Goldman Sachs Investment Banking Pitch Book

Goldman

Sachs

Alternatives:

Overview

Key

Benefits

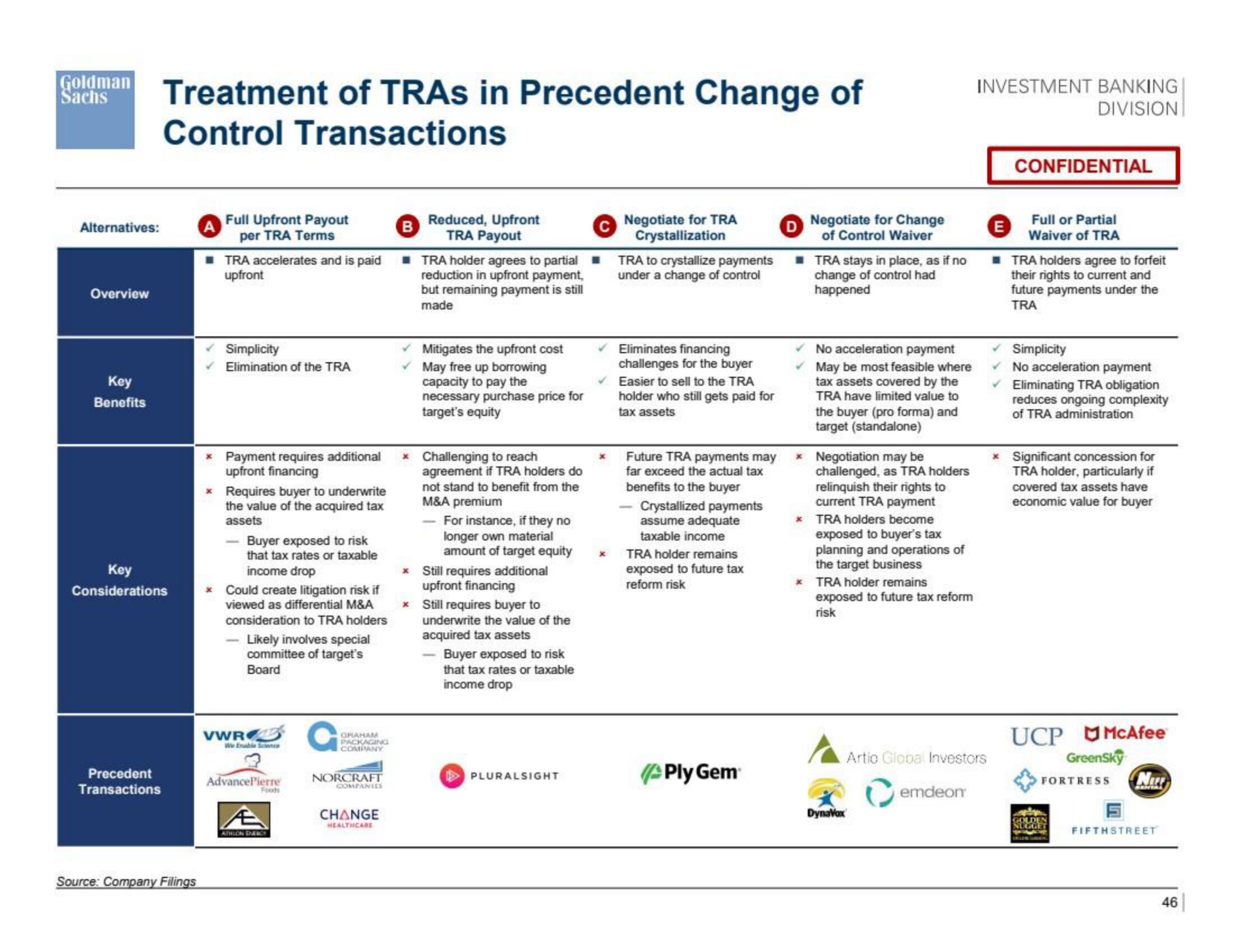

Treatment of TRAS in Precedent Change of

Control Transactions

Key

Considerations

Precedent

Transactions

Source: Company Filings

*

*

Full Upfront Payout

per TRA Terms

Simplicity

Elimination of the TRA

☐

TRA accelerates and is paid TRA holder agrees to partial

upfront

reduction in upfront payment,

but remaining payment is still

made

Payment requires additional

upfront financing

Requires buyer to underwrite

the value of the acquired tax

assets

- Buyer exposed to risk

that tax rates or taxable

income drop

* Could create litigation risk if

viewed as differential M&A

consideration to TRA holders

- Likely involves special

committee of target's

Board

VWR

We Enable Science

AdvancePierre

Å

ATHLON DERCY

Foods

G

GRAHAM

PACKAGING

COMPANY

NORCRAFT

COMPANIES

B

CHANGE

HEALTHCARE

*

*

Reduced, Upfront

TRA Payout

*

Mitigates the upfront cost

May free up borrowing

capacity to pay the

necessary purchase price for

target's equity

Challenging to reach

agreement if TRA holders do

not stand to benefit from the

M&A premium

- For instance, if they no

longer own material

amount of target equity

Still requires additional

upfront financing

Still requires buyer to

underwrite the value of the

acquired tax assets

Buyer exposed to risk

that tax rates or taxable

income drop

PLURALSIGHT

✓

x

Negotiate for TRA

Crystallization

TRA to crystallize payments

under a change of control

Eliminates financing

challenges for the buyer

Easier to sell to the TRA

holder who still gets paid for

tax assets

Future TRA payments may

far exceed the actual tax

benefits to the buyer

Crystallized payments

assume adequate

taxable income

TRA holder remains

exposed to future tax

reform risk

-

Ply Gem

D

Negotiate for Change

of Control Waiver

TRA stays in place, as if no

change of control had

happened

No acceleration payment

✓ May be most feasible where

tax assets covered by the

TRA have limited value to

the buyer (pro forma) and

target (standalone)

x Negotiation may be

challenged, as TRA holders

relinquish their rights to

current TRA payment

* TRA holders become

exposed to buyer's tax

planning and operations of

the target business

* TRA holder remains

exposed to future tax reform

risk

DynaVox

INVESTMENT BANKING

DIVISION

Artio Global Investors

emdeon

CONFIDENTIAL

Full or Partial

Waiver of TRA

E

■TRA holders agree to forfeit

their rights to current and

future payments under the

TRA

Simplicity

No acceleration payment

Eliminating TRA obligation

reduces ongoing complexity

of TRA administration

* Significant concession for

TRA holder, particularly if

covered tax assets have

economic value for buyer

UCP McAfee

GreenSky

FORTRESS NECE

FIFTHSTREET

46View entire presentation