Cloudflare Investor Presentation Deck

Cash, Cash Equiv, & AFS ($ in millions)

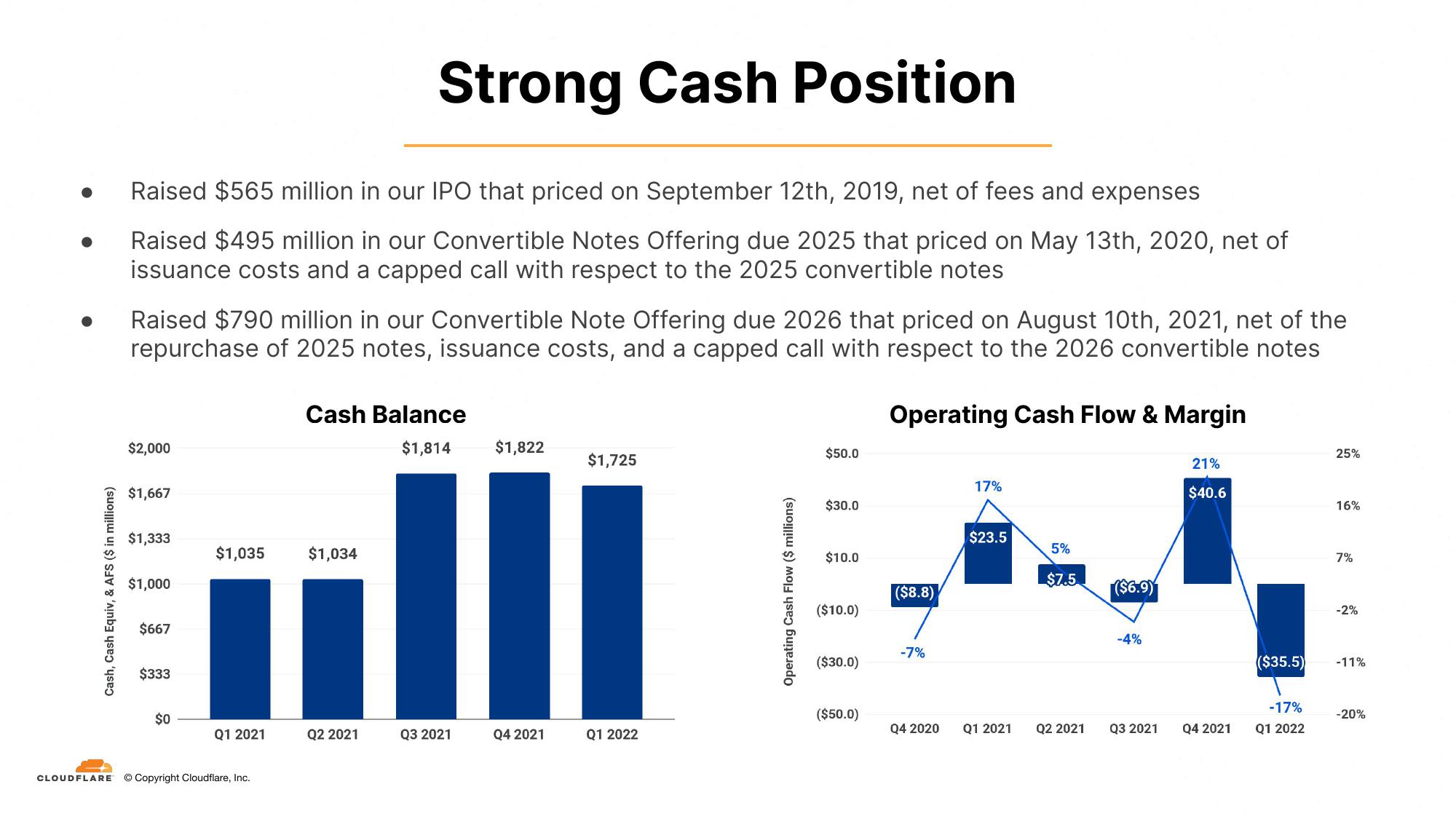

Raised $565 million in our IPO that priced on September 12th, 2019, net of fees and expenses

Raised $495 million in our Convertible Notes Offering due 2025 that priced on May 13th, 2020, net of

issuance costs and a capped call with respect to the 2025 convertible notes

Raised $790 million in our Convertible Note Offering due 2026 that priced on August 10th, 2021, net of the

repurchase of 2025 notes, issuance costs, and a capped call with respect to the 2026 convertible notes

$2,000

$1,667

$1,333

$1,000

$667

$333

$0

$1,035

Q1 2021

CLOUDFLARE © Copyright Cloudflare, Inc.

Strong Cash Position

Cash Balance

$1,814

$1,034

Q2 2021

Q3 2021

$1,822

Q4 2021

$1,725

Q1 2022

Operating Cash Flow ($ millions)

$50.0

$30.0

$10.0

($10.0)

($30.0)

($50.0)

Operating Cash Flow & Margin

($8.8)

-7%

Q4 2020

17%

$23.5

Q1 2021

5%

$7.5

Q2 2021

($6.9)

-4%

Q3 2021

21%

$40.6

Q4 2021

($35.5)

-17%

Q1 2022

25%

16%

7%

-2%

-11%

-20%View entire presentation