HyperloopTT Investor Presentation Deck

H

Confidential and Proprietary

29

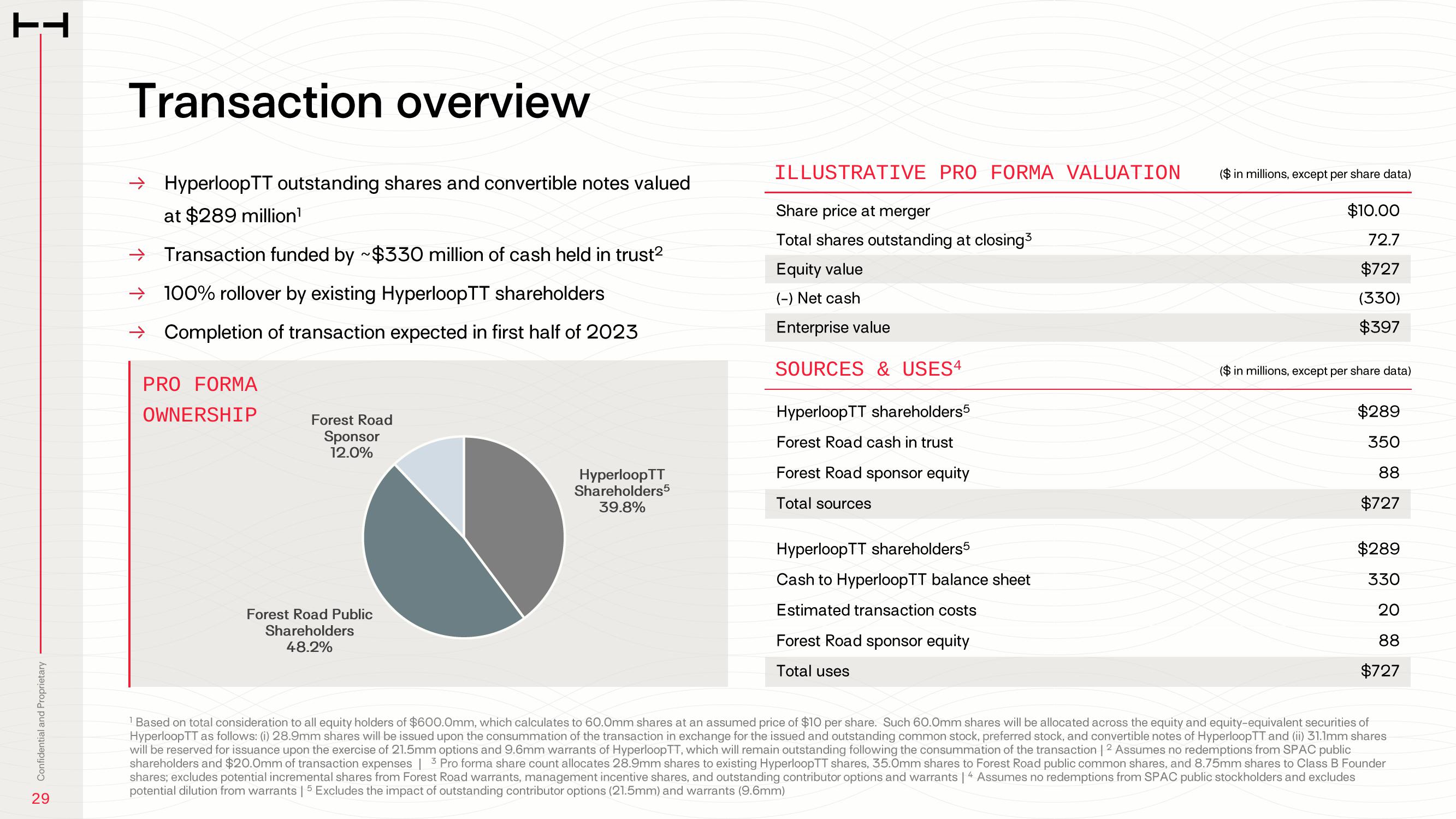

Transaction overview

→ HyperloopTT outstanding shares and convertible notes valued

at $289 million¹

→➜ Transaction funded by ~$330 million of cash held in trust²

→ 100% rollover by existing HyperloopTT shareholders

→ Completion of transaction expected in first half of 2023

PRO FORMA

OWNERSHIP

Forest Road

Sponsor

12.0%

Forest Road Public

Shareholders

48.2%

HyperloopTT

Shareholders5

39.8%

ILLUSTRATIVE PRO FORMA VALUATION

Share price at merger

Total shares outstanding at closing3

Equity value

(-) Net cash

Enterprise value

SOURCES & USES4

HyperloopTT shareholders5

Forest Road cash in trust

Forest Road sponsor equity

Total sources

HyperloopTT shareholders5

Cash to HyperloopTT balance sheet

Estimated transaction costs

Forest Road sponsor equity

Total uses

($ in millions, except per share data)

$10.00

72.7

$727

(330)

$397

($ in millions, except per share data)

$289

350

88

$727

$289

330

20

88

$727

¹ Based on total consideration to all equity holders of $600.0mm, which calculates to 60.0mm shares at an assumed price of $10 per share. Such 60.0mm shares will be allocated across the equity and equity-equivalent securities of

HyperloopTT as follows: (i) 28.9mm shares will be issued upon the consummation of the transaction in exchange for the issued and outstanding common stock, preferred stock, and convertible notes of HyperloopTT and (ii) 31.1mm shares

will be reserved for issuance upon the exercise of 21.5mm options and 9.6mm warrants of HyperloopTT, which will remain outstanding following the consummation of the transaction | 2 Assumes no redemptions from SPAC public

shareholders and $20.0mm of transaction expenses | 3 Pro forma share count allocates 28.9mm shares to existing HyperloopTT shares, 35.0mm shares to Forest Road public common shares, and 8.75mm shares to Class B Founder

shares; excludes potential incremental shares from Forest Road warrants, management incentive shares, and outstanding contributor options and warrants | 4 Assumes no redemptions from SPAC public stockholders and excludes

potential dilution from warrants | 5 Excludes the impact of outstanding contributor options (21.5mm) and warrants (9.6mm)View entire presentation