Adtheorent SPAC Presentation Deck

Transaction Overview

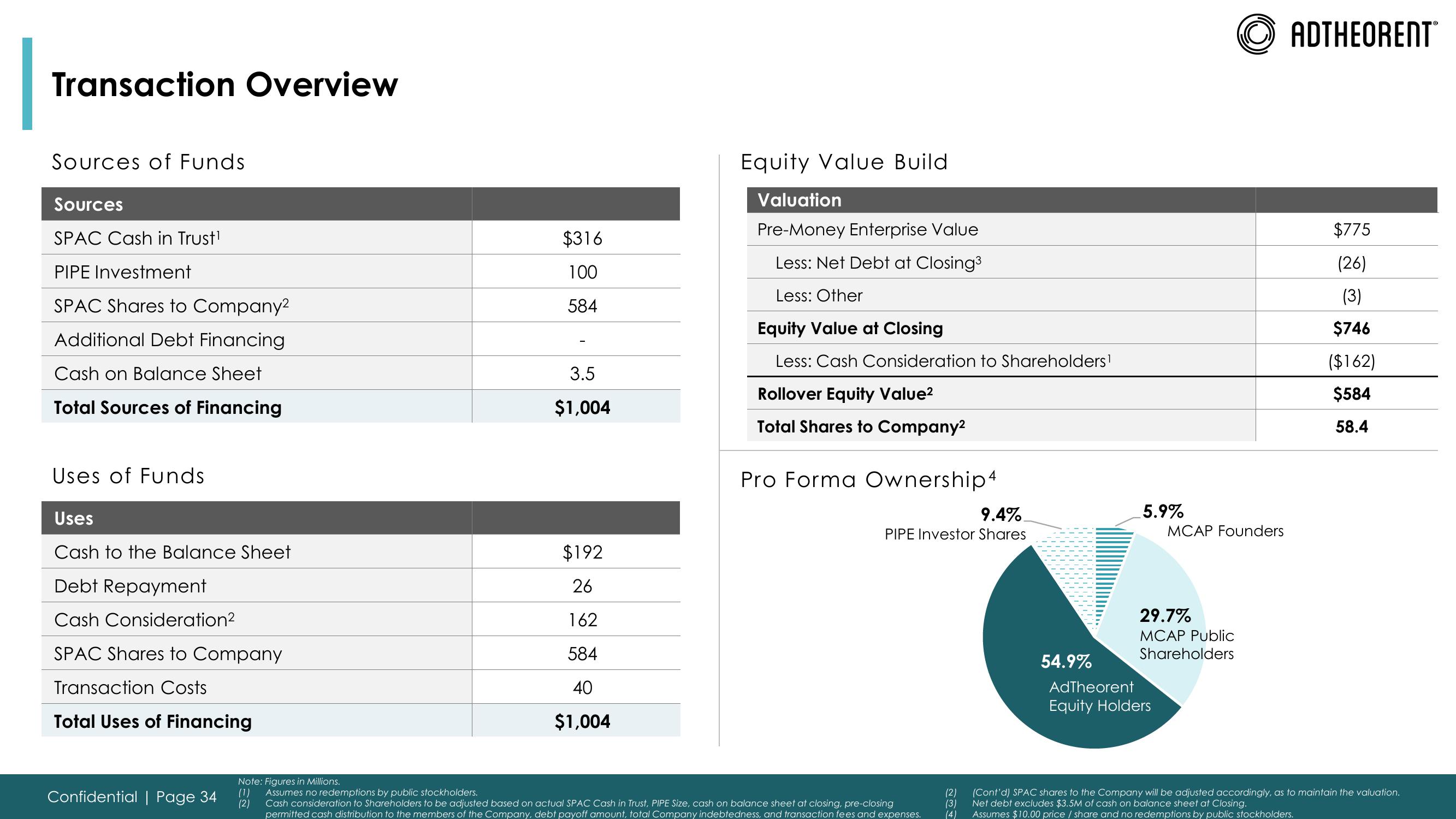

Sources of Funds

Sources

SPAC Cash in Trust¹

PIPE Investment

SPAC Shares to Company²

Additional Debt Financing

Cash on Balance Sheet

Total Sources of Financing

Uses of Funds

Uses

Cash to the Balance Sheet

Debt Repayment

Cash Consideration²

SPAC Shares to Company

Transaction Costs

Total Uses of Financing

Confidential | Page 34

Note: Figures in Millions.

(1) Assumes no redemptions by public stockholders.

(2)

$316

100

584

3.5

$1,004

$192

26

162

584

40

$1,004

Equity Value Build

Valuation

Pre-Money Enterprise Value

Less: Net Debt at Closing³

Less: Other

Equity Value at Closing

Less: Cash Consideration to Shareholders¹

Rollover Equity Value²

Total Shares to Company²

Pro Forma Ownership4

9.4%

PIPE Investor Shares

Cash consideration to Shareholders to be adjusted based on actual SPAC Cash in Trust, PIPE Size, cash on balance sheet at closing, pre-closing

permitted cash distribution to the members of the Company, debt payoff amount, total Company indebtedness, and transaction fees and expenses.

(2)

(3)

(4)

54.9%

5.9%

MCAP Founders

29.7%

MCAP Public

Shareholders

AdTheorent

Equity Holders

ADTHEORENT

$775

(26)

(3)

$746

($162)

$584

58.4

(Cont'd) SPAC shares to the Company will be adjusted accordingly, as to maintain the valuation.

Net debt excludes $3.5M of cash on balance sheet at Closing.

Assumes $10.00 price / share and no redemptions by public stockholders.View entire presentation