AngloAmerican Results Presentation Deck

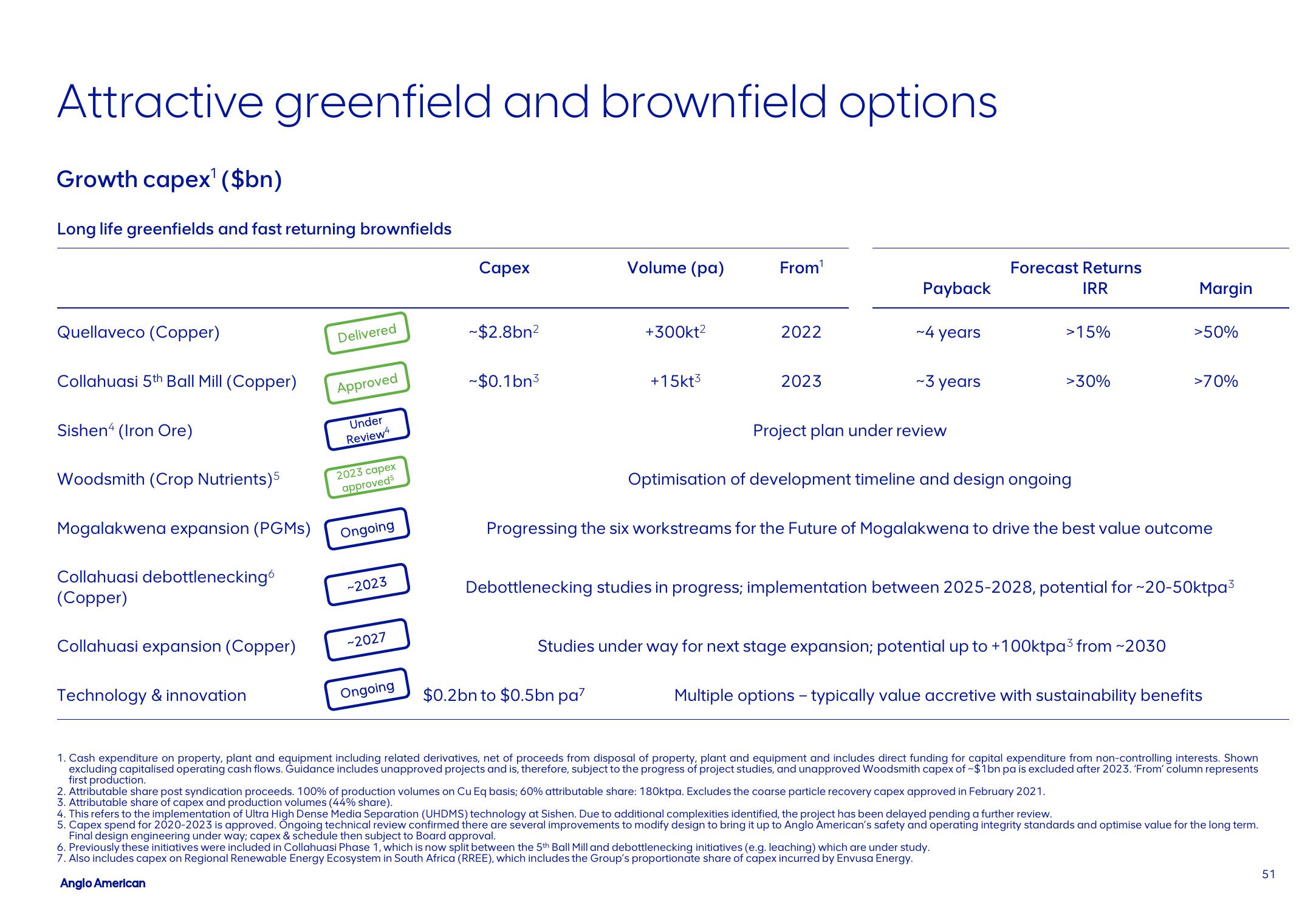

Attractive greenfield and brownfield options

Growth capex¹ ($bn)

Long life greenfields and fast returning brownfields

Quellaveco (Copper)

Collahuasi 5th Ball Mill (Copper)

Sishen (Iron Ore)

Woodsmith (Crop Nutrients)5

Mogalakwena expansion (PGMs)

Collahuasi debottlenecking

(Copper)

Collahuasi expansion (Copper)

Technology & innovation

Delivered

0000000

Approved

Under

Review4

2023 capex

approved5

Ongoing

-2023

-2027

Ongoing

Capex

~$2.8bn²

~$0.1bn³

Volume (pa)

+300kt²

+15kt3

$0.2bn to $0.5bn pa7

From¹

2022

2023

Payback

~4 years

~3 years

Project plan under review

Forecast Returns

IRR

>15%

Optimisation of development timeline and design ongoing

>30%

Studies under way for next stage expansion; potential up to +100ktpa³ from ~2030

Progressing the six workstreams for the Future of Mogalakwena to drive the best value outcome

Margin

Debottlenecking studies in progress; implementation between 2025-2028, potential for ~20-50ktpa³

2. Attributable share post syndication proceeds. 100% of production volumes on Cu Eq basis; 60% attributable share: 180ktpa. Excludes the coarse particle recovery capex approved in February 2021.

3. Attributable share of capex and production volumes (44% share).

>50%

6. Previously these initiatives were included in Collahuasi Phase 1, which is now split between the 5th Ball Mill and debottlenecking initiatives (e.g. leaching) which are under study.

7. Also includes capex on Regional Renewable Energy Ecosystem in South Africa (RREE), which includes the Group's proportionate share of capex incurred by Envusa Energy.

Anglo American

>70%

Multiple options - typically value accretive with sustainability benefits

1. Cash expenditure on property, plant and equipment including related derivatives, net of proceeds from disposal of property, plant and equipment and includes direct funding for capital expenditure from non-controlling interests. Shown

excluding capitalised operating cash flows. Guidance includes unapproved projects and is, therefore, subject to the progress of project studies, and unapproved Woodsmith capex of ~$1bn pa is excluded after 2023. 'From' column represents

first production.

4. This refers to the implementation of Ultra High Dense Media Separation (UHDMS) technology at Sishen. Due to additional complexities identified, the project has been delayed pending a further review.

5. Capex spend for 2020-2023 is approved. Ongoing technical review confirmed there are several improvements to modify design to bring it up to Anglo American's safety and operating integrity standards and optimise value for the long term.

Final design engineering under way; capex & schedule then subject to Board approval.

51View entire presentation