J.P.Morgan Software Investment Banking

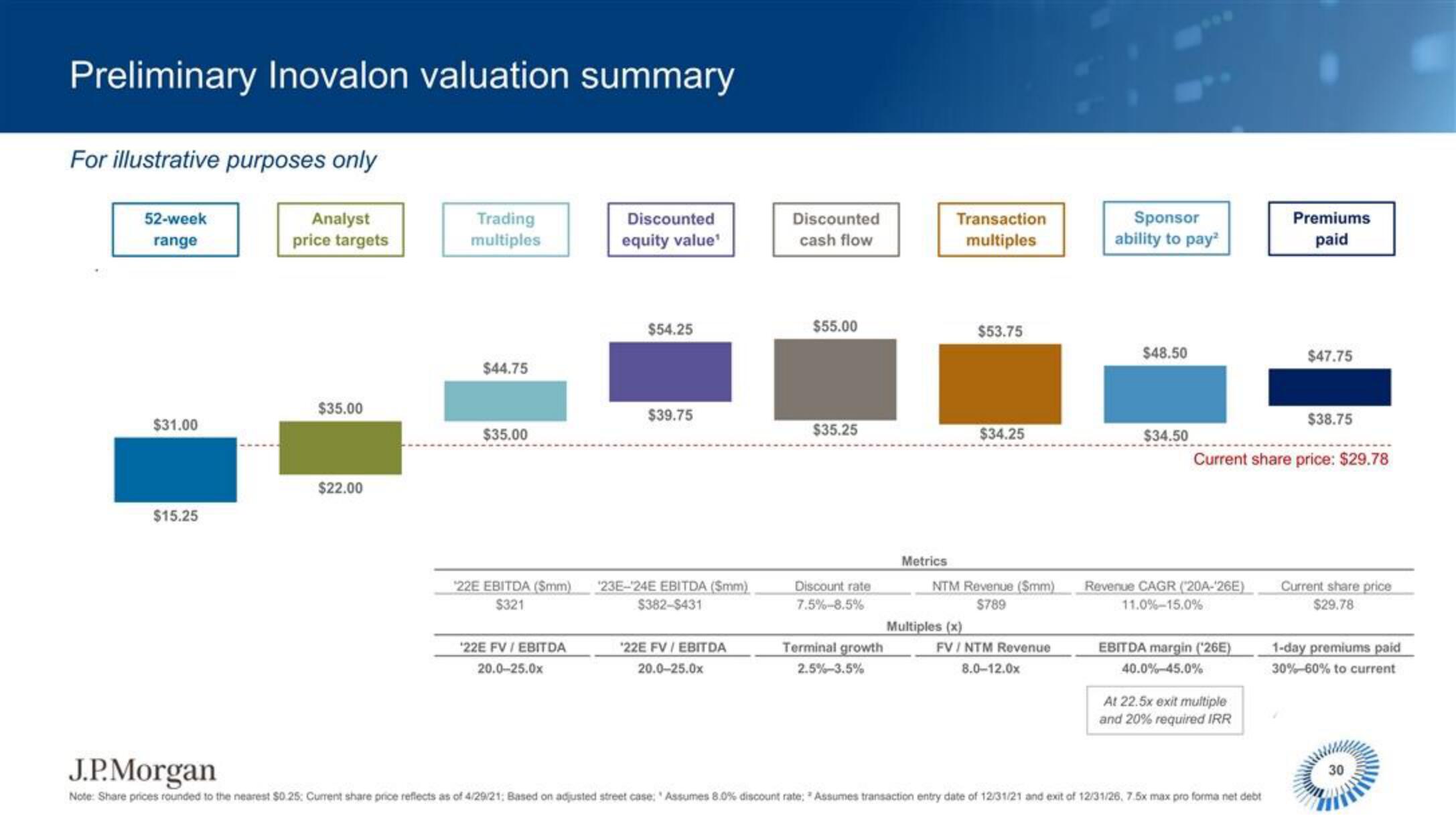

Preliminary Inovalon valuation summary

For illustrative purposes only

52-week

range

Analyst

price targets

$31.00

$15.25

$35.00

$22.00

Trading

multiples

$44.75

$35.00

22E EBITDA (Smm)

$321

'22E FV / EBITDA

20.0-25.0x

Discounted

equity value¹

$54.25

$39.75

23E-24E EBITDA (Smm)

$382-$431

*22E FV/ EBITDA

20.0-25.0x

Discounted

cash flow

$55.00

$35.25

Discou rate

7.5%-8.5%

Terminal growth

2.5%-3.5%

Metrics

Transaction

multiples

$53.75

Multiples (x)

$34.25

NTM Revenue (Smm)

$789

FV / NTM Revenue

8.0-12.0x

Sponsor

ability to pay²

$48.50

$34.50

Revenue CAGR (20A-26E)

11.0%-15.0%

EBITDA margin ('26E)

40.0%-45.0%

Current share price: $29.78

At 22.5x exit multiple

and 20% required IRR

Premiums

paid

J.P.Morgan

Note: Share prices rounded to the nearest $0.25: Current share price reflects as of 4/29/21; Based on adjusted street case: Assumes 8.0% discount rate; Assumes transaction entry date of 12/31/21 and exit of 12/31/26, 7.5x max pro forma net debt

$47.75

$38.75

Current share price

$29.78

1-day premiums paid

30%-60% to current

30View entire presentation