Bakkt SPAC Presentation Deck

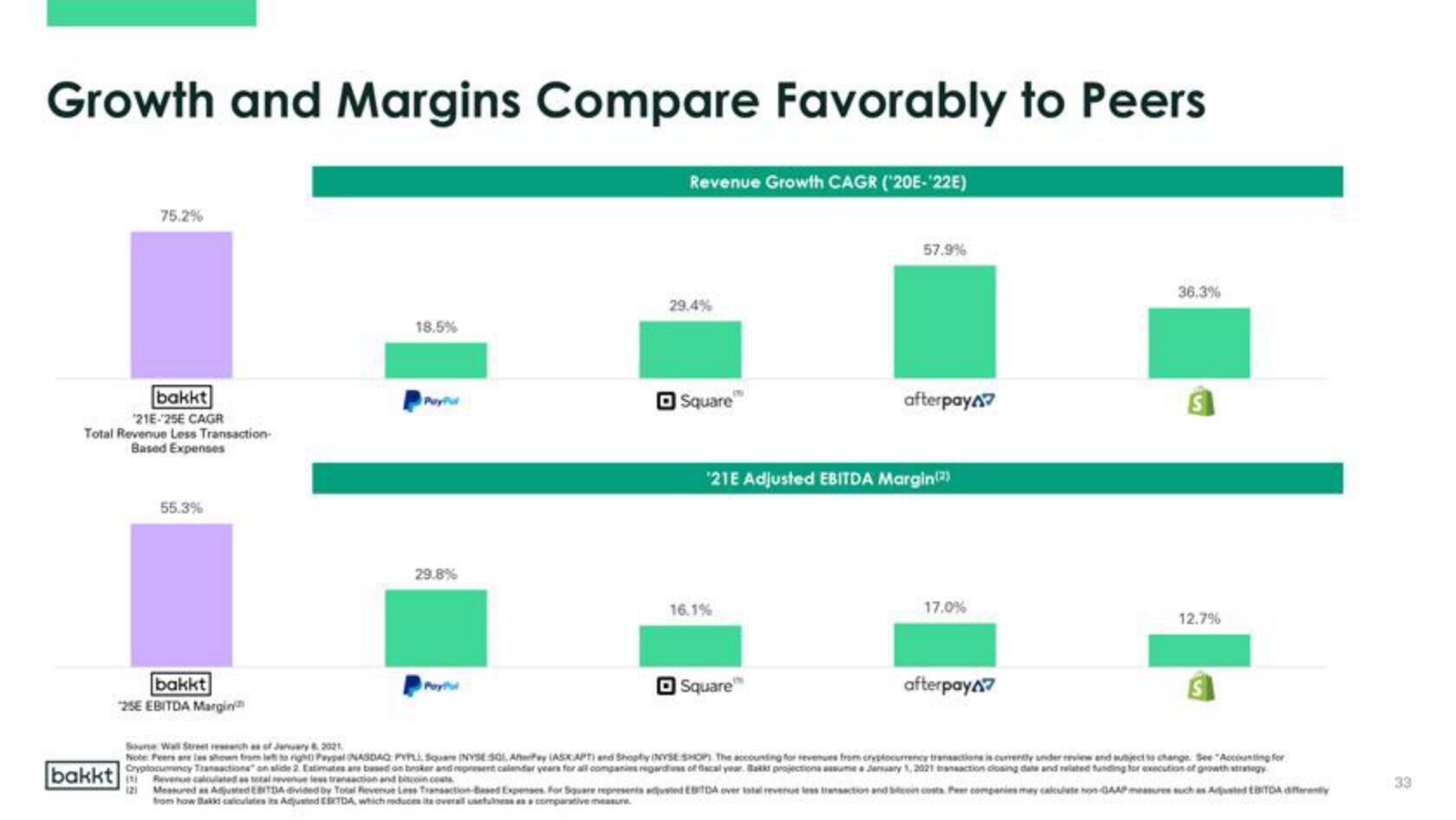

Growth and Margins Compare Favorably to Peers

75.2%

bakkt

¹21E-25E CAGR

Total Revenue Less Transaction-

Based Expenses

55.3%

bakkt

"25E EBITDA Margin

18.5%

29.8%

Revenue Growth CAGR ('20E-'22E)

29.4%

Square

16.1%

57.9%

'21E Adjusted EBITDA Margin(2)

Square

afterpay

17.0%

afterpay

36.3%

12.7%

Source Wall Street research as of January 8, 2021

Note: Peers are las shown from left to right Peypel NASDAQ PYPLI, Square (NYSE 501. AfterPay (ASKAPT) and Shopfly INYSE SHOP The accounting for revenues from cryptocurrency transactions is currently under review and subject to change See Accounting for

Cryptocumency Transactions on slide 2. Estimates are based on broker and represent calendar years for all companies regardless of fiscal year Bakkt projections assume a January 1, 2021 transaction closing date and related funding for execution of growth strategy

bakkt ve calculated as total revenue les transaction and biscoin costs

21 Measured as Adjusted EBITDA divided by Total Revenue Less Transaction-Based Expenses for Square represents adjusted EBITDA over total revenue less transaction and bitcoin costs. Per companies may calculate hos-GAAP measures such as Add EBITDA differently

from how Blakk calculates its Adjusted EBITDA, which reduces its overall usefulness as a comparative measure

33View entire presentation