergies drive EPS accretion of

-$0.30 in 2015, excluding any debt financing.

costs and assuming 427 million shares.

4. Projected 2015 EBITDA, including synergies,

-$230 million*.

5. Forecast returns exceed risk adjusted hurdle

rate.

6. Significantly lowers planned capital spending.

* EBITDA is gross margin plus selling, general and administrative expenses but excluding deductions for

depreciation, depletion and amortization.

MosaicView entire presentation