Mister Car Wash Investor Presentation Deck

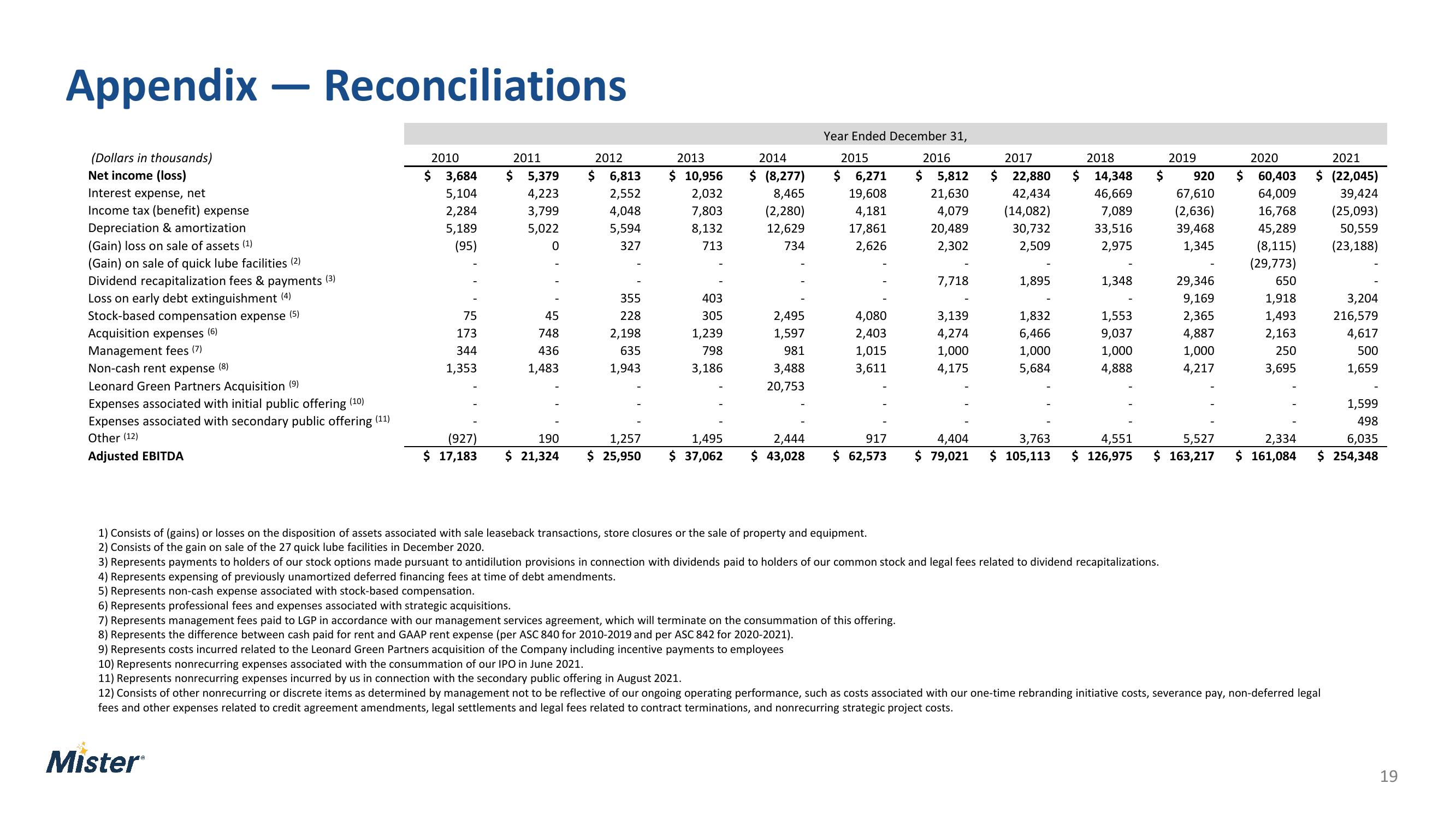

Appendix - Reconciliations

(Dollars in thousands)

Net income (loss)

Interest expense, net

Income tax (benefit) expense

Depreciation & amortization

(Gain) loss on sale of assets (¹)

(Gain) on sale of quick lube facilities (2)

Dividend recapitalization fees & payments (³)

Loss on early debt extinguishment (4)

Stock-based compensation expense (5)

Acquisition expenses (6)

Management fees (7)

Non-cash rent expense (8)

Leonard Green Partners Acquisition (9)

Expenses associated with initial public offering (10)

Expenses associated with secondary public offering (11)

Other (12)

Adjusted EBITDA

2010

2011

$ 3,684 $ 5,379

5,104

4,223

3,799

2,284

5,189

5,022

(95)

0

75

173

344

1,353

45

748

436

1,483

2012

$ 6,813

2,552

4,048

5,594

327

355

228

2,198

635

1,943

2013

$ 10,956

2,032

7,803

8,132

713

403

305

1,239

798

3,186

(927)

190

1,257

1,495

$ 17,183 $ 21,324 $ 25,950 $ 37,062

2014

$ (8,277)

8,465

(2,280)

12,629

734

2,495

1,597

981

3,488

20,753

2,444

$ 43,028

Year Ended December 31,

2015

6,271

19,608

4,181

17,861

2,626

4,080

2,403

1,015

3,611

917

$ 62,573

1) Consists of (gains) or losses on the disposition of assets associated with sale leaseback transactions, store closures or the sale of property and equipment.

2) Consists of the gain on sale of the 27 quick lube facilities in December 2020.

2016

$ 5,812

21,630

4,079

20,489

2,302

7,718

3,139

4,274

1,000

4,175

$

2017

22,880

42,434

(14,082)

30,732

2,509

1,895

1,832

6,466

1,000

5,684

2018

2019

$ 14,348 $ 920

46,669

7,089

33,516

2,975

1,348

1,553

9,037

1,000

4,888

4,404

3,763

4,551

$ 79,021 $ 105,113 $ 126,975

67,610

(2,636)

39,468

1,345

3) Represents payments to holders of our stock options made pursuant to antidilution provisions in connection with dividends paid to holders of our common stock and legal fees related to dividend recapitalizations.

4) Represents expensing of previously unamortized deferred financing fees at time of debt amendments.

5) Represents non-cash expense associated with stock-based compensation.

6) Represents professional fees and expenses associated with strategic acquisitions.

7) Represents management fees paid to LGP in accordance with our management services agreement, which will terminate on the consummation of this offering.

8) Represents the difference between cash paid for rent and GAAP rent expense (per ASC 840 for 2010-2019 and per ASC 842 for 2020-2021).

9) Represents costs incurred related to the Leonard Green Partners acquisition of the Company including incentive payments to employees

10) Represents nonrecurring expenses associated with the consummation of our IPO in June 2021.

11) Represents nonrecurring expenses incurred by us in connection with the secondary public offering in August 2021.

29,346

9,169

2,365

4,887

1,000

4,217

2020

$ 60,403

64,009

16,768

45,289

(8,115)

(29,773)

650

1,918

1,493

2,163

250

3,695

5,527

2,334

$ 163,217 $ 161,084

2021

$ (22,045)

39,424

(25,093)

50,559

(23,188)

3,204

216,579

4,617

500

1,659

1,599

498

6,035

$ 254,348

12) Consists of other nonrecurring or discrete items as determined by management not to be reflective of our ongoing operating performance, such as costs associated with our one-time rebranding initiative costs, severance pay, non-deferred legal

fees and other expenses related to credit agreement amendments, legal settlements and legal fees related to contract terminations, and nonrecurring strategic project costs.

Mister

19View entire presentation