Cannae SPAC Presentation Deck

QOMPLX:

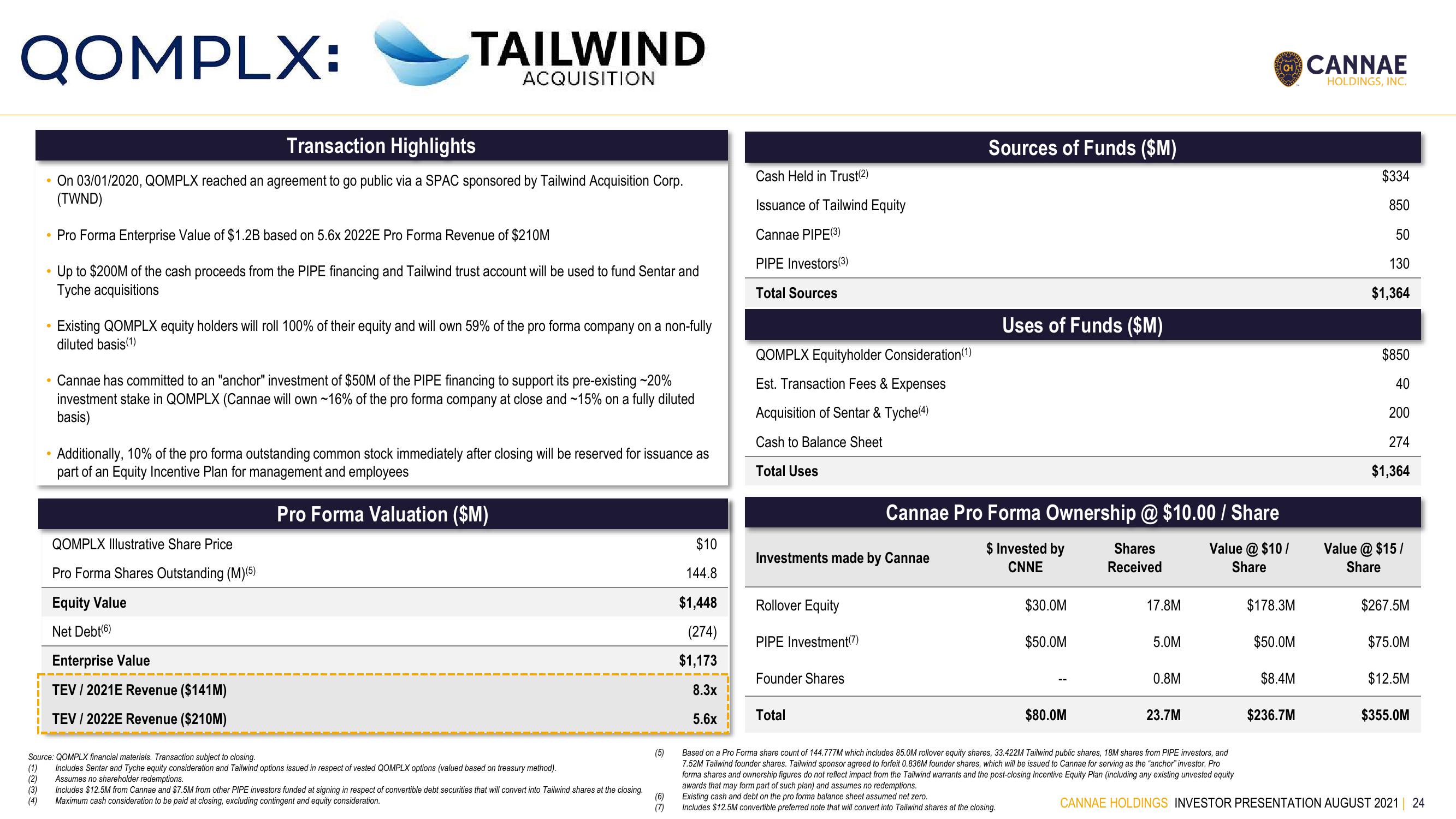

Transaction Highlights

●

On 03/01/2020, QOMPLX reached an agreement to go public via a SPAC sponsored by Tailwind Acquisition Corp.

(TWND)

Pro Forma Enterprise Value of $1.2B based on 5.6x 2022E Pro Forma Revenue of $210M

Up to $200M of the cash proceeds from the PIPE financing and Tailwind trust account will be used to fund Sentar and

Tyche acquisitions

.

Existing QOMPLX equity holders will roll 100% of their equity and will own 59% of the pro forma company on a non-fully

diluted basis(1)

TAILWIND

ACQUISITION

Cannae has committed to an "anchor" investment of $50M of the PIPE financing to support its pre-existing -20%

investment stake in QOMPLX (Cannae will own ~16% of the pro forma company at close and ~15% on a fully diluted

basis)

Additionally, 10% of the pro forma outstanding common stock immediately after closing will be reserved for issuance as

part of an Equity Incentive Plan for management and employees

Pro Forma Valuation ($M)

QOMPLX Illustrative Share Price

Pro Forma Shares Outstanding (M) (5)

Equity Value

Net Debt (6)

Enterprise Value

TEV / 2021E Revenue ($141M)

TEV / 2022E Revenue ($210M)

Source: QOMPLX financial materials. Transaction subject to closing.

(1) Includes Sentar and Tyche equity consideration and Tailwind options issued in respect of vested QOMPLX options (valued based on treasury method).

(2)

Assumes no shareholder redemptions.

(3)

(4)

Includes $12.5M from Cannae and $7.5M from other PIPE investors funded at signing in respect of convertible debt securities that will convert into Tailwind shares at the closing.

Maximum cash consideration to be paid at closing, excluding contingent and equity consideration.

(5)

(6)

(7)

$10

144.8

$1,448

(274)

$1,173

8.3x

5.6x

Cash Held in Trust(2)

Issuance of Tailwind Equity

Cannae PIPE (3)

PIPE Investors(3)

Total Sources

QOMPLX Equityholder Consideration (1)

Est. Transaction Fees & Expenses

Acquisition of Sentar & Tyche(4)

Cash to Balance Sheet

Total Uses

Investments made by Cannae

Rollover Equity

PIPE Investment(7)

Founder Shares

Total

Sources of Funds ($M)

Uses of Funds ($M)

Cannae Pro Forma Ownership @ $10.00 / Share

$ Invested by

CNNE

Value @ $10/

Share

$30.0M

$50.0M

$80.0M

Shares

Received

17.8M

5.0M

0.8M

23.7M

CH

Based on a Pro Forma share count of 144.777M which includes 85.0M rollover equity shares, 33.422M Tailwind public shares, 18M shares from PIPE investors, and

7.52M Tailwind founder shares. Tailwind sponsor agreed to forfeit 0.836M founder shares, which will be issued to Cannae for serving as the "anchor" investor. Pro

forma shares and ownership figures do not reflect impact from the Tailwind warrants and the post-closing Incentive Equity Plan (including any existing unvested equity

awards that may form part of such plan) and assumes no redemptions.

Existing cash and debt on the pro forma balance sheet assumed net zero.

Includes $12.5M convertible preferred note that will convert into Tailwind shares at the closing.

$178.3M

$50.0M

$8.4M

$236.7M

CANNAE

HOLDINGS, INC.

$334

850

50

130

$1,364

$850

40

200

274

$1,364

Value @ $15/

Share

$267.5M

$75.0M

$12.5M

$355.0M

CANNAE HOLDINGS INVESTOR PRESENTATION AUGUST 2021 24View entire presentation