Antero Midstream Partners Investor Presentation Deck

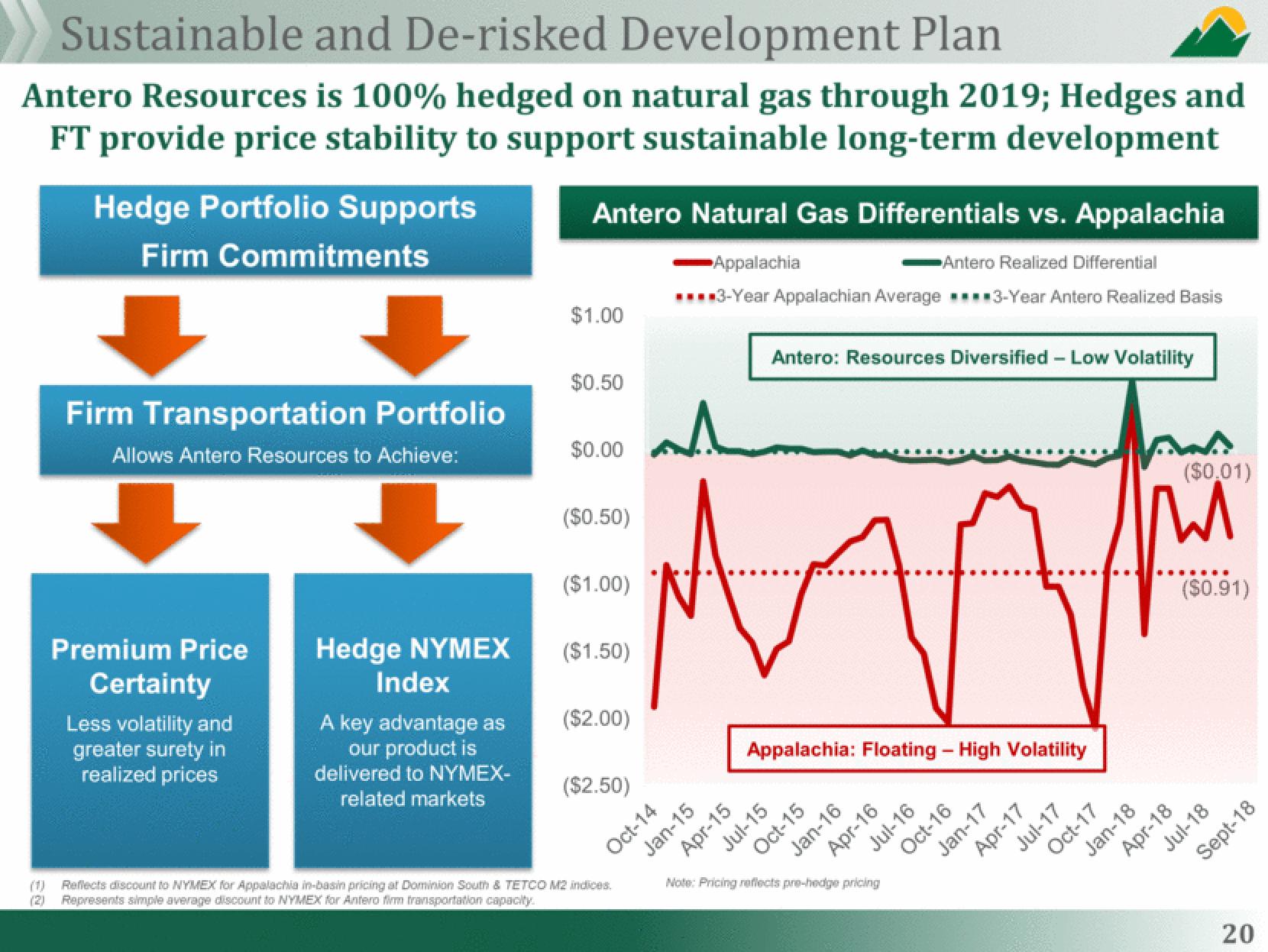

Sustainable and De-risked Development Plan

Antero Resources is 100% hedged on natural gas through 2019; Hedges and

FT provide price stability to support sustainable long-term development

Hedge Portfolio Supports

Firm Commitments

Firm Transportation Portfolio

Allows Antero Resources to Achieve:

Premium Price Hedge NYMEX

Index

Certainty

Less volatility and

greater surety in

realized prices

A key advantage as

our product is

delivered to NYMEX-

related markets

Antero Natural Gas Differentials vs. Appalachia

Appalachia

Antero Realized Differential

▪▪▪▪3-Year Appalachian Average ■■■■3-Year Antero Realized Basis

$1.00

$0.50

$0.00

($0.50)

($1.00)

($1.50)

($2.00)

($2.50)

Reflects discount to NYMEX for Appalachia in-basin pricing at Dominion South & TETCO M2 indices.

Represents simple average discount to NYMEX for Antero firm transportation capacity.

ad

MA

Oct-14

Jan-15

Antero: Resources Diversified - Low Volatility

Apr-15

Appalachia: Floating - High Volatility

Jul-15

Oct-15

Jan-16

Apr-16

Note: Pricing reflects pre-hedge pricing

Jul-16

Oct-16

Jan-17

Apr-17

LL-INC

Oct-17

Jan-18

($0,01)

пл

($0.91)

Apr-18

Jul-18

Sept-18

20View entire presentation