Cboe Results Presentation Deck

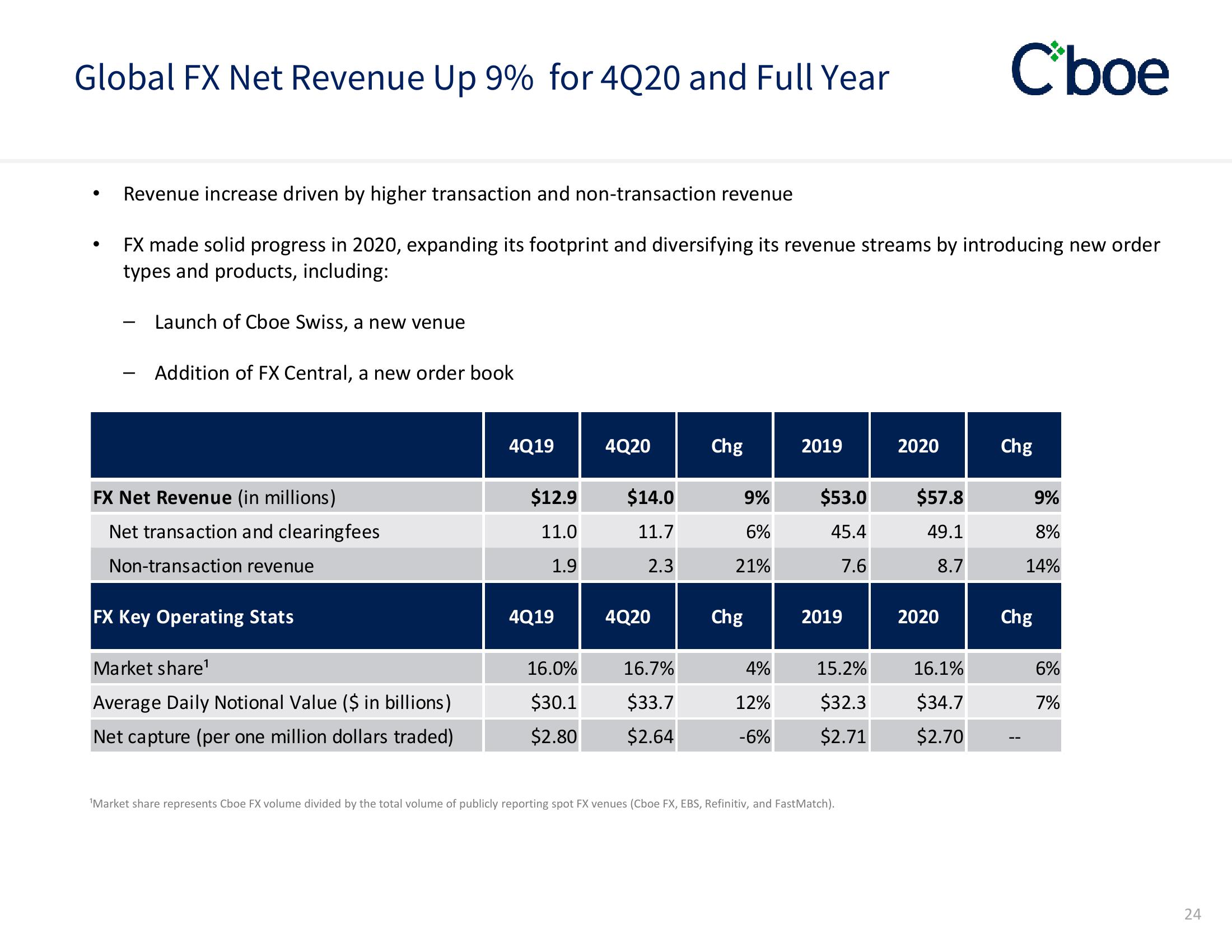

Global FX Net Revenue Up 9% for 4Q20 and Full Year

Revenue increase driven by higher transaction and non-transaction revenue

FX made solid progress in 2020, expanding its footprint and diversifying its revenue streams by introducing new order

types and products, including:

-

Launch of Cboe Swiss, a new venue

Addition of FX Central, a new order book

FX Net Revenue (in millions)

Net transaction and clearingfees

Non-transaction revenue

FX Key Operating Stats

Market share¹

Average Daily Notional Value ($ in billions)

Net capture (per one million dollars traded)

4Q19

$12.9 $14.0

11.0

11.7

1.9

2.3

4Q19

4Q20

16.0%

$30.1

$2.80

4Q20

16.7%

$33.7

$2.64

Chg

9%

6%

21%

Chg

4%

12%

-6%

2019

$53.0 $57.8

45.4

49.1

7.6

8.7

2019

15.2%

$32.3

$2.71

2020

¹Market share represents Cboe FX volume divided by the total volume of publicly reporting spot FX venues (Cboe FX, EBS, Refinitiv, and FastMatch).

2020

Cboe

16.1%

$34.7

$2.70

Chg

9%

8%

14%

Chg

6%

7%

24View entire presentation