Evercore Investment Banking Pitch Book

Financial Analysis

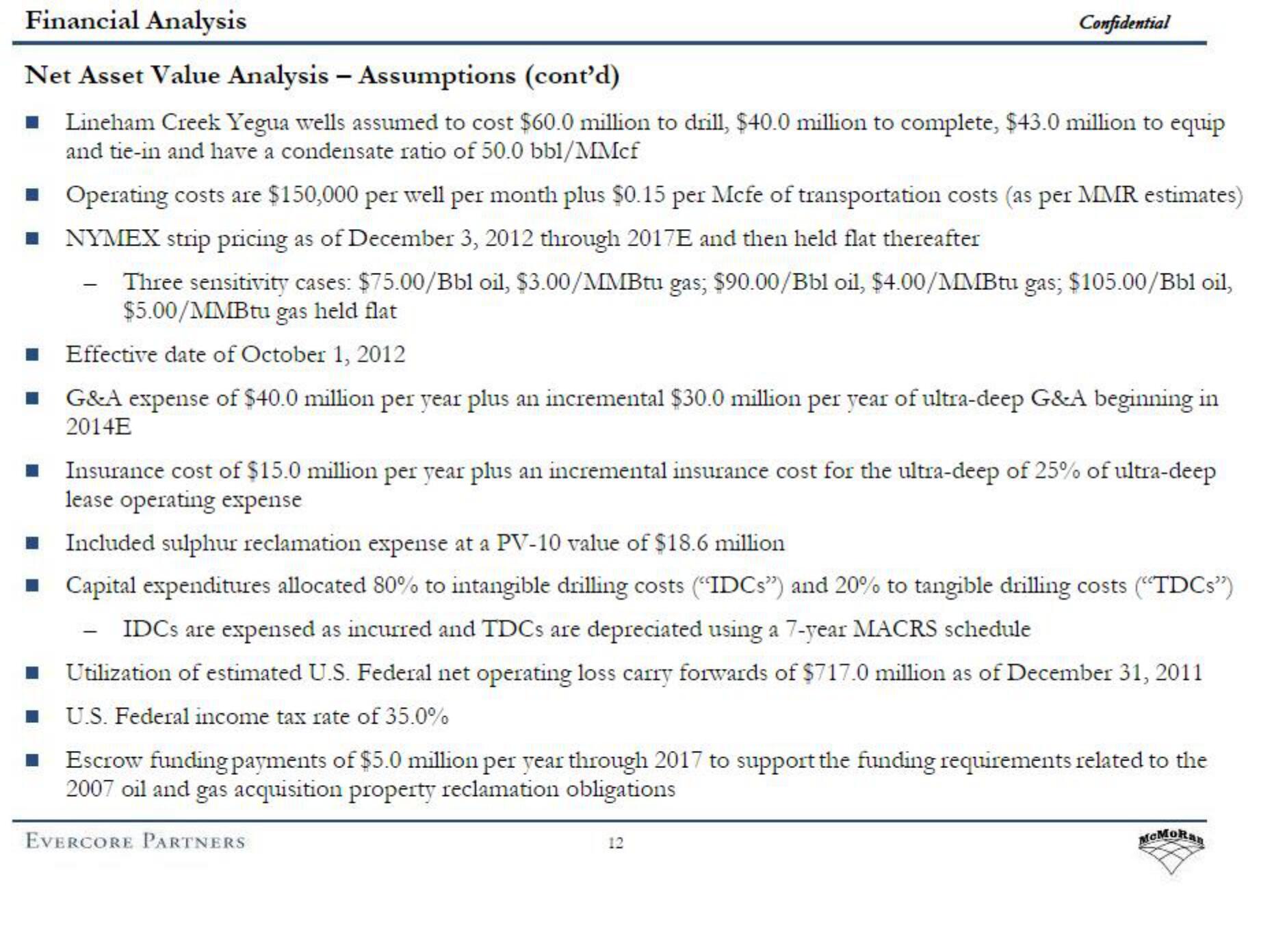

Net Asset Value Analysis - Assumptions (cont'd)

■ Lineham Creek Yegua wells assumed to cost $60.0 million to drill, $40.0 million to complete, $43.0 million to equip

and tie-in and have a condensate ratio of 50.0 bb1/MMcf

■ Operating costs are $150,000 per well per month plus $0.15 per Mcfe of transportation costs (as per MMR estimates)

NYMEX strip pricing as of December 3, 2012 through 2017E and then held flat thereafter

Three sensitivity cases: $75.00/Bbl oil, $3.00/MMBtu gas; $90.00/Bbl oil, $4.00/MMBtu gas; $105.00/Bbl oil,

$5.00/MMBtu gas held flat

Effective date of October 1, 2012

■

■

Confidential

G&A expense of $40.0 million per year plus an incremental $30.0 million per year of ultra-deep G&A beginning in

2014E

■ Insurance cost of $15.0 million per year plus an incremental insurance cost for the ultra-deep of 25% of ultra-deep

lease operating expense

Included sulphur reclamation expense at a PV-10 value of $18.6 million

■ Capital expenditures allocated 80% to intangible drilling costs ("IDCs") and 20% to tangible drilling costs ("TDCs")

- IDCs are expensed as incurred and TDCs are depreciated using a 7-year MACRS schedule

■ Utilization of estimated U.S. Federal net operating loss carry forwards of $717.0 million as of December 31, 2011

■ U.S. Federal income tax rate of 35.0%

■ Escrow funding payments of $5.0 million per year through 2017 to support the funding requirements related to the

2007 oil and gas acquisition property reclamation obligations

EVERCORE PARTNERS

12

MCMoRanView entire presentation