Ready Capital Investor Presentation Deck

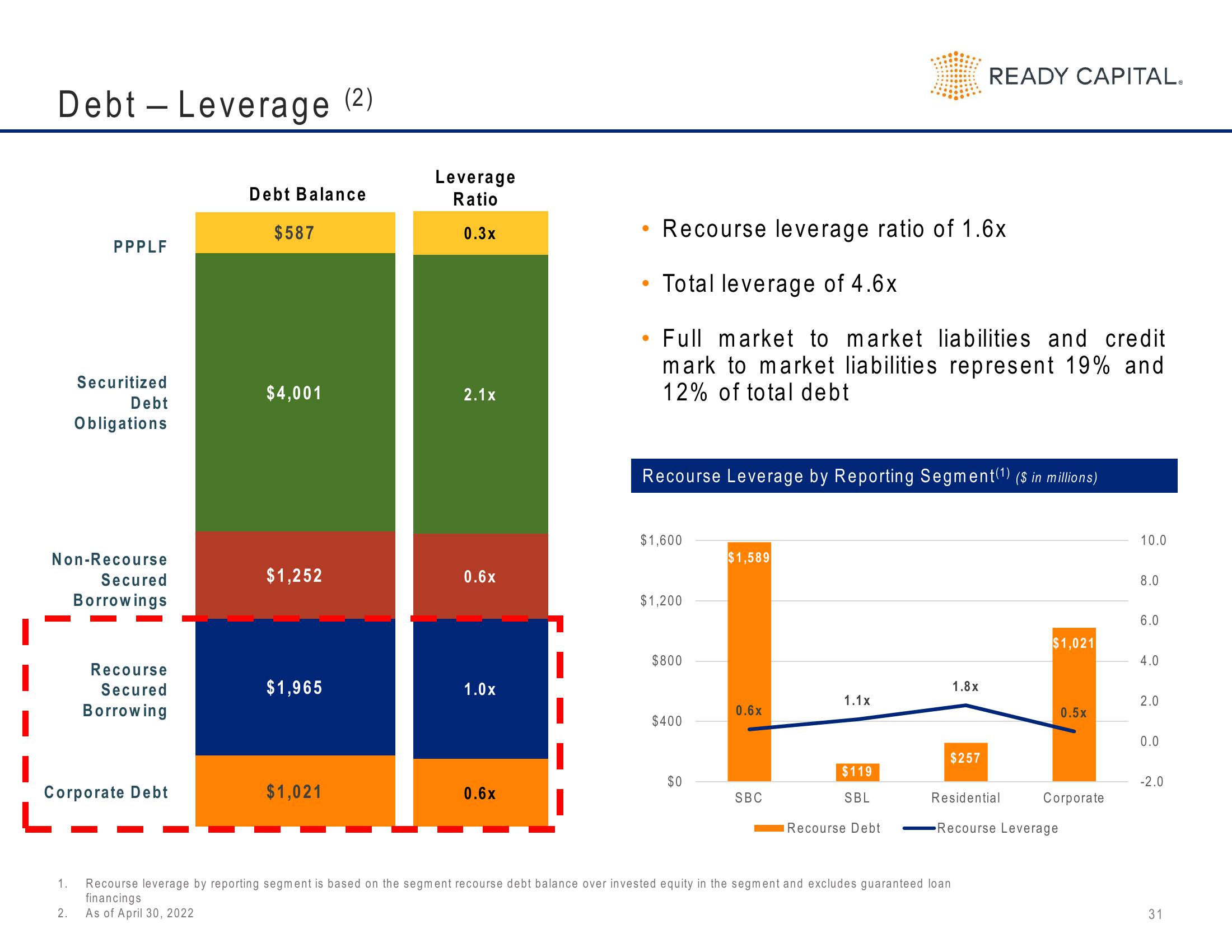

Debt - Leverage (2)

PPPLF

Securitized

Debt

Obligations

Non-Recourse

Secured

Borrowings

1.

Recourse

Secured

Borrowing

Corporate Debt

Debt Balance

$587

$4,001

$1,252

$1,965

$1,021

Leverage

Ratio

0.3x

2.1x

0.6x

1.0x

0.6x

●

●

Recourse leverage ratio of 1.6x

Total leverage of 4.6x

Full market to market liabilities and credit

mark to market liabilities represent 19% and

12% of total debt

Recourse Leverage by Reporting Segment(¹) ($ in millions)

$1,600

$1,200

$800

$400

$0

$1,589

0.6x

SBC

1.1x

$119

SBL

Recourse Debt

READY CAPITAL.

1.8x

$257

Recourse leverage by reporting segment is based on the segment recourse debt balance over invested equity in the segment and excludes guaranteed loan

financings

2. As of April 30, 2022

$1,021

Residential

Recourse Leverage

0.5x

Corporate

10.0

8.0

6.0

4.0

2.0

0.0

-2.0

31View entire presentation