Baird Investment Banking Pitch Book

AR'S IDENTIFIED STEPS TO JOIN THE ELITE E&P GROUP

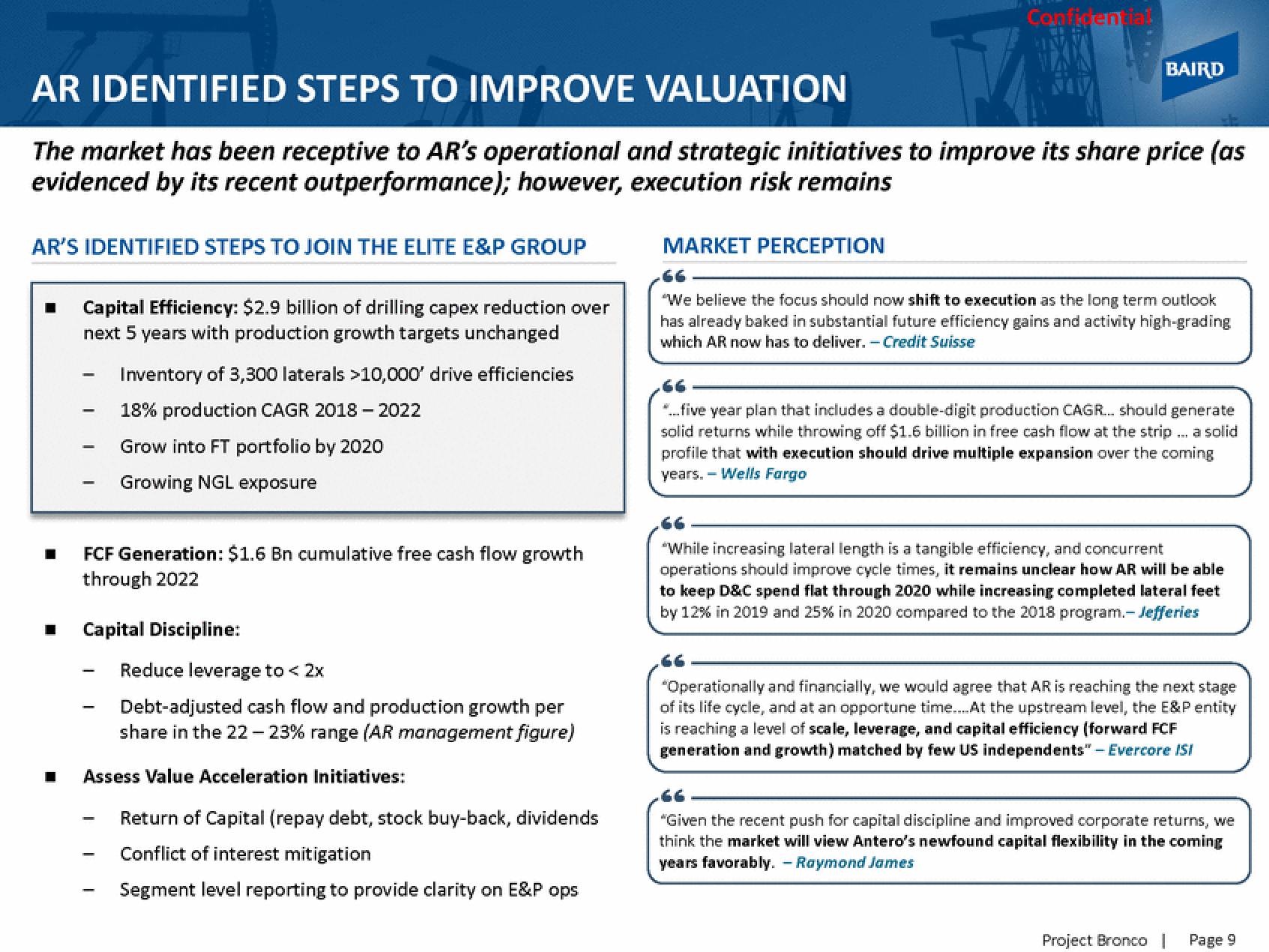

AR IDENTIFIED STEPS TO IMPROVE VALUATION

The market has been receptive to AR's operational and strategic initiatives to improve its share price (as

evidenced by its recent outperformance); however, execution risk remains

■

■

Capital Efficiency: $2.9 billion of drilling capex reduction over

next 5 years with production growth targets unchanged

-

-

-

FCF Generation: $1.6 Bn cumulative free cash flow growth

through 2022

Capital Discipline:

-

Inventory of 3,300 laterals >10,000' drive efficiencies

18% production CAGR 2018-2022

Grow into FT portfolio by 2020

Growing NGL exposure

-

Reduce leverage to < 2x

Debt-adjusted cash flow and production growth per

share in the 22-23% range (AR management figure)

Assess Value Acceleration Initiatives:

Return of Capital (repay debt, stock buy-back, dividends

Conflict of interest mitigation

Segment level reporting to provide clarity on E&P ops

Confidential

MARKET PERCEPTION

BAIRD

"We believe the focus should now shift to execution as the long term outlook

has already baked in substantial future efficiency gains and activity high-grading

which AR now has to deliver. - Credit Suisse

*... five year plan that includes a double-digit production CAGR... should generate

solid returns while throwing off $1.6 billion in free cash flow at the strip... a solid

profile that with execution should drive multiple expansion over the coming

years. Wells Fargo

"While increasing lateral length is a tangible efficiency, and concurrent

operations should improve cycle times, it remains unclear how AR will be able

to keep D&C spend flat through 2020 while increasing completed lateral feet

by 12% in 2019 and 25% in 2020 compared to the 2018 program.- Jefferies

"Operationally and financially, we would agree that AR is reaching the next stage

of its life cycle, and at an opportune time.....At the upstream level, the E&P entity

is reaching a level of scale, leverage, and capital efficiency (forward FCF

generation and growth) matched by few US independents" - Evercore ISI

"Given the recent push for capital discipline and improved corporate returns, we

think the market will view Antero's newfound capital flexibility in the coming

years favorably. - Raymond James

Project Bronco

Page 9View entire presentation