Endeavour Mining Investor Presentation Deck

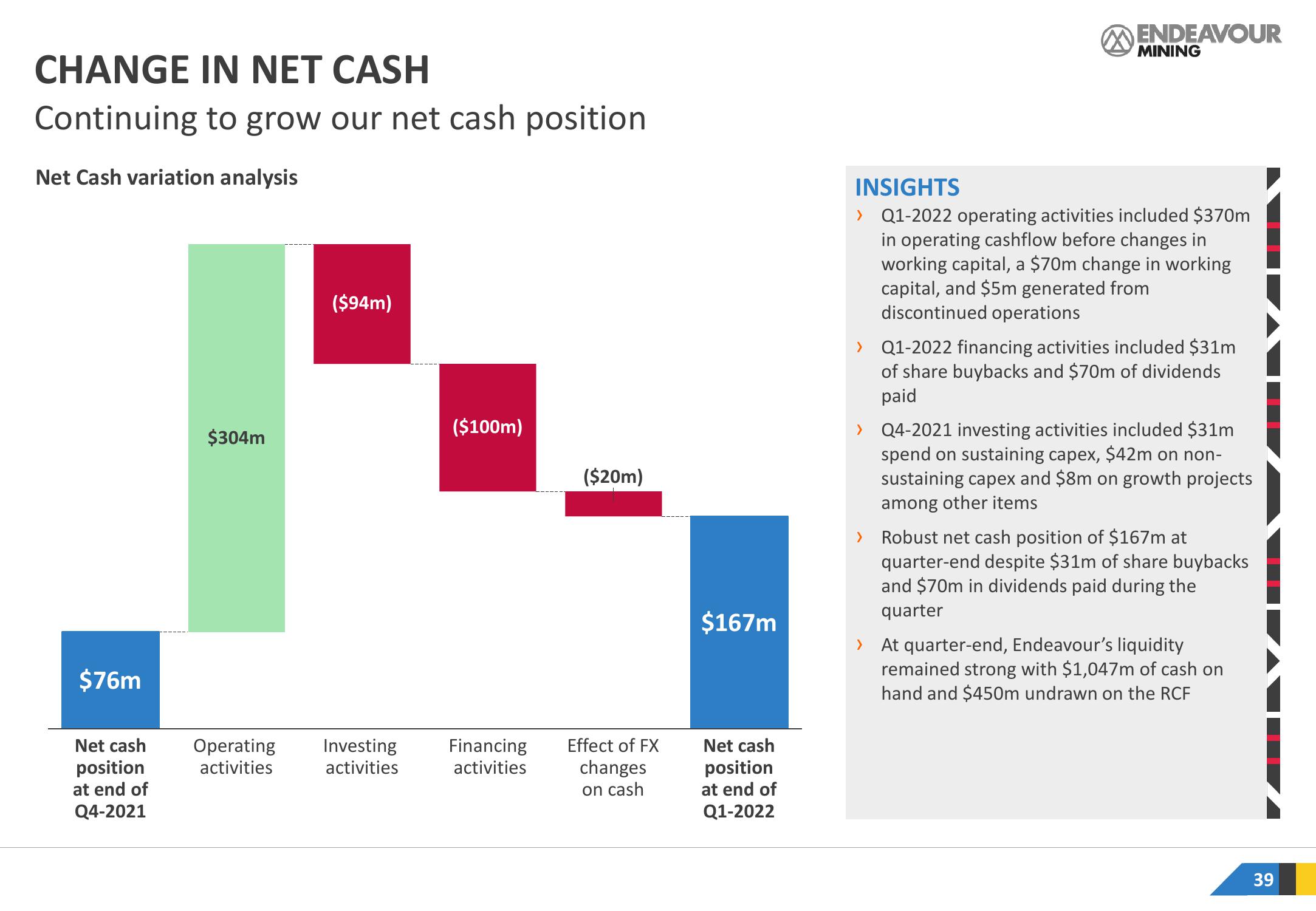

CHANGE IN NET CASH

Continuing to grow our net cash position

Net Cash variation analysis

$76m

Net cash

position

at end of

Q4-2021

$304m

($94m)

Operating Investing

activities

activities

($100m)

($20m)

Financing Effect of FX

activities

changes

on cash

$167m

Net cash

position

at end of

Q1-2022

>

ENDEAVOUR

INSIGHTS

Q1-2022 operating activities included $370m

in operating cashflow before changes in

working capital, a $70m change in working

capital, and $5m generated from

discontinued operations

MINING

>

> Q1-2022 financing activities included $31m

of share buybacks and $70m of dividends

paid

Q4-2021 investing activities included $31m

spend on sustaining capex, $42m on non-

sustaining capex and $8m on growth projects

among other items

> Robust net cash position of $167m at

quarter-end despite $31m of share buybacks

and $70m in dividends paid during the

quarter

> At quarter-end, Endeavour's liquidity

remained strong with $1,047m of cash on

hand and $450m undrawn on the RCF

39View entire presentation