Maersk Investor Presentation Deck

Logistics & Services - highlights Q4 2020

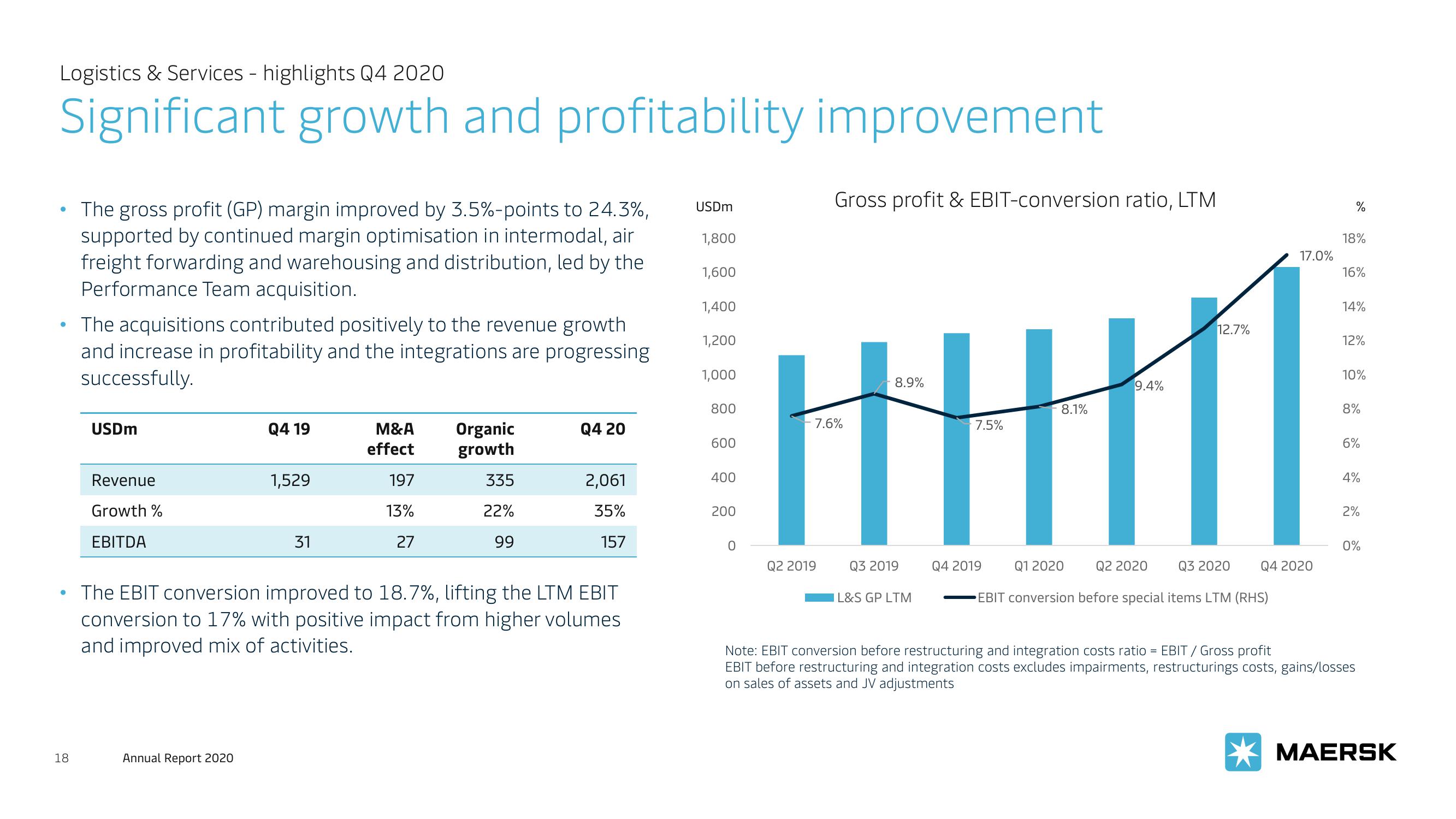

Significant growth and profitability improvement

●

●

●

18

The gross profit (GP) margin improved by 3.5%-points to 24.3%,

supported by continued margin optimisation in intermodal, air

freight forwarding and warehousing and distribution, led by the

Performance Team acquisition.

The acquisitions contributed positively to the revenue growth

and increase in profitability and the integrations are progressing

successfully.

USDm

Revenue

Growth %

EBITDA

Q4 19

Annual Report 2020

1,529

31

M&A

effect

197

13%

27

Organic

growth

335

22%

99

Q4 20

2,061

35%

157

The EBIT conversion improved to 18.7%, lifting the LTM EBIT

conversion to 17% with positive impact from higher volumes

and improved mix of activities.

USDm

1,800

1,600

1,400

1,200

1,000

800

600

400

200

0

Gross profit & EBIT-conversion ratio, LTM

- 7.6%

Q2 2019

8.9%

Q3 2019

IL&S GP LTM

7.5%

8.1%

Q4 2019

Q1 2020

9.4%

Q3 2020

EBIT conversion before special items LTM (RHS)

12.7%

Q2 2020

17.0%

Q4 2020

%

18%

16%

14%

12%

10%

8%

6%

2%

0%

Note: EBIT conversion before restructuring and integration costs ratio = EBIT / Gross profit

EBIT before restructuring and integration costs excludes impairments, restructurings costs, gains/losses

on sales of assets and JV adjustments

MAERSKView entire presentation