Enact IPO Presentation Deck

Enact | Investor Presentation

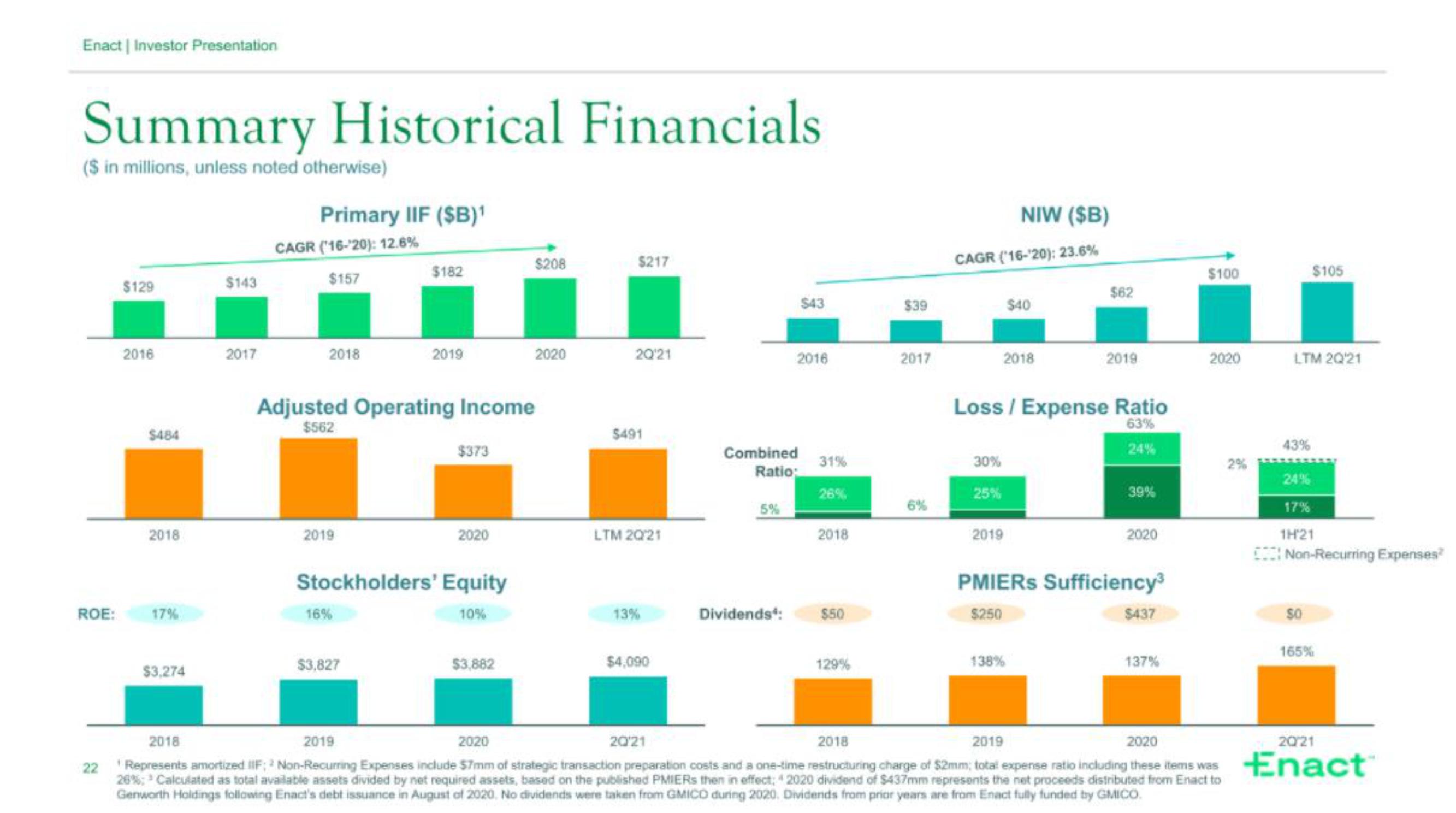

Summary Historical Financials

($ in millions, unless noted otherwise)

ROE:

$129

2016

$484

2018

17%

$3,274

$143

2017

Primary IIF ($B)¹

CAGR (16-20): 12.6%

$157

2018

2019

$182

Adjusted Operating Income

$562

16%

2019

$3,827

$373

Stockholders' Equity

10%

2020

$208

$3,882

2020

$217

20¹21

$491

LTM 2021

13%

$4,090

20′21

5%

$43

Combined 31%

Ratio:

26%

Dividends*:

2016

2018

$50

129%

$39

2017

6%

NIW ($B)

CAGR ('16-'20): 23.6%

2018

30%

25%

$40

2019

Loss / Expense Ratio

63%

24%

$62

138%

2019

39%

2020

PMIERS Sufficiency³

$250

$437

137%

$100

2020

2018

2019

2020

2018

2019

2020

22 Represents amortized IIF; 2 Non-Recurring Expenses include $7mm of strategic transaction preparation costs and a one-time restructuring charge of $2mm; total expense ratio including these items was

26%; Calculated as total available assets divided by net required assets, based on the published PMIERS then in effect; 2020 dividend of $437mm represents the net proceeds distributed from Enact to

Genworth Holdings following Enact's debt issuance in August of 2020. No dividends were taken from GMICO during 2020. Dividends from prior years are from Enact fully funded by GMICO.

2%

LTM 2Q¹21

43%

$105

24%

17%

1H'21

Non-Recurring Expenses?

SO

165%

20/21

EnactView entire presentation