Summit Hotel Properties Investor Presentation Deck

11

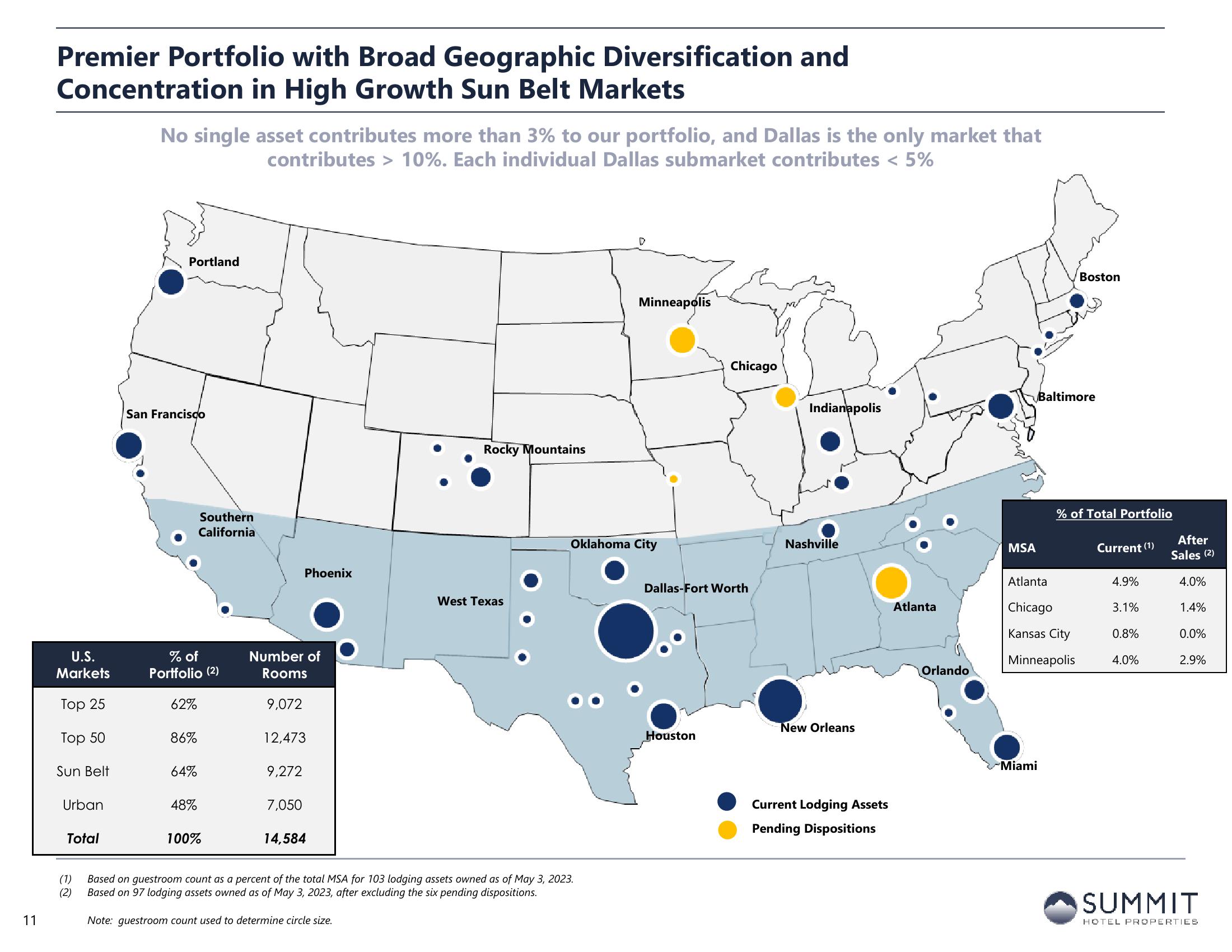

Premier Portfolio with Broad Geographic Diversification and

Concentration in High Growth Sun Belt Markets

U.S.

Markets

Top 25

Top 50

Sun Belt

Urban

Total

No single asset contributes more than 3% to our portfolio, and Dallas is the only market that

contributes > 10%. Each individual Dallas submarket contributes < 5%

Portland

San Francisco

% of

Portfolio (2)

62%

86%

64%

Southern

California

48%

100%

Number of

Rooms

9,072

Phoenix

12,473

9,272

7,050

14,584

Rocky Mountains

West Texas

D

(1)

Based on guestroom count as a percent of the total MSA for 103 lodging assets owned as of May 3, 2023.

(2) Based on 97 lodging assets owned as of May 3, 2023, after excluding the six pending dispositions.

Note: guestroom count used to determine circle size.

Minneapolis

Oklahoma City

Chicago

Dallas-Fort Worth

Houston

Indianapolis

Nashville

New Orleans

Current Lodging Assets

Pending Dispositions

Atlanta

Orlando

MSA

Baltimore

Atlanta

Boston

Chicago

Kansas City

Minneapolis

Miami

% of Total Portfolio

Current (1)

4.9%

3.1%

0.8%

4.0%

After

Sales (2)

4.0%

1.4%

0.0%

2.9%

SUMMIT

HOTEL PROPERTIESView entire presentation