Near Investor Presentation Deck

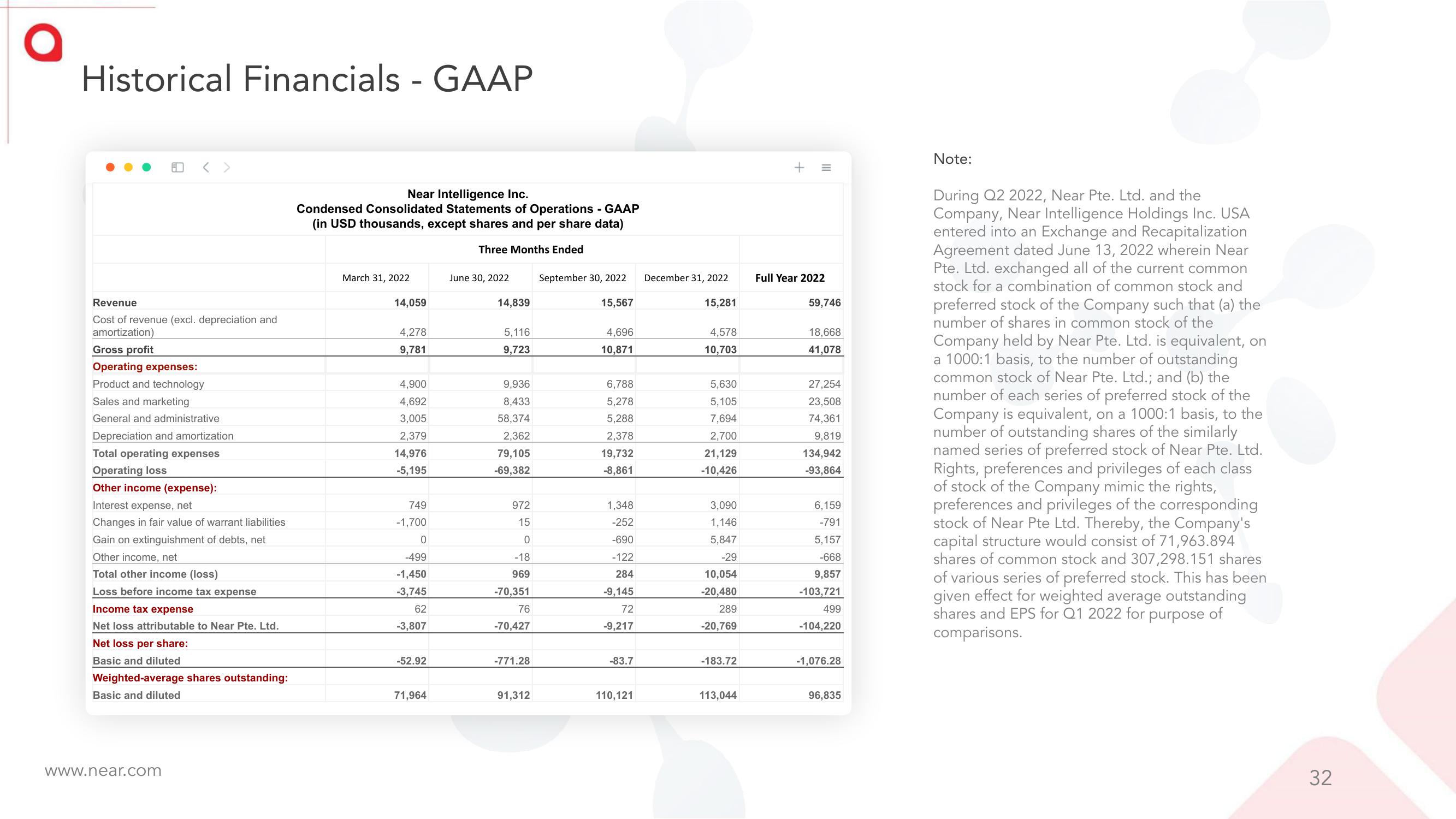

Historical Financials - GAAP

Revenue

Cost of revenue (excl. depreciation and

amortization)

Gross profit

Operating expenses:

Product and technology

Sales and marketing

General and administrative

Depreciation and amortization

Total operating expenses

Operating loss

Other income (expense):

Interest expense, net

Changes in fair value of warrant liabilities

Gain on extinguishment of debts, net

Other income, net

Total other income (loss)

Loss before income tax expense

Income tax expense

Net loss attributable to Near Pte. Ltd.

Net loss per share:

Basic and diluted

Weighted-average shares outstanding:

Basic and diluted

www.near.com

Near Intelligence Inc.

Condensed Consolidated Statements of Operations - GAAP

(in USD thousands, except shares and per share data)

Three Months Ended

March 31, 2022

14,059

4,278

9,781

4,900

4,692

3,005

2,379

14,976

-5,195

749

-1,700

0

-499

-1,450

-3,745

62

-3,807

-52.92

71,964

June 30, 2022

14,839

5,116

9,723

9,936

8,433

58,374

2,362

79,105

-69,382

972

15

0

-18

969

-70,351

76

-70,427

-771.28

91,312

September 30, 2022

15,567

4,696

10,871

6,788

5,278

5,288

2,378

19,732

-8,861

1,348

-252

-690

-122

284

-9,145

72

-9,217

-83.7

110,121

December 31, 2022

15,281

4,578

10,703

5,630

5,105

7,694

2,700

21,129

-10,426

3,090

1,146

5,847

-29

10,054

-20,480

289

-20,769

-183.72

113,044

+ =

III

Full Year 2022

59,746

18,668

41,078

27,254

23,508

74,361

9,819

134,942

-93,864

6,159

-791

5,157

-668

9,857

-103,721

499

-104,220

-1,076.28

96,835

Note:

During Q2 2022, Near Pte. Ltd. and the

Company, Near Intelligence Holdings Inc. USA

entered into an Exchange and Recapitalization

Agreement dated June 13, 2022 wherein Near

Pte. Ltd. exchanged all of the current common

stock for a combination of common stock and

preferred stock of the Company such that (a) the

number of shares in common stock of the

Company held by Near Pte. Ltd. is equivalent, on

a 1000:1 basis, to the number of outstanding

common stock of Near Pte. Ltd.; and (b) the

number of each series of preferred stock of the

Company is equivalent, on a 1000:1 basis, to the

number of outstanding shares of the similarly

named series of preferred stock of Near Pte. Ltd.

Rights, preferences and privileges of each class

of stock of the Company mimic the rights,

preferences and privileges of the corresponding

stock of Near Pte Ltd. Thereby, the Company's

capital structure would consist of 71,963.894

shares of common stock and 307,298.151 shares

of various series of preferred stock. This has been

given effect for weighted average outstanding

shares and EPS for Q1 2022 for purpose of

comparisons.

32View entire presentation