Bausch+Lomb Results Presentation Deck

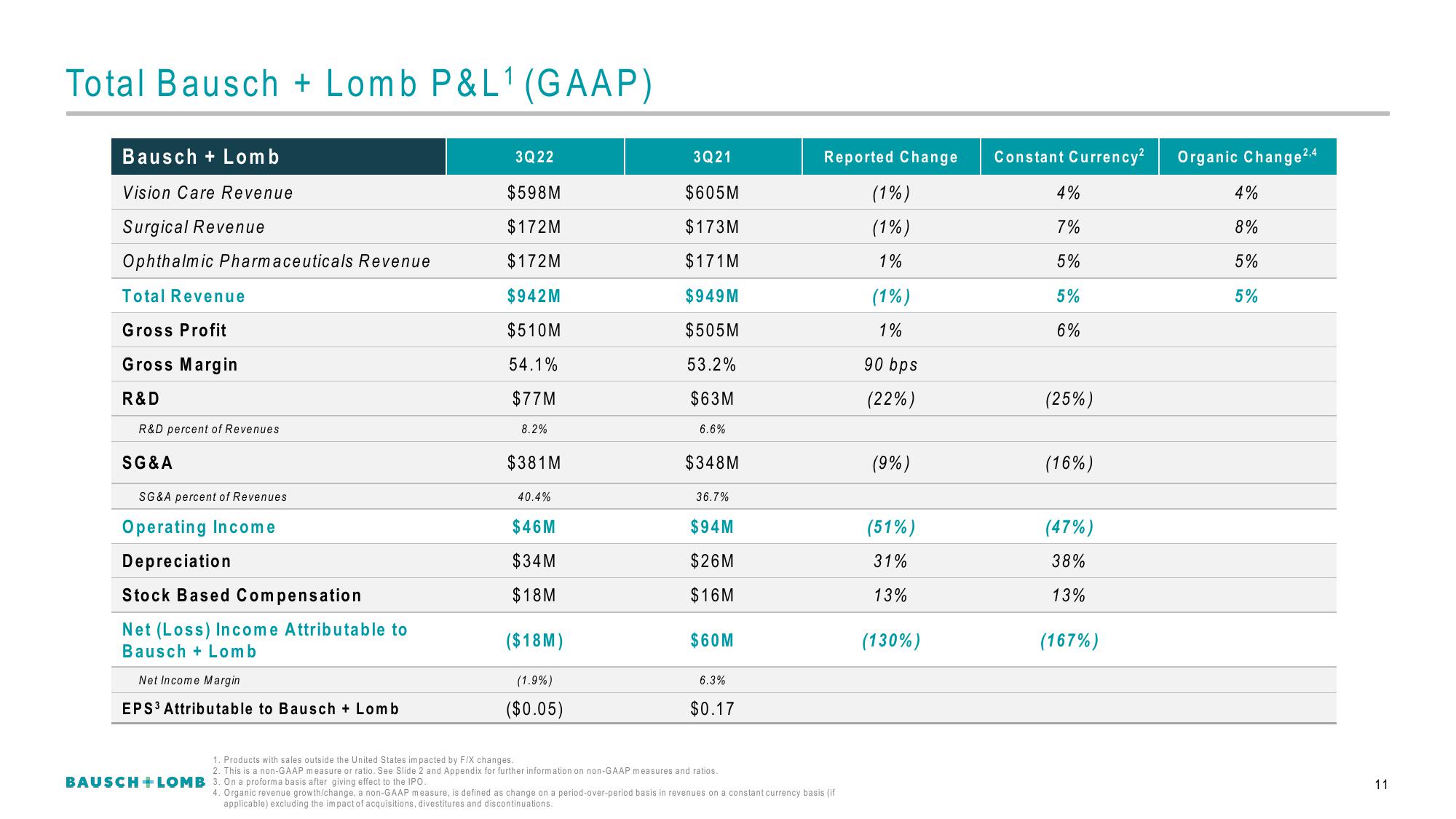

Total Bausch + Lomb P&L¹ (GAAP)

Bausch + Lomb

Vision Care Revenue

Surgical Revenue

Ophthalmic Pharmaceuticals Revenue

Total Revenue

Gross Profit

Gross Margin

R&D

R&D percent of Revenues

SG&A

SG&A percent of Revenues

Operating Income

Depreciation

Stock Based Compensation

Net (Loss) Income Attributable to

Bausch+Lomb

Net Income Margin

EPS³ Attributable to Bausch + Lomb

3Q22

$598M

$172M

$172M

$942M

$510M

54.1%

$77M

8.2%

BAUSCH + LOMB 3. On a proforma basis after giving effect to the IPO.

$381M

40.4%

$46M

$34M

$18M

($18M)

(1.9%)

($0.05)

3Q21

$605M

$173M

$171M

$949M

$505M

53.2%

$63M

6.6%

$348M

36.7%

$94M

$26M

$16M

$60M

6.3%

$0.17

1. Products with sales outside the United States impacted by F/X changes.

2. This is a non-GAAP measure or ratio. See Slide 2 and Appendix for further information on non-GAAP measures and ratios.

Reported Change

(1%)

(1%)

1%

4. Organic revenue growth/change, a non-GAAP measure, is defined as change on a period-over-period basis in revenues on a constant currency basis (if

applicable) excluding the impact of acquisitions, divestitures and discontinuations.

(1%)

1%

90 bps

(22%)

(9%)

(51%)

31%

13%

(130%)

Constant Currency²

4%

7%

5%

5%

6%

(25%)

(16%)

(47%)

38%

13%

(167%)

Organic Change 2,4

4%

8%

5%

5%

11View entire presentation