AT&T Results Presentation Deck

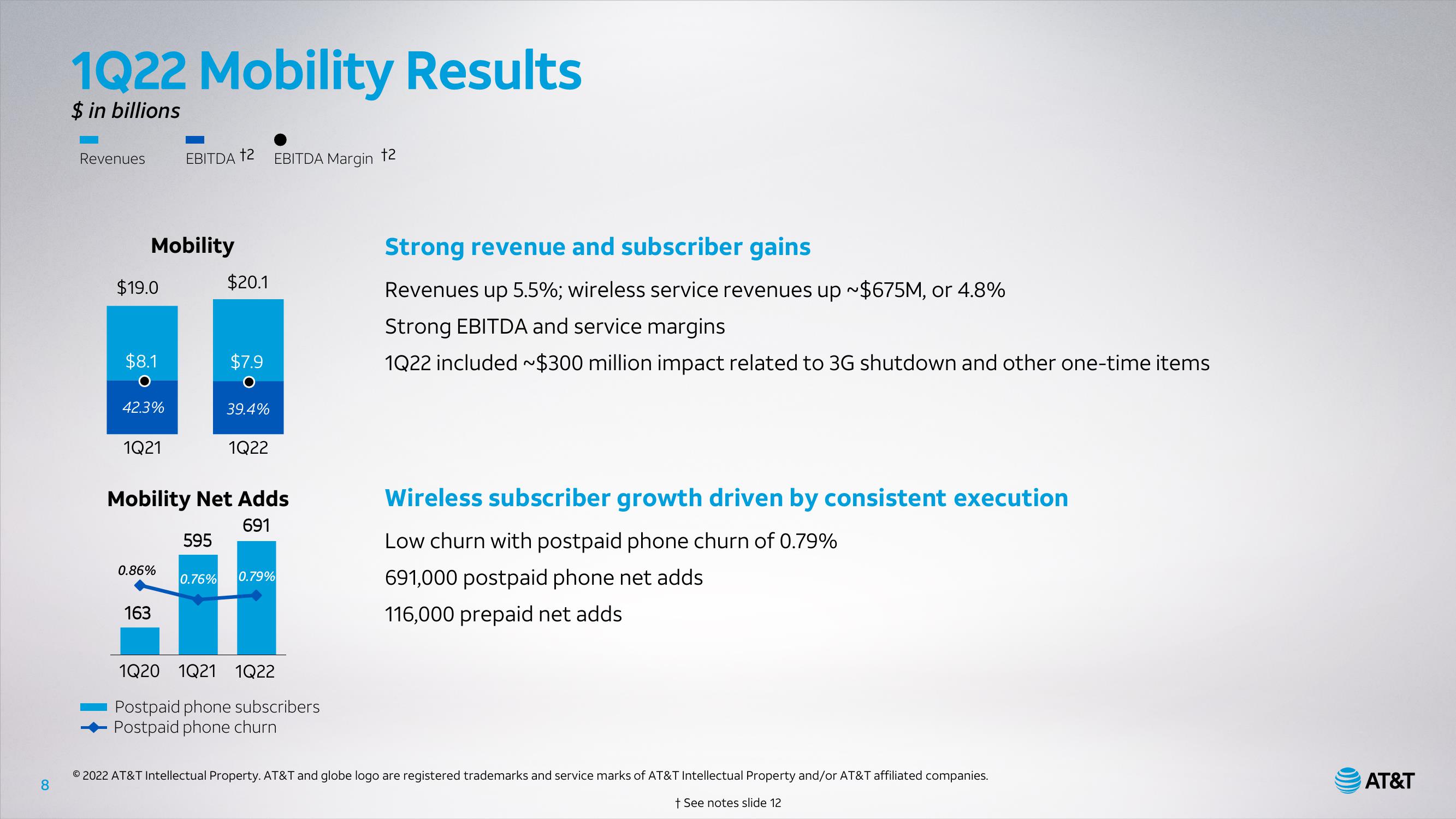

1Q22 Mobility Results

$ in billions

Revenues

Mobility

$19.0

$8.1

42.3%

1Q21

EBITDA †2

0.86%

163

$20.1

595

$7.9

39.4%

Mobility Net Adds

691

1Q22

EBITDA Margin †2

0.76% 0.79%

1Q20 1Q21 1Q22

Postpaid phone subscribers

Postpaid phone churn

Strong revenue and subscriber gains

Revenues up 5.5%; wireless service revenues up ~$675M, or 4.8%

Strong EBITDA and service margins

1Q22 included ~$300 million impact related to 3G shutdown and other one-time items

Wireless subscriber growth driven by consistent execution

Low churn with postpaid phone churn of 0.79%

691,000 postpaid phone net adds

116,000 prepaid net adds

8

© 2022 AT&T Intellectual Property. AT&T and globe logo are registered trademarks and service marks of AT&T Intellectual Property and/or AT&T affiliated companies.

+ See notes slide 12

AT&TView entire presentation