J.P.Morgan Investment Banking

APPENDIX

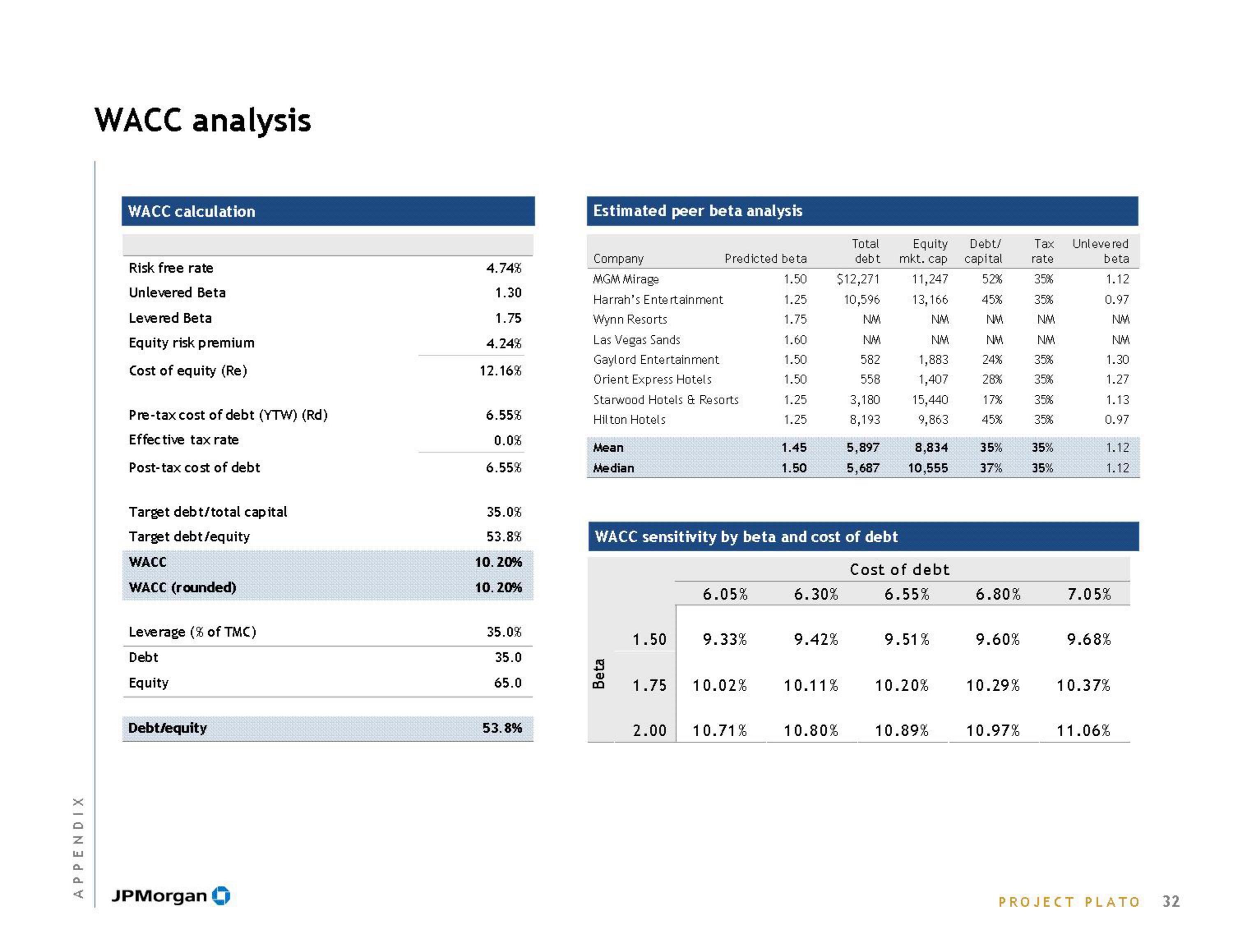

WACC analysis

WACC calculation

Risk free rate

Unlevered Beta

Levered Beta

Equity risk premium

Cost of equity (Re)

Pre-tax cost of debt (YTW) (Rd)

Effective tax rate

Post-tax cost of debt

Target debt/total capital

Target debt /equity

WACC

WACC (rounded)

Leverage (8 of TMC)

Debt

Equity

Debt/equity

JPMorgan

4.74%

1.30

1.75

4.24%

12.16%

6.55%

0.0%

6.55%

35.0%

53.8%

10. 20%

10. 20%

35.0%

35.0

65.0

53.8%

Estimated peer beta analysis

Company

MGM Mirage

Harrah's Entertainment

Wynn Resorts

Las Vegas Sands

Gaylord Entertainment

Orient Express Hotels

Starwood Hotels & Resorts

Hilton Hotels

Mean

Median

Beta

1.50

Predicted beta

1.50

1.25

1.75

1.60

1.50

1.50

1.25

1.25

1.75

2.00

WACC sensitivity by beta and cost of debt

6.05%

9.33%

10.02%

1.45

1.50

10.71%

Total

debt

$12,271

10,596

NM

NM

582

558

3,180

8,193

6.30%

9.42%

10.11%

5,897

5,687

10.80%

Equity

mkt. cap

11,247

13,166

NM

NM

1,883

1,407

15,440

9,863

8,834

10,555

Cost of debt

6.55%

9.51%

10.20%

10.89%

Debt/

capital

52%

45%

NM

NM

24%

28%

17%

45%

35%

37%

6.80%

9.60%

10.29%

10.97%

Tax

rate

35%

35%

NM

NM

35%

35%

35%

35%

35%

35%

Unlevered

beta

1.12

0.97

NM

NM

1.30

1.27

1.13

0.97

1.12

1.12

7.05%

9.68%

10.37%

11.06%

PROJECT PLATO

32View entire presentation