Olaplex Investor Presentation Deck

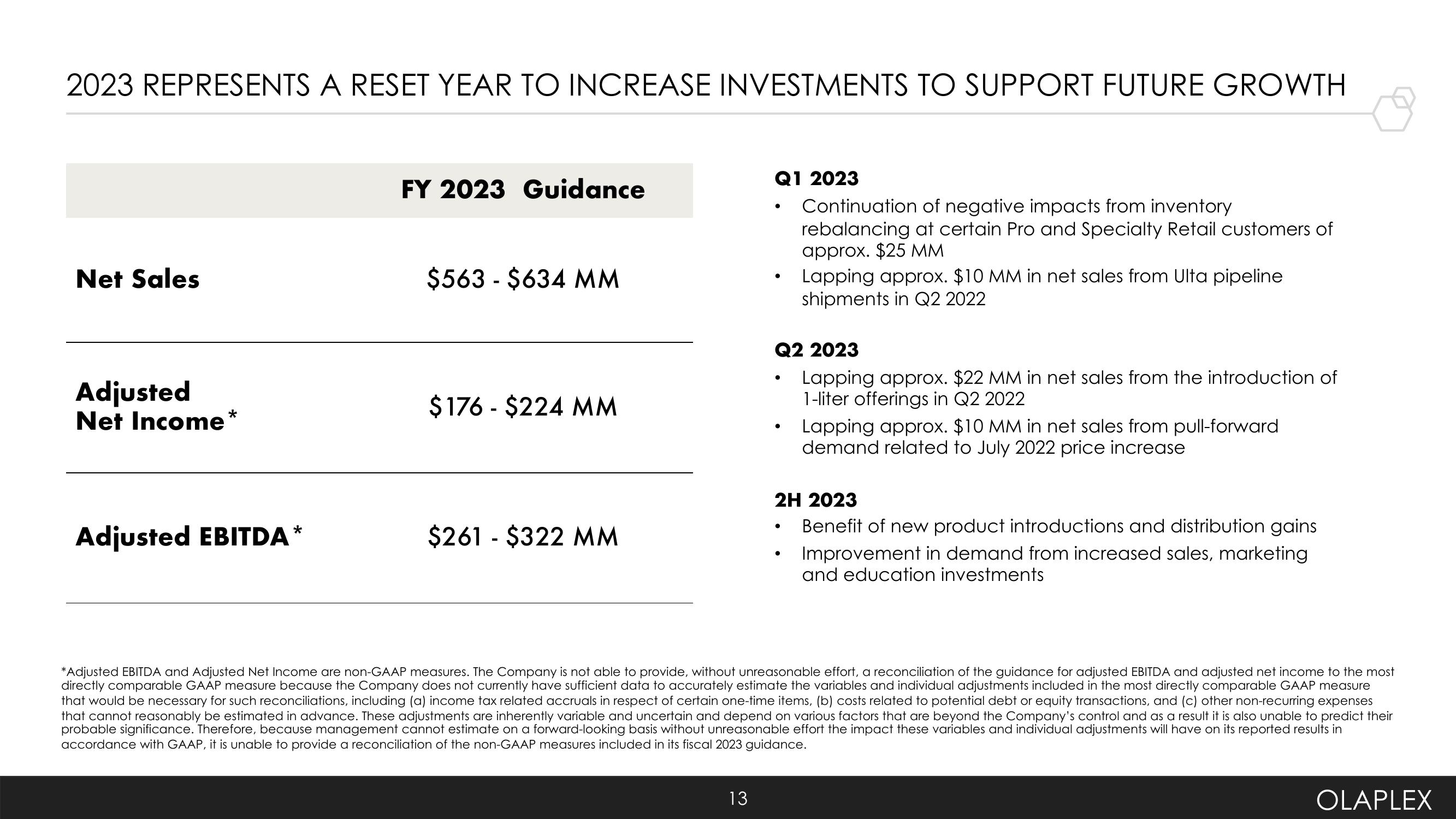

2023 REPRESENTS A RESET YEAR TO INCREASE INVESTMENTS TO SUPPORT FUTURE GROWTH

Net Sales

Adjusted

Net Income*

Adjusted EBITDA*

FY 2023 Guidance

$563 - $634 MM

$176 - $224 MM

$261 - $322 MM

Q1 2023

13

.

●

●

Continuation of negative impacts from inventory

rebalancing at certain Pro and Specialty Retail customers of

approx. $25 MM

Q2 2023

Lapping approx. $22 MM in net sales from the introduction of

1-liter offerings in Q2 2022

Lapping approx. $10 MM in net sales from Ulta pipeline

shipments in Q2 2022

●

Lapping approx. $10 MM in net sales from pull-forward

demand related to July 2022 price increase

2H 2023

Benefit of new product introductions and distribution gains

Improvement in demand from increased sales, marketing

and education investments

*Adjusted EBITDA and Adjusted Net Income are non-GAAP measures. The Company is not able to provide, without unreasonable effort, a reconciliation of the guidance for adjusted EBITDA and adjusted net income to the most

directly comparable GAAP measure because the Company does not currently have sufficient data to accurately estimate the variables and individual adjustments included in the most directly comparable GAAP measure

that would be nece ary for such reconciliations, including (a) income tax related accruals in respect of certain one-time items, (b) costs related to potential debt or equity transactions, and (c) other non-recurring expenses

that cannot reasonably be estimated in advance. These adjustments are inherently variable and uncertain and depend on various factors that are beyond the Company's control and as a result it is also unable to predict their

probable significance. Therefore, because management cannot estimate on a forward-looking basis without unreasonable effort the impact these variables and individual adjustments will have on its reported results in

accordance with GAAP, it is unable to provide a reconciliation of the non-GAAP measures included in its fiscal 2023 guidance.

OLAPLEXView entire presentation