3Q22 Investor Update

FOCUSED ON COMMERICAL TRANSFORMATION IN 3Q

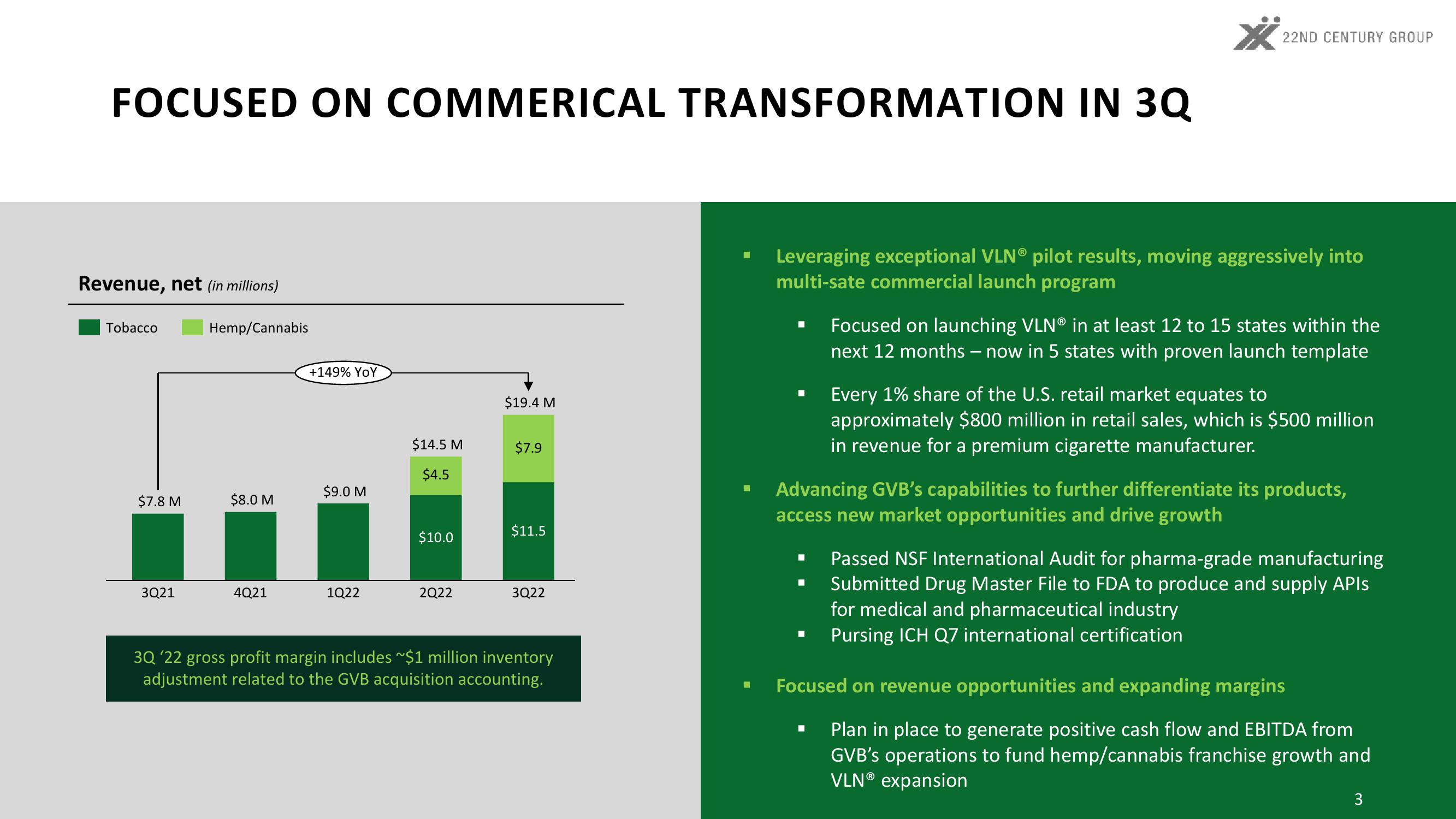

Revenue, net (in millions)

Tobacco

$7.8 M

3Q21

Hemp/Cannabis

$8.0 M

4Q21

+149% YoY

$9.0 M

1Q22

$14.5 M

$4.5

$10.0

2Q22

$19.4 M

$7.9

$11.5

3Q22

3Q '22 gross profit margin includes ~$1 million inventory

adjustment related to the GVB acquisition accounting.

■

Leveraging exceptional VLNⓇ pilot results, moving aggressively into

multi-sate commercial launch program

■

22ND CENTURY GROUP

■

■

Focused on launching VLN® in at least 12 to 15 states within the

next 12 months - now in 5 states with proven launch template

Advancing GVB's capabilities to further differentiate its products,

access new market opportunities and drive growth

Every 1% share of the U.S. retail market equates to

approximately $800 million in retail sales, which is $500 million

in revenue for a premium cigarette manufacturer.

Passed NSF International Audit for pharma-grade manufacturing

Submitted Drug Master File to FDA to produce and supply APIs

for medical and pharmaceutical industry

Pursing ICH Q7 international certification

Focused on revenue opportunities and expanding margins

Plan in place to generate positive cash flow and EBITDA from

GVB's operations to fund hemp/cannabis franchise growth and

VLNⓇ expansion

3View entire presentation