J.P.Morgan Results Presentation Deck

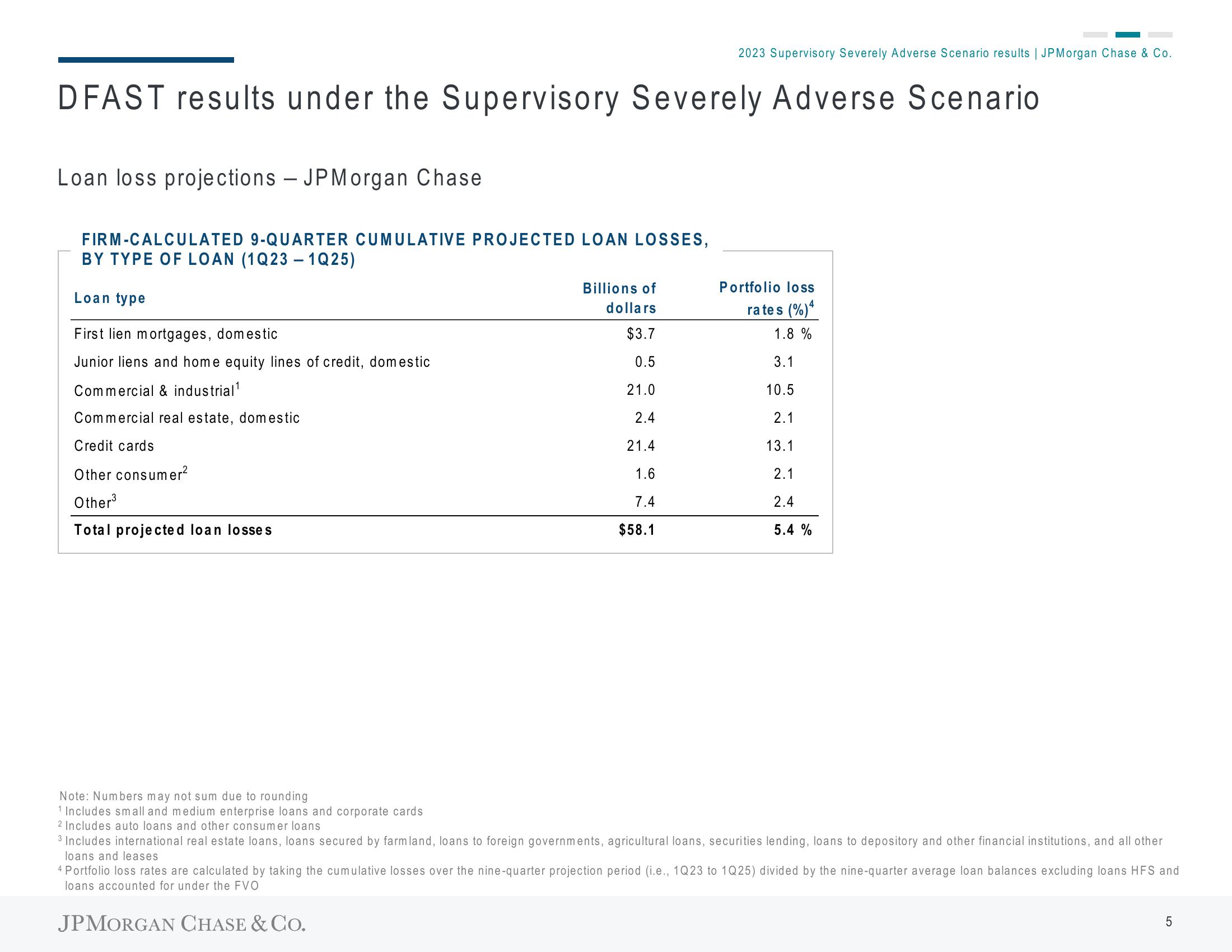

DFAST results under the Supervisory Severely Adverse Scenario

Loan loss projections - JPMorgan Chase

FIRM-CALCULATED 9-QUARTER CUMULATIVE PROJECTED LOAN LOSSES,

BY TYPE OF LOAN (1Q23 - 1Q25)

Loan type

First lien mortgages, domestic

Junior liens and home equity lines of credit, domestic

Commercial & industrial¹

Commercial real estate, domestic

Credit cards

Other consumer²

Other³

Total projected loan losses

2023 Supervisory Severely Adverse Scenario results | JPMorgan Chase & Co.

Billions of

dollars

$3.7

0.5

21.0

2.4

21.4

1.6

7.4

$58.1

Portfolio loss

rates (%) 4

1.8 %

3.1

10.5

2.1

13.1

2.1

2.4

5.4 %

Note: Numbers may not sum due to rounding

¹ Includes small and medium enterprise loans and corporate cards

2 Includes auto loans and other consumer loans

3 Includes international real estate loans, loans secured by farm land, loans to foreign governments, agricultural loans, securities lending, loans to depository and other financial institutions, and all other

loans and leases

4 Portfolio loss rates are calculated by taking the cumulative losses over the nine-quarter projection period (i.e., 1Q23 to 1Q25) divided by the nine-quarter average loan balances excluding loans HFS and

loans accounted for under the FVO

JPMORGAN CHASE & CO.

5View entire presentation