Presentation to Vermont Pension Investment Committee

Case Study: Healthcare Receivables Facility

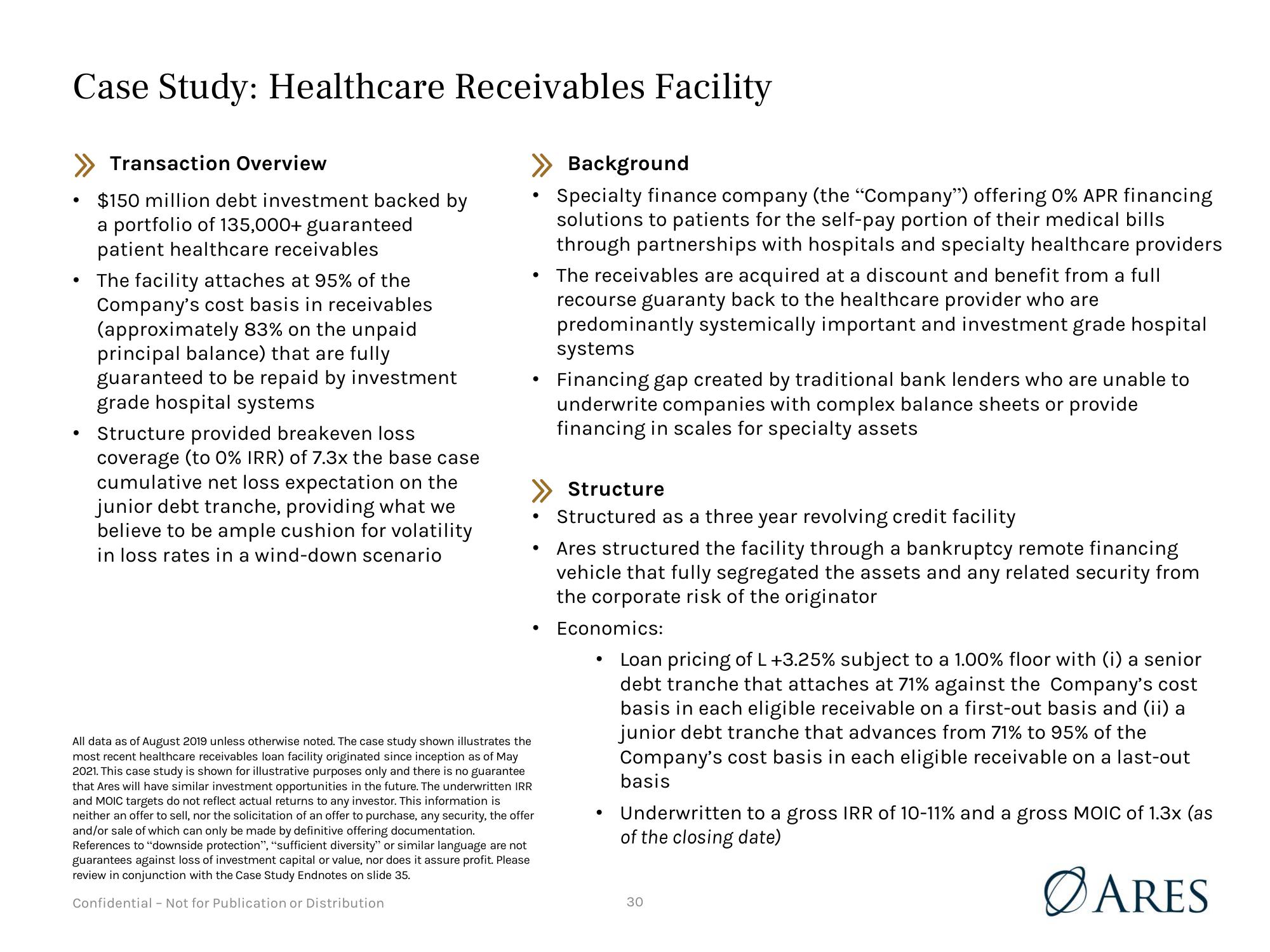

» Transaction Overview

$150 million debt investment backed by

a portfolio of 135,000+ guaranteed

patient healthcare receivables

●

●

●

The facility attaches at 95% of the

Company's cost basis in receivables

(approximately 83% on the unpaid

principal balance) that are fully

guaranteed to be repaid by investment

grade hospital systems

Structure provided breakeven loss

coverage (to 0% IRR) of 7.3x the base case

cumulative net loss expectation on the

junior debt tranche, providing what we

believe to be ample cushion for volatility

in loss rates in a wind-down scenario

>> Background

●

●

●

●

All data as of August 2019 unless otherwise noted. The case study shown illustrates the

most recent healthcare receivables loan facility originated since inception as of May

2021. This case study is shown for illustrative purposes only and there is no guarantee

that Ares will have similar investment opportunities in the future. The underwritten IRR

and MOIC targets do not reflect actual returns to any investor. This information is

neither an offer to sell, nor the solicitation of an offer to hase, any secur the offer

and/or sale of which can only be made by definitive offering documentation.

References to "downside protection", "sufficient diversity" or similar language are not

guarantees against loss of investment capital or value, nor does it assure profit. Please

review in conjunction with the Case Study Endnotes on slide 35.

Confidential - Not for Publication or Distribution

Specialty finance company (the "Company") offering 0% APR financing

solutions to patients for the self-pay portion of their medical bills

through partnerships with hospitals and specialty healthcare providers

The receivables are acquired at a discount and benefit from a full

recourse guaranty back to the healthcare provider who are

predominantly systemically important and investment grade hospital

systems

Financing gap created by traditional bank lenders who are unable to

underwrite companies with complex balance sheets or provide

financing in scales for specialty assets

Structure

Structured as a three year revolving credit facility

Ares structured the facility through a bankruptcy remote financing

vehicle that fully segregated the assets and any related security from

the corporate risk of the originator

Economics:

Loan pricing of L +3.25% subject to a 1.00% floor with (i) a senior

debt tranche that attaches at 71% against the Company's cost

basis in each eligible receivable on a first-out basis and (ii) a

junior debt tranche that advances from 71% to 95% of the

Company's cost basis in each eligible receivable on a last-out

basis

Underwritten to a gross IRR of 10-11% and a gross MOIC of 1.3x (as

of the closing date)

ØARES

30View entire presentation