FiscalNote Investor Presentation Deck

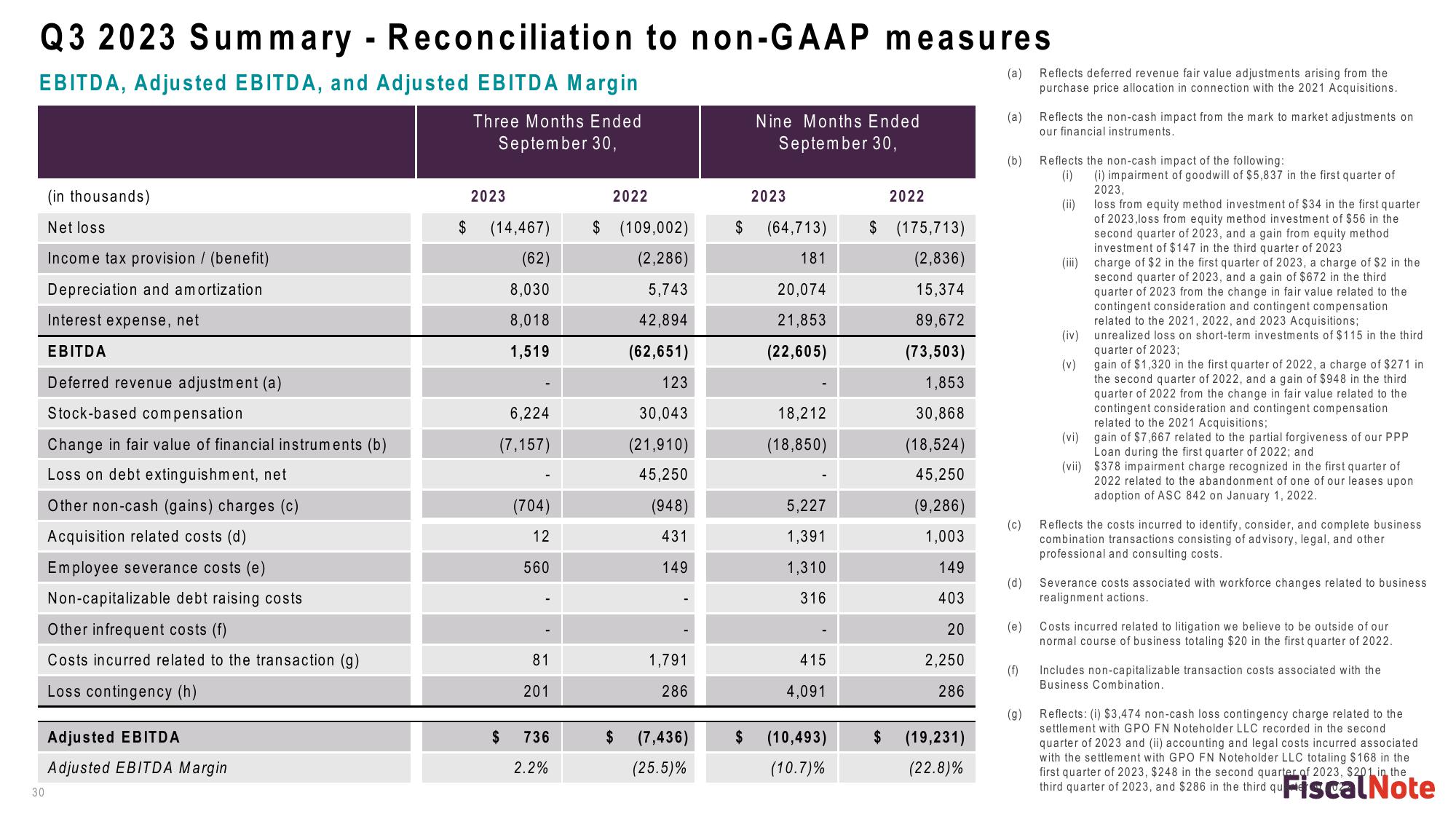

Q3 2023 Summary - Reconciliation to non-GAAP measures

EBITDA, Adjusted EBITDA, and Adjusted EBITDA Margin

30

(in thousands)

Net loss

Income tax provision / (benefit)

Depreciation and amortization

Interest expense, net

EBITDA

Deferred revenue adjustment (a)

Stock-based compensation

Change in fair value of financial instruments (b)

Loss on debt extinguishment, net

Other non-cash (gains) charges (c)

Acquisition related costs (d)

Employee severance costs (e)

Non-capitalizable debt raising costs

Other infrequent costs (f)

Costs incurred related to the transaction (g)

Loss contingency (h)

Adjusted EBITDA

Adjusted EBITDA Margin

$

Three Months Ended

September 30,

2023

(14,467)

(62)

8,030

8,018

1,519

6,224

(7,157)

$

(704)

12

560

81

201

736

2.2%

2022

$ (109,002)

(2,286)

5,743

42,894

(62,651)

123

30,043

(21,910)

45,250

$

(948)

431

149

1,791

286

(7,436)

(25.5)%

$

$

Nine Months Ended

September 30,

2023

(64,713)

181

20,074

21,853

(22,605)

18,212

(18,850)

5,227

1,391

1,310

316

415

4,091

(10,493)

(10.7)%

2022

$ (175,713)

(2,836)

15,374

89,672

(73,503)

1,853

30,868

(18,524)

45,250

(9,286)

1,003

149

403

20

$

2,250

286

(19,231)

(22.8)%

(a) Reflects deferred revenue fair value adjustments arising from the

purchase price allocation in connection with the 2021 Acquisitions.

(a)

(b)

Reflects the non-cash impact from the mark to market adjustments on

our financial instruments.

Reflects the non-cash impact of the following:

(i)

(ii)

(f)

(i) impairment of goodwill of $5,837 in the first quarter of

2023,

loss from equity method investment of $34 in the first quarter

of 2023,loss from equity method investment of $56 in the

second quarter of 2023, and a gain from equity method

investment of $147 in the third quarter of 2023

(iii) charge of $2 in the first quarter of 2023, a charge of $2 in the

second quarter of 2023, and a gain of $672 in the third

quarter of 2023 from the change in fair value related to the

contingent consideration and contingent compensation

related to the 2021, 2022, and 2023 Acquisitions;

unrealized loss on short-term investments of $115 in the third

quarter of 2023;

(c) Reflects the costs incurred to identify, consider, and complete business

combination transactions consisting of advisory, legal, and other

professional and consulting costs.

(g)

(iv)

(v) gain of $1,320 in the first quarter of 2022, a charge of $271 in

the second quarter of 2022, and a gain of $948 in the third

quarter of 2022 from the change in fair value related to the

contingent consideration and contingent compensation

related to the 2021 Acquisitions;

(vi) gain of $7,667 related to the partial forgiveness of our PPP

Loan during the first quarter of 2022; and

(vii) $378 impairment charge recognized in the first quarter of

2022 related to the abandonment of one of our leases upon

adoption of ASC 842 on January 1, 2022.

(d) Severance costs associated with workforce changes related to business

realignment actions..

(e) Costs incurred related to litigation we believe to be outside of our

normal course of business totaling $20 in the first quarter of 2022.

Includes non-capitalizable transaction costs associated with the

Business Combination.

Reflects: (i) $3,474 non-cash loss contingency charge related to the

settlement with GPO FN Noteholder LLC recorded in the second

quarter of 2023 and (ii) accounting and legal costs incurred associated

with the settlement with GPO FN Noteholder LLC totaling $168 in the

first quarter of 2023, $248 in the second quarter of 2023, $201 in the

third quarter of 2023, and $286 in the third qu Fiscal NoteView entire presentation