Trian Partners Activist Presentation Deck

Illustrative Returns

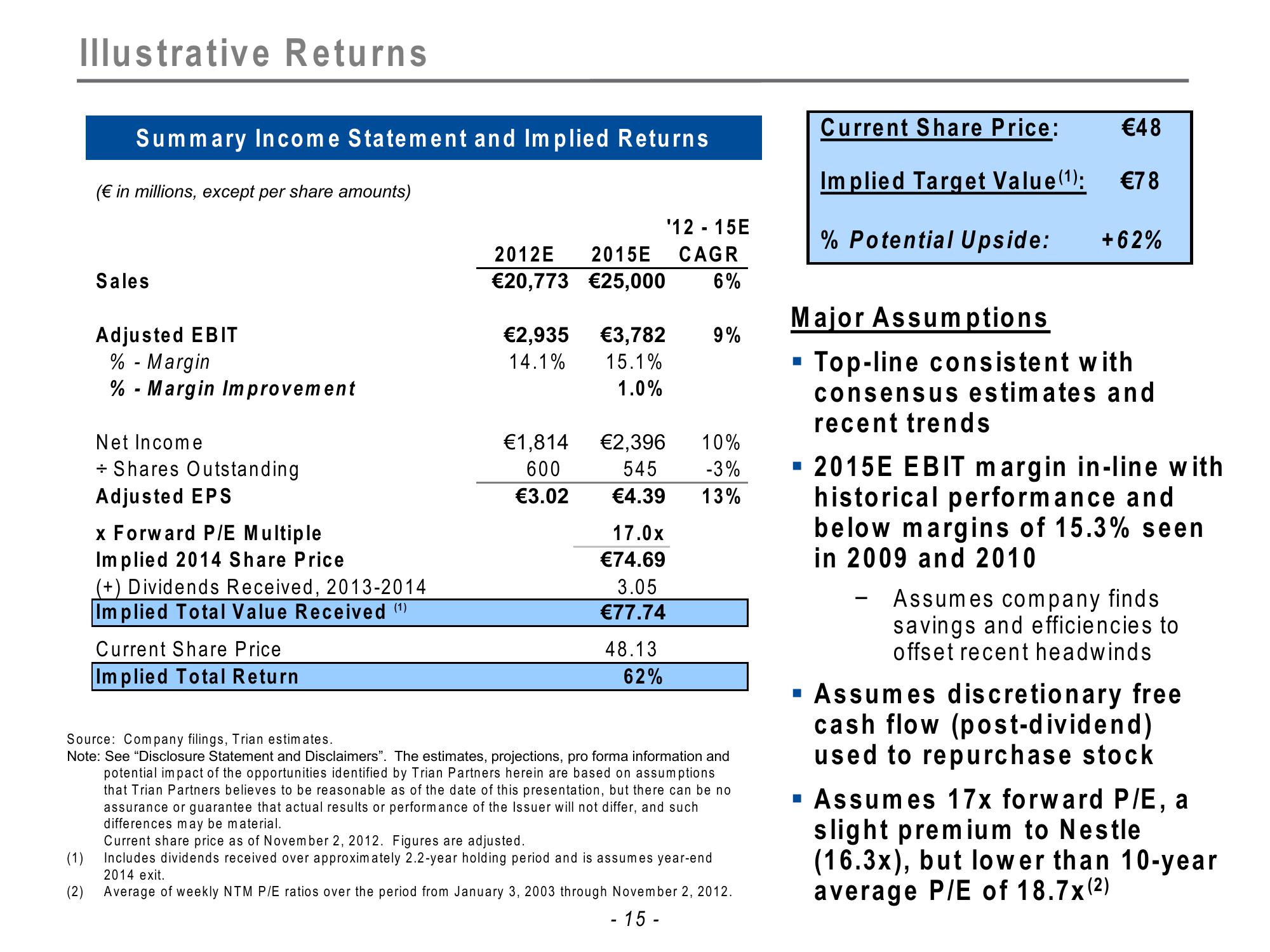

Summary Income Statement and Implied Returns

(€ in millions, except per share amounts)

Sales

Adjusted EBIT

% - Margin

%-Margin Improvement

Net Income

+ Shares Outstanding

Adjusted EPS

x Forward P/E Multiple

Implied 2014 Share Price

(+) Dividends Received, 2013-2014

Implied Total Value Received (¹)

Current Share Price

Implied Total Return

'12 - 15E

2012E 2015E CAGR

€20,773 €25,000 6%

€2,935 €3,782

14.1% 15.1%

1.0%

€1,814

600

€3.02

€2,396

545

€4.39

17.0x

€74.69

3.05

€77.74

48.13

62%

9%

10%

-3%

13%

Source: Company filings, Trian estimates.

Note: See "Disclosure Statement and Disclaimers". The estimates, projections, pro forma information and

potential impact of the opportunities identified by Trian Partners herein are based on assumptions

that Trian Partners believes to be reasonable as of the date of this presentation, but there can be no

assurance or guarantee that actual results or performance of the Issuer will not differ, and such

differences may be material.

Current share price as of November 2, 2012. Figures are adjusted.

(1) Includes dividends received over approximately 2.2-year holding period and is assumes year-end

2014 exit.

(2) Average of weekly NTM P/E ratios over the period from January 3, 2003 through November 2, 2012.

- 15-

Current Share Price:

Implied Target Value (¹):

% Potential Upside:

■

€48

€78

+62%

Major Assumptions

Top-line consistent with

consensus estimates and

recent trends

▪ 2015E EBIT margin in-line with

historical performance and

below margins of 15.3% seen

in 2009 and 2010

Assumes company finds

savings and efficiencies to

offset recent headwinds

▪ Assumes discretionary free

cash flow (post-dividend)

used to repurchase stock

a

▪ Assumes 17x forward P/E,

slight premium to Nestle

(16.3x), but lower than 10-year

average P/E of 18.7x (²)View entire presentation