Satellogic SPAC

DETAILED TRANSACTION OVERVIEW

($mm)

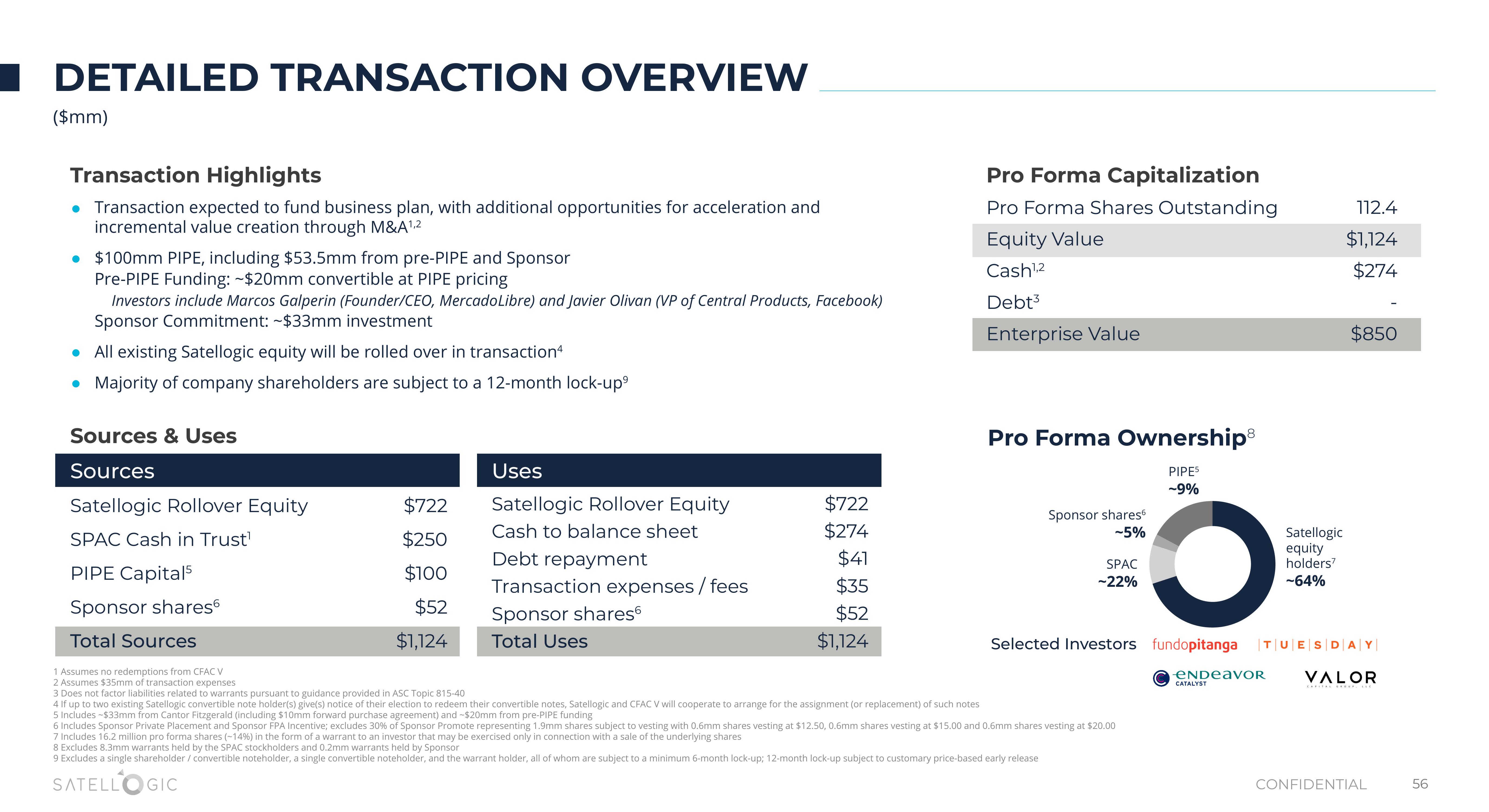

Transaction Highlights

• Transaction expected to fund business plan, with additional opportunities for acceleration and

incremental value creation through M&A¹,2

• $100mm PIPE, including $53.5mm from pre-PIPE and Sponsor

Pre-PIPE Funding: ~$20mm convertible at PIPE pricing

Investors include Marcos Galperin (Founder/CEO, Mercado Libre) and Javier Olivan (VP of Central Products, Facebook)

Sponsor Commitment:~$33mm investment

• All existing Satellogic equity will be rolled over in transaction4

• Majority of company shareholders are subject to a 12-month lock-up⁹

Sources & Uses

Sources

Satellogic Rollover Equity

SPAC Cash in Trust¹

PIPE Capital5

Sponsor shares

Total Sources

1 Assumes no redemptions from CFAC V

2 Assumes $35mm of transaction expenses.

$722

$250

$100

$52

$1,124

Uses

Satellogic Rollover Equity

Cash to balance sheet

Debt repayment

Transaction expenses/ fees

Sponsor shares6

Total Uses

$722

$274

$41

$35

$52

$1,124

Pro Forma Capitalization

Pro Forma Shares Outstanding

Equity Value

Cash¹,2

Debt³

Enterprise Value

Sponsor shares

-5%

Pro Forma Ownership

PIPE5

-9%

O

Selected Investors fundopitanga TUESDAY

SPAC

-22%

3 Does not factor liabilities related to warrants pursuant to guidance provided in ASC Topic 815-40

4 If up to two existing Satellogic convertible note holder(s) give(s) notice of their election to redeem their convertible notes, Satellogic and CFAC V will cooperate to arrange for the assignment (or replacement) of such notes

5 Includes -$33mm from Cantor Fitzgerald (including $10mm forward purchase agreement) and -$20mm from pre-PIPE funding

6 Includes Sponsor Private Placement and Sponsor FPA Incentive; excludes 30% of Sponsor Promote representing 1.9mm shares subject to vesting with 0.6mm shares vesting at $12.50, 0.6mm shares vesting at $15.00 and 0.6mm shares vesting at $20.00

7 Includes 16.2 million pro forma shares (-14%) in the form of a warrant to an investor that may be exercised only in connection with a sale of the underlying shares

8 Excludes 8.3mm warrants held by the SPAC stockholders and 0.2mm warrants held by Sponsor

9 Excludes a single shareholder / convertible noteholder, a single convertible noteholder, and the warrant holder, all of whom are subject to a minimum 6-month lock-up; 12-month lock-up subject to customary price-based early release

SATELLOGIC

ENDEAVOR

CATALYST

112.4

$1,124

$274

Satellogic

equity

holders'

-64%

$850

VALOR

CONFIDENTIAL

56View entire presentation