Silicon Valley Bank Results Presentation Deck

2021 Outlook

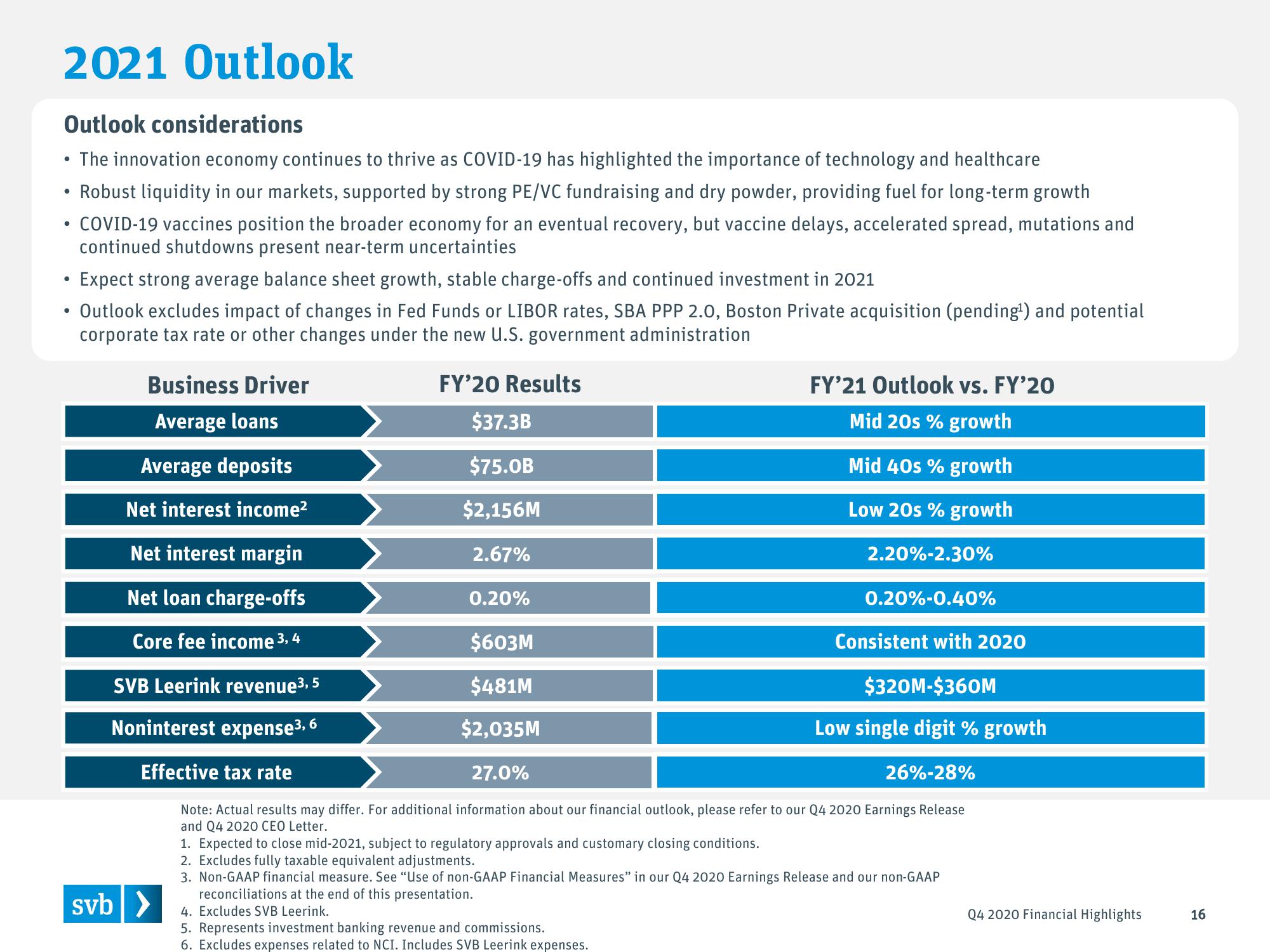

Outlook considerations

The innovation economy continues to thrive as COVID-19 has highlighted the importance of technology and healthcare

• Robust liquidity in our markets, supported by strong PE/VC fundraising and dry powder, providing fuel for long-term growth

COVID-19 vaccines position the broader economy for an eventual recovery, but vaccine delays, accelerated spread, mutations and

continued shutdowns present near-term uncertainties

●

●

Expect strong average balance sheet growth, stable charge-offs and continued investment in 2021

• Outlook excludes impact of changes in Fed Funds or LIBOR rates, SBA PPP 2.0, Boston Private acquisition (pending¹) and potential

corporate tax rate or other changes under the new U.S. government administration

FY'20 Results

$37.3B

$75.0B

$2,156M

2.67%

●

Business Driver

Average loans

Average deposits

Net interest income²

Net interest margin

Net loan charge-offs

Core fee income 3, 4

SVB Leerink revenue ³, 5

Noninterest expense³, 6

0.20%

svb >

FY'21 Outlook vs. FY'20

Mid 20s % growth

Mid 40s % growth

Low 20s % growth

2.20%-2.30%

0.20%-0.40%

$603M

$481M

$320M-$360M

$2,035M

Low single digit % growth

Effective tax rate

27.0%

26%-28%

Note: Actual results may differ. For additional information about our financial outlook, please refer to our Q4 2020 Earnings Release

and Q4 2020 CEO Letter.

Consistent with 2020

1. Expected to close mid-2021, subject to regulatory approvals and customary closing conditions.

2. Excludes fully taxable equivalent adjustments.

3. Non-GAAP financial measure. See "Use of non-GAAP Financial Measures" in our Q4 2020 Earnings Release and our non-GAAP

reconciliations at the end of this presentation.

4. Excludes SVB Leerink.

5. Represents investment banking revenue and commissions.

6. Excludes expenses related to NCI. Includes SVB Leerink expenses.

Q4 2020 Financial Highlights

16View entire presentation