OSP Value Fund IV LP Q4 2022

OSP

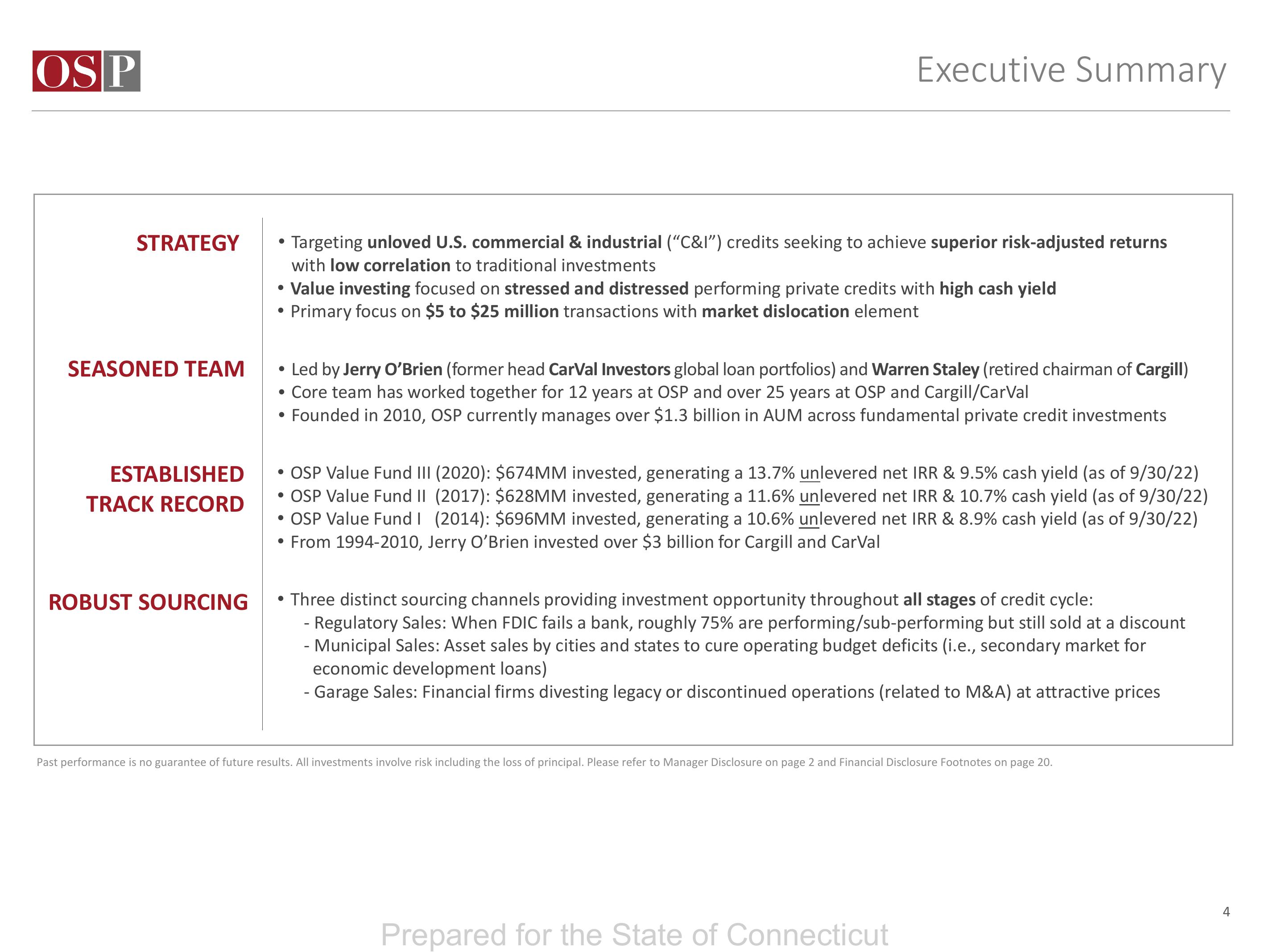

STRATEGY

SEASONED TEAM

ESTABLISHED

TRACK RECORD

ROBUST SOURCING

• Targeting unloved U.S. commercial & industrial ("C&I") credits seeking to achieve superior risk-adjusted returns

with low correlation to traditional investments

• Value investing focused on stressed and distressed performing private credits with high cash yield

• Primary focus on $5 to $25 million transactions with market dislocation element

Executive Summary

●

Led by Jerry O'Brien (former head Carval Investors global loan portfolios) and Warren Staley (retired chairman of Cargill)

●

• Core team has worked together for 12 years at OSP and over 25 years at OSP and Cargill/CarVal

Founded in 2010, OSP currently manages over $1.3 billion in AUM across fundamental private credit investments

●

• OSP Value Fund III (2020): $674MM invested, generating a 13.7% unlevered net IRR & 9.5% cash yield (as of 9/30/22)

• OSP Value Fund II (2017): $628MM invested, generating a 11.6% unlevered net IRR & 10.7% cash yield (as of 9/30/22)

• OSP Value Fund I (2014): $696MM invested, generating a 10.6% unlevered net IRR & 8.9% cash yield (as of 9/30/22)

• From 1994-2010, Jerry O'Brien invested over $3 billion for Cargill and Carval

• Three distinct sourcing channels providing investment opportunity throughout all stages of credit cycle:

- Regulatory Sales: When FDIC fails a bank, roughly 75% are performing/sub-performing but still sold at a discount

- Municipal Sales: Asset sales by cities and states to cure operating budget deficits (i.e., secondary market for

economic development loans)

- Garage Sales: Financial firms divesting legacy or discontinued operations (related to M&A) at attractive prices

Past performance is no guarantee of future results. All investments involve risk including the loss of principal. Please refer to Manager Disclosure on page 2 and Financial Disclosure Footnotes on page 20.

Prepared for the State of Connecticut

4View entire presentation