Allwyn Results Presentation Deck

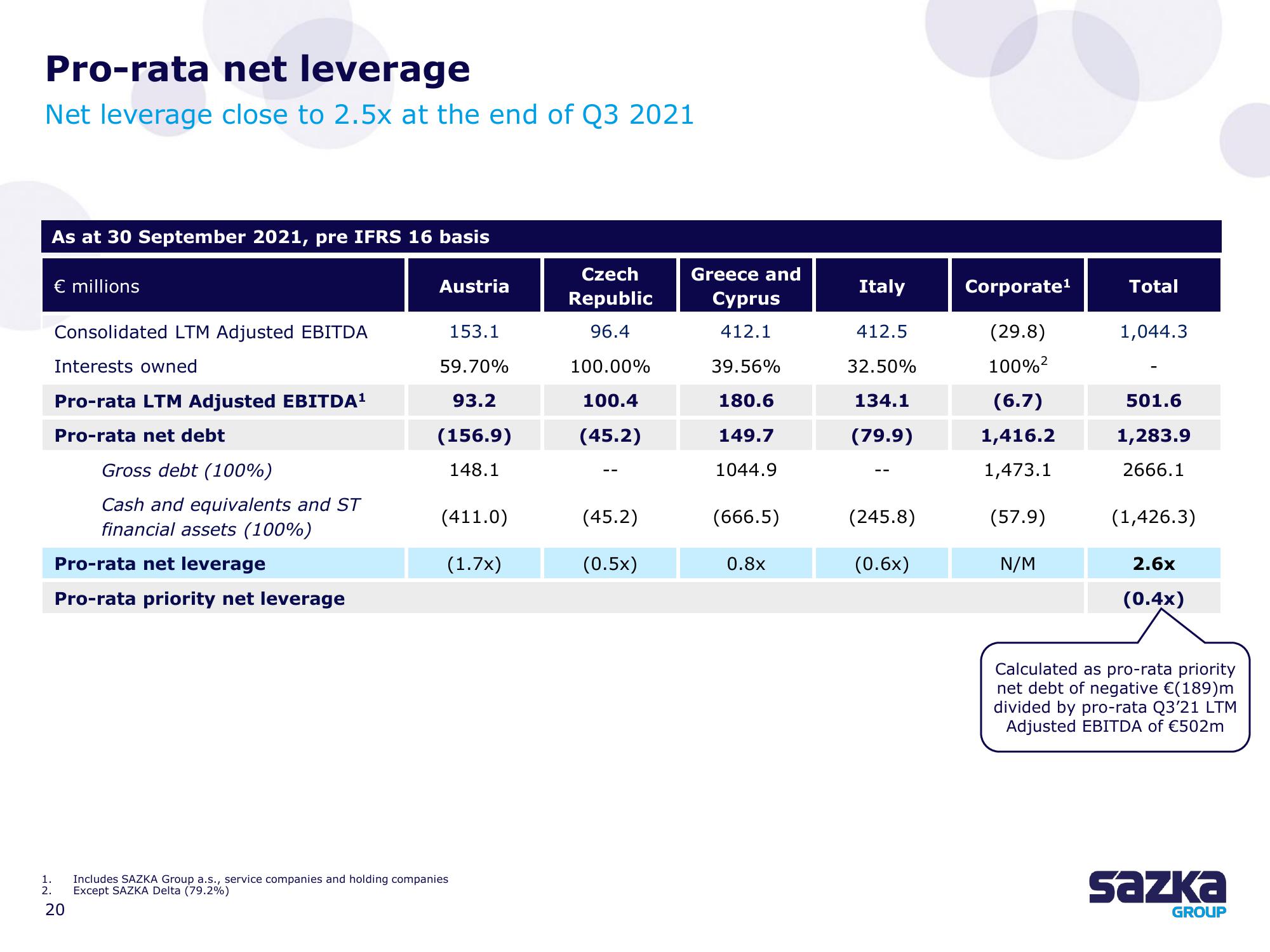

Pro-rata net leverage

Net leverage close to 2.5x at the end of Q3 2021

As at 30 September 2021, pre IFRS 16 basis

€ millions

1.

2.

Consolidated LTM Adjusted EBITDA

Interests owned

Pro-rata LTM Adjusted EBITDA¹

Pro-rata net debt

Gross debt (100%)

Cash and equivalents and ST

financial assets (100%)

Pro-rata net leverage

Pro-rata priority net leverage

20

Austria

153.1

59.70%

93.2

(156.9)

148.1

(411.0)

(1.7x)

Includes SAZKA Group a.s., service companies and holding companies

Except SAZKA Delta (79.2%)

Czech

Republic

96.4

100.00%

100.4

(45.2)

(45.2)

(0.5x)

Greece and

Cyprus

412.1

39.56%

180.6

149.7

1044.9

(666.5)

0.8x

Italy

412.5

32.50%

134.1

(79.9)

(245.8)

(0.6x)

Corporate¹

(29.8)

100%²

(6.7)

1,416.2

1,473.1

(57.9)

N/M

Total

1,044.3

501.6

1,283.9

2666.1

(1,426.3)

2.6x

(0.4x)

Calculated as pro-rata priority

net debt of negative €(189)m

divided by pro-rata Q3'21 LTM

Adjusted EBITDA of €502m

Sazka

GROUPView entire presentation