BlackRock Global Long/Short Credit Absolute Return Credit

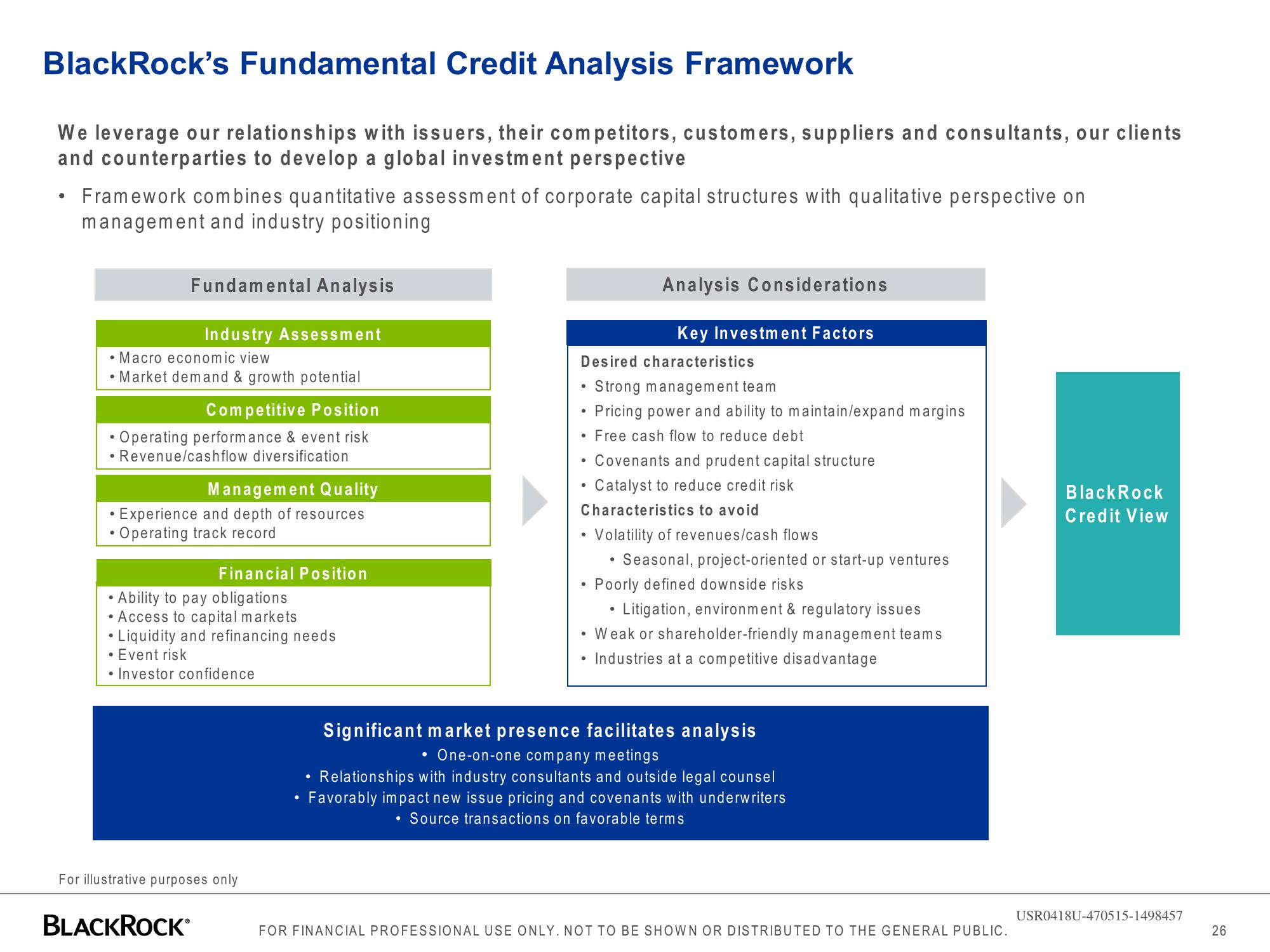

BlackRock's Fundamental Credit Analysis Framework

We leverage our relationships with issuers, their competitors, customers, suppliers and consultants, our clients

and counterparties to develop a global investment perspective

Framework combines quantitative assessment of corporate capital structures with qualitative perspective on

management and industry positioning

Fundamental Analysis

Industry Assessment

• Macro economic view

• Market demand & growth potential

Competitive Position

• Operating performance & event risk

• Revenue/cashflow diversification

Management Quality

• Experience and depth of resources

• Operating track record

Financial Position

• Ability to pay obligations

• Access to capital markets

• Liquidity and refinancing needs

• Event risk

• Investor confidence

BLACKROCK®

For illustrative purposes only

●

●

Desired characteristics

Strong management team

• Pricing power and ability to maintain/expand margins

Free cash flow to reduce debt

●

●

Analysis Considerations

Key Investment Factors

●

Covenants and prudent capital structure

Catalyst to reduce credit risk

Characteristics to avoid

Volatility of revenues/cash flows

Seasonal, project-oriented or start-up ventures

Poorly defined downside risks

Litigation, environment & regulatory issues

Weak or shareholder-friendly management teams

Industries at a competitive disadvantage

●

Significant market presence facilitates analysis

• One-on-one company meetings

Relationships with industry consultants and outside legal counsel

• Favorably impact new issue pricing and covenants with underwriters

Source transactions on favorable terms

FOR FINANCIAL PROFESSIONAL USE ONLY. NOT TO BE SHOWN OR DISTRIBUTED TO THE GENERAL PUBLIC.

BlackRock

Credit View

USR0418U-470515-1498457

26View entire presentation