J.P.Morgan Investment Banking

VALUATION SUMMARY

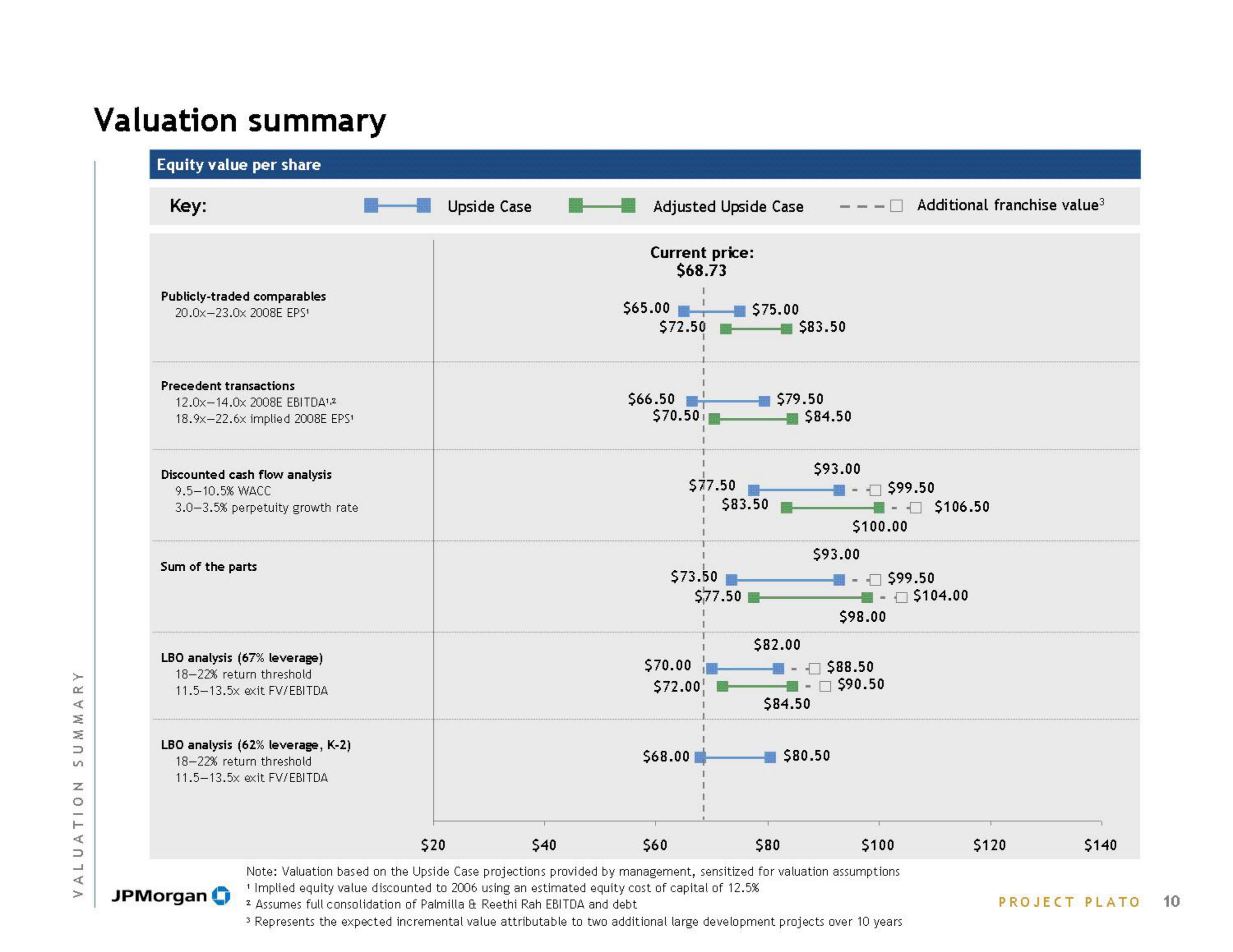

Valuation summary

Equity value per share

Key:

Publicly-traded comparables

20.0x-23.0x 2008E EPS¹

Precedent transactions

12.0x-14.0x 2008E EBITDA¹.²

18.9x-22.6x implied 2008E EPS¹

Discounted cash flow analysis

9.5-10.5% WACC

3.0-3.5 % perpetuity growth rate

Sum of the parts

LBO analysis (67% leverage)

18-22% return threshold

11.5-13.5x exit FV/EBITDA

LBO analysis (62% leverage, K-2)

18-22% return threshold

11.5-13.5x exit FV/EBITDA

JPMorgan

Upside Case

Adjusted Upside Case

$40

Current price:

$68.73

$65.00

$72.50

$66.50

$70.50

1

$70.00

1

$77.50

I

$68.00

I

$73.50

1

$72.00

$77.50

1

$75.00

$83.50

$83.50

$79.50

$82.00

$84.50

$84.50

$93.00

$93.00

$100.00

$80.50

$98.00

$88.50

$90.50

$99.50

Additional franchise value³

$20

$60

$80

$100

Note: Valuation based on the Upside Case projections provided by management, sensitized for valuation assumptions

¹ Implied equity value discounted to 2006 using an estimated equity cost of capital of 12.5%

z Assumes full consolidation of Palmilla & Reethi Rah EBITDA and debt

3 Represents the expected incremental value attributable to two additional large development projects over 10 years

$99.50

$106.50

$104.00

$120

$140

PROJECT PLATO

10View entire presentation