NewFortress Energy Investor Update

Executive Summary

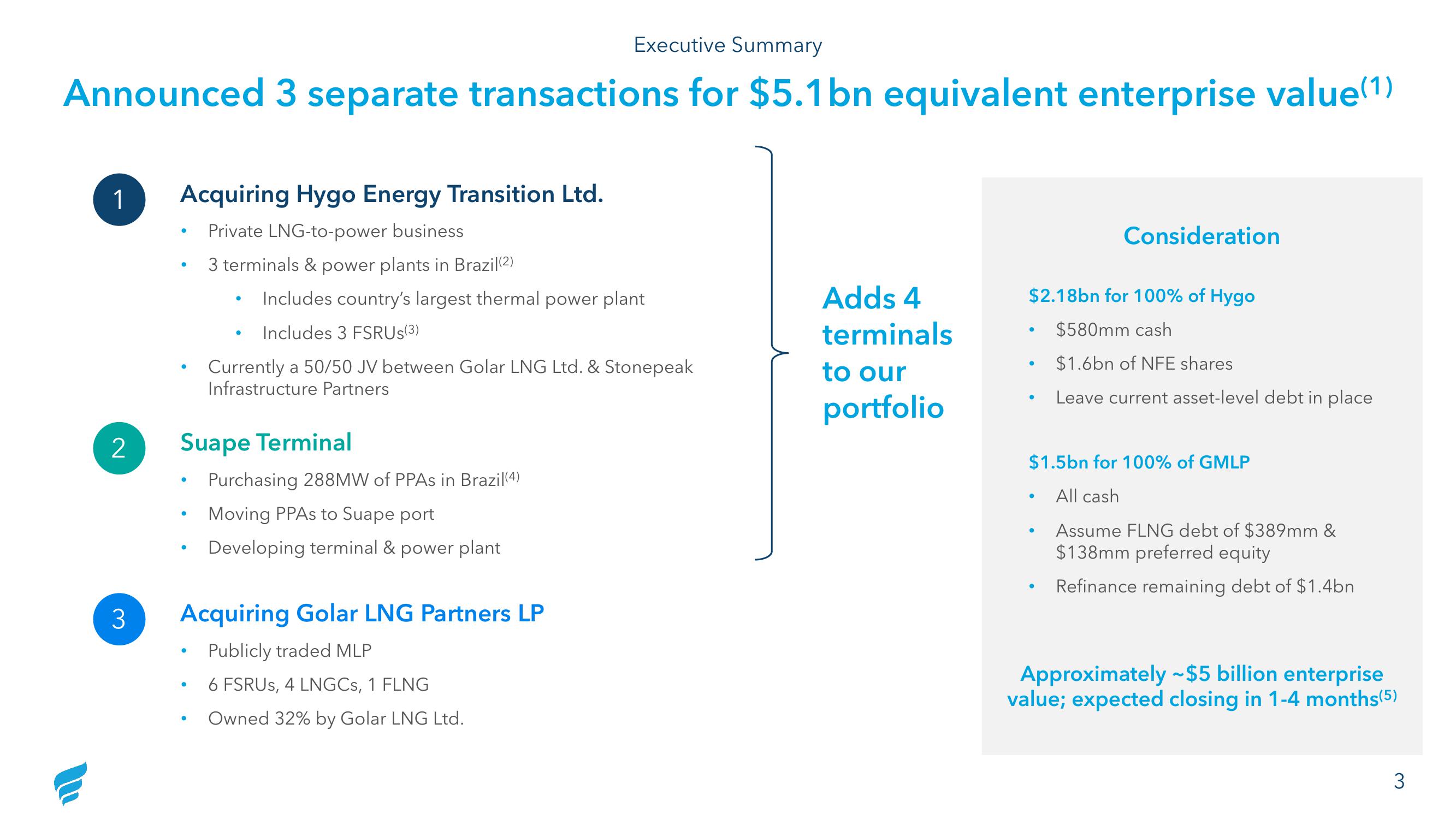

Announced 3 separate transactions for $5.1 bn equivalent enterprise value(1)

1

2

3

Acquiring Hygo Energy Transition Ltd.

Private LNG-to-power business

●

●

●

•

3 terminals & power plants in Brazil(2)

Suape Terminal

Purchasing 288MW of PPAs in Brazil(4)

Moving PPAs to Suape port

Developing terminal & power plant

●

●

●

●

Includes country's largest thermal power plant

Includes 3 FSRUS(³)

Currently a 50/50 JV between Golar LNG Ltd. & Stonepeak

Infrastructure Partners

Acquiring Golar LNG Partners LP

Publicly traded MLP

6 FSRUS, 4 LNGCs, 1 FLNG

Owned 32% by Golar LNG Ltd.

Adds 4

terminals

to our

portfolio

$2.18bn for 100% of Hygo

$580mm cash

$1.6bn of NFE shares

Leave current asset-level debt in place

●

●

Consideration

$1.5bn for 100% of GMLP

All cash

Assume FLNG debt of $389mm &

$138mm preferred equity

Refinance remaining debt of $1.4bn

●

●

Approximately ~$5 billion enterprise

value; expected closing in 1-4 months(5)

3View entire presentation