Apollo Global Management Investor Day Presentation Deck

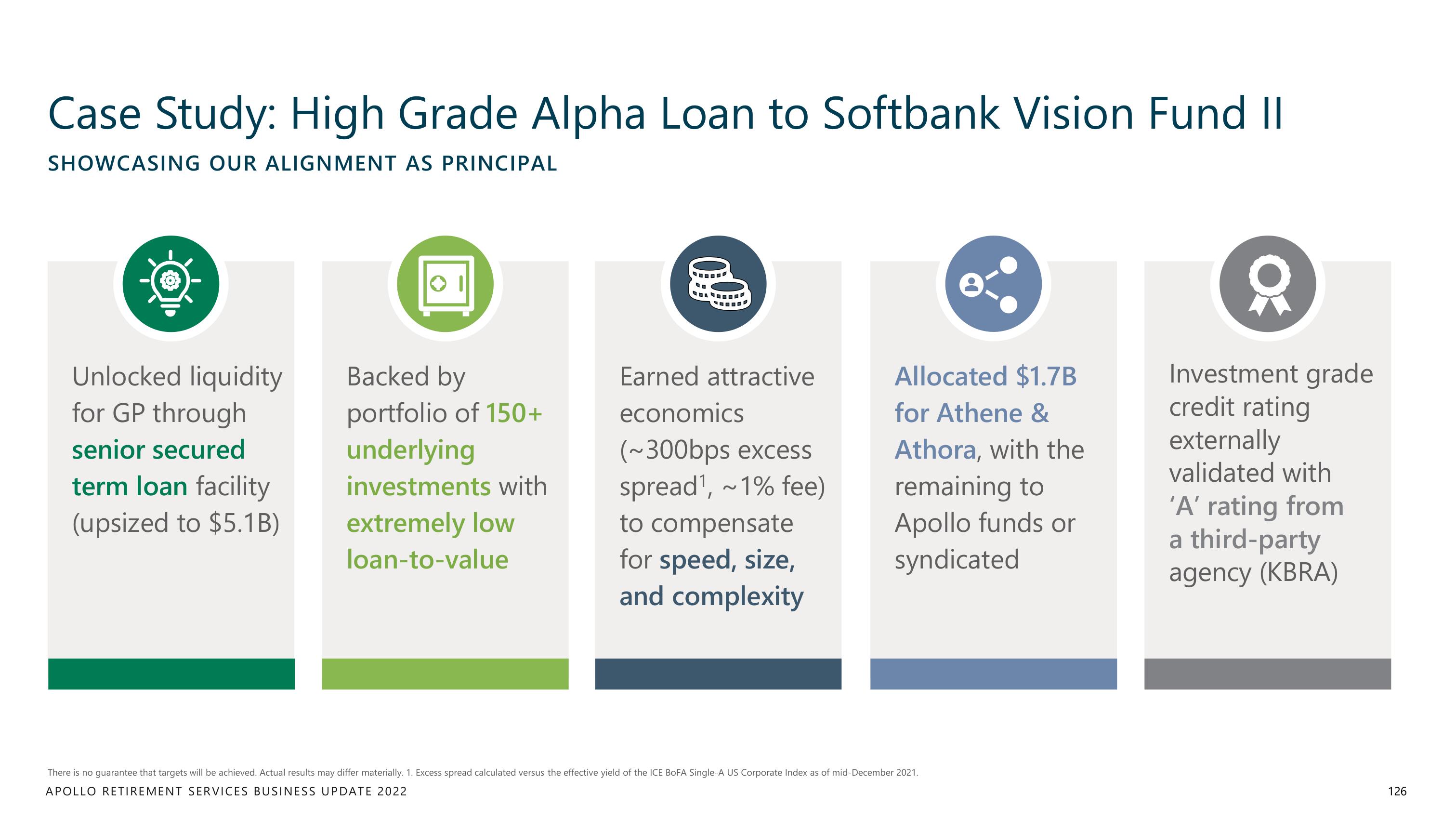

Case Study: High Grade Alpha Loan to Softbank Vision Fund II

SHOWCASING OUR ALIGNMENT AS PRINCIPAL

Unlocked liquidity

for GP through

senior secured

term loan facility

(upsized to $5.1B)

Backed by

portfolio of 150+

underlying

investments with

extremely low

loan-to-value

Earned attractive

economics

(~300bps excess

spread¹, ~1% fee)

to compensate

for speed, size,

and complexity

Allocated $1.7B

for Athene &

Athora, with the

remaining to

Apollo funds or

syndicated

There is no guarantee that targets will be achieved. Actual results may differ materially. 1. Excess spread calculated versus the effective yield of the ICE BOFA Single-A US Corporate Index as of mid-December 2021.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

O

Investment grade

credit rating

externally

validated with

'A' rating from

a third-party

agency (KBRA)

126View entire presentation