Crocs Investor Presentation Deck

NON-GAAP RECONCILIATION (cont'd)

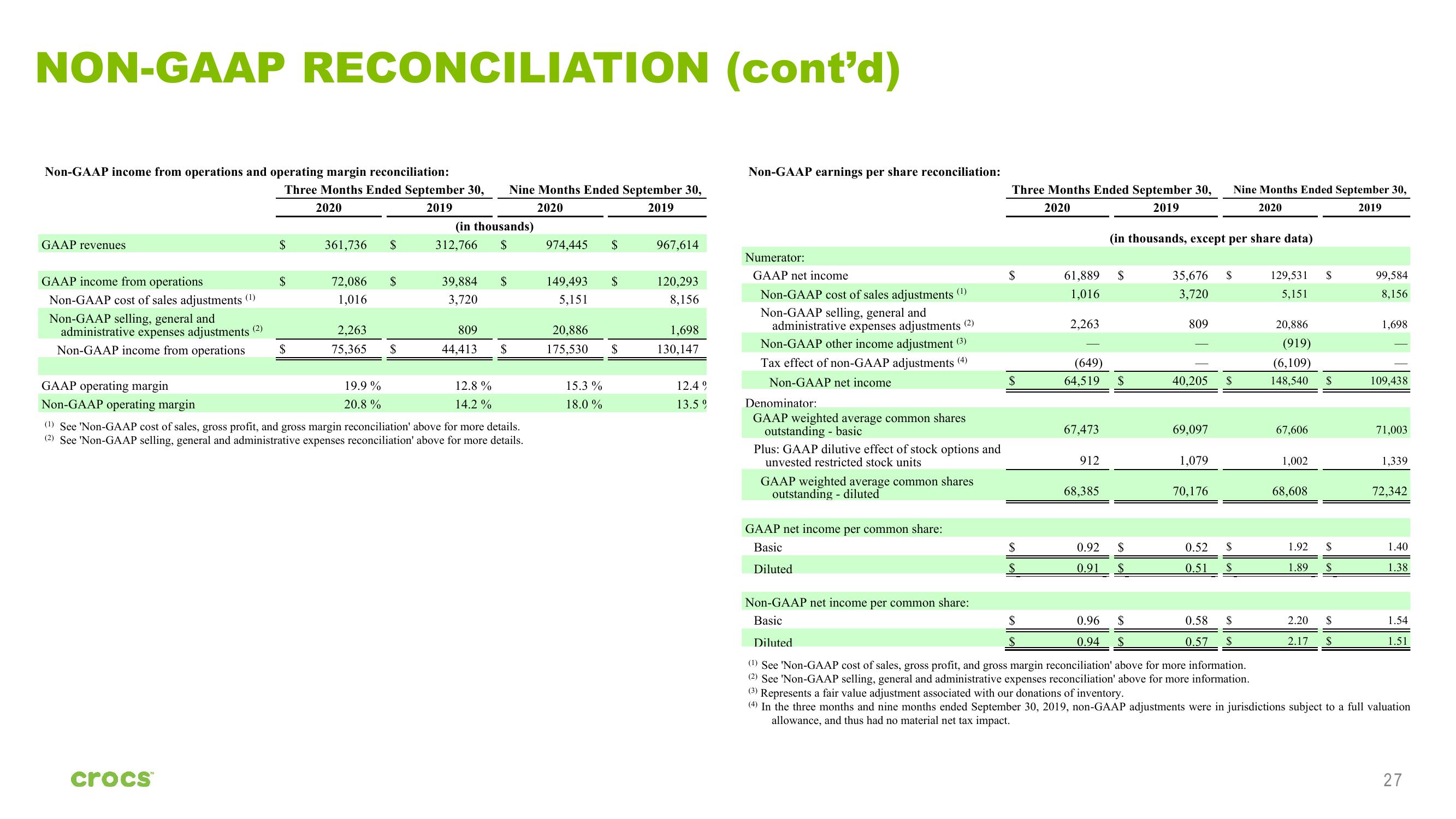

Non-GAAP income from operations and operating margin reconciliation:

GAAP revenues

GAAP income from operations

Non-GAAP cost of sales adjustments (¹)

Non-GAAP selling, general and

administrative expenses adjustments (2)

Non-GAAP income from operations

Three Months Ended September 30, Nine Months Ended September 30,

2020

2019

2020

2019

crocs™

$

$

$

361,736 $

72,086 $

1,016

2,263

75,365

$

19.9 %

20.8%

(in thousands)

312,766 $

39,884 $

3,720

809

44,413

GAAP operating margin

Non-GAAP operating margin

(1) See 'Non-GAAP cost of sales, gross profit, and gross margin reconciliation' above for more details.

(2) See 'Non-GAAP selling, general and administrative expenses reconciliation' above for more details.

$

12.8%

14.2%

974,445 $

149,493

5,151

20,886

175,530

15.3%

18.0%

$

$

967,614

120,293

8,156

1,698

130,147

12.49

13.59

Non-GAAP earnings per share reconciliation:

Numerator:

GAAP net income

Non-GAAP cost of sales adjustments (¹)

Non-GAAP selling, general and

administrative expenses adjustments (2)

Non-GAAP other income adjustment (3)

Tax effect of non-GAAP adjustments (4)

Non-GAAP net income

Denominator:

GAAP weighted average common shares

outstanding - basic

Plus: GAAP dilutive effect of stock options and

unvested restricted stock units

GAAP weighted average common shares

outstanding - diluted

GAAP net income per common share:

Basic

Diluted

Three Months Ended September 30, Nine Months Ended September 30,

2020

2019

2020

2019

$

$

$

61,889

1,016

$

$

2,263

(649)

64,519

67,473

912

68,385

(in thousands, except per share data)

$

$

0.92 $

0.91

35,676

3,720

0.96 $

0.94 $

809

40,205

69,097

1,079

70,176

0.52

0.51

$

Non-GAAP net income per common share:

Basic

Diluted

(1) See 'Non-GAAP cost of sales, gross profit, and gross margin reconciliation' above for more information.

(2) See 'Non-GAAP selling, general and administrative expenses reconciliation' above for more information.

0.58

0.57

$

$

$

$

$

129,531

5,151

20,886

(919)

(6,109)

148,540

67,606

1,002

68,608

$

$

$

1.92

1.89 $

2.20 $

2.17 $

99,584

8,156

1,698

109,438

71,003

1,339

72,342

1.40

1.38

1.54

1.51

(3) Represents a fair value adjustment associated with our donations of inventory.

(4) In the three months and nine months ended September 30, 2019, non-GAAP adjustments were in jurisdictions subject to a full valuation

allowance, and thus had no material net tax impact.

27View entire presentation