AstraZeneca Results Presentation Deck

$bn

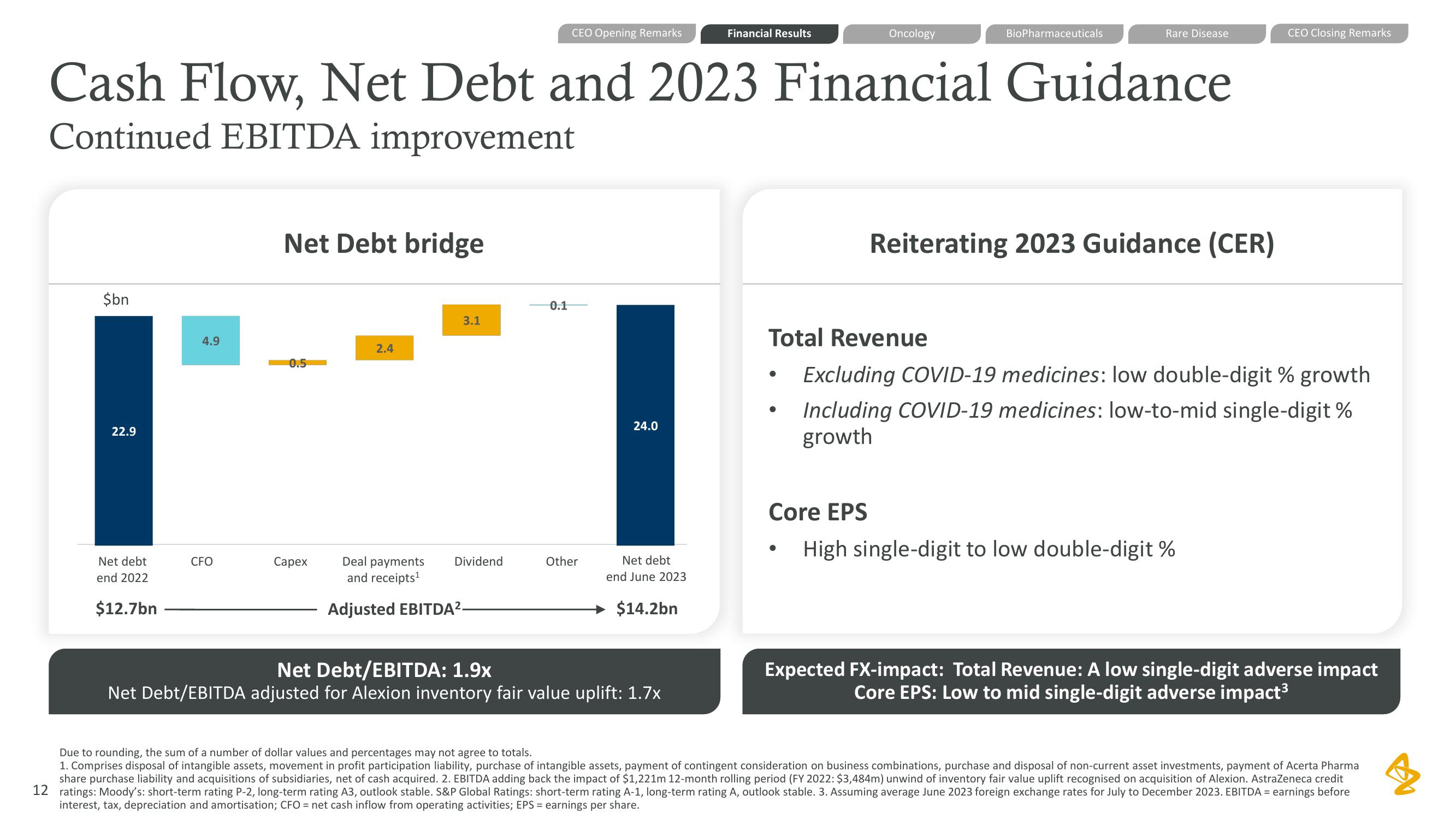

22.9

Net debt

end 2022

$12.7bn

4.9

Cash Flow, Net Debt and 2023 Financial Guidance

Continued EBITDA improvement

CFO

Net Debt bridge

0.5

Capex

2.4

3.1

Deal payments

and receipts¹

Adjusted EBITDA².

Dividend

CEO Opening Remarks

0.1

Other

24.0

Net debt

end June 2023

$14.2bn

Financial Results

Net Debt/EBITDA: 1.9x

Net Debt/EBITDA adjusted for Alexion inventory fair value uplift: 1.7x

●

Oncology

●

BioPharmaceuticals

Rare Disease

●

Total Revenue

Excluding COVID-19 medicines: low double-digit % growth

Including COVID-19 medicines: low-to-mid single-digit %

growth

Reiterating 2023 Guidance (CER)

Core EPS

High single-digit to low double-digit %

CEO Closing Remarks

Expected FX-impact: Total Revenue: A low single-digit adverse impact

Core EPS: Low to mid single-digit adverse impact³

Due to rounding, the sum of a number of dollar values and percentages may not agree to totals.

1. Comprises disposal of intangible assets, movement in profit participation liability, purchase of intangible assets, payment of contingent consideration on business combinations, purchase and disposal of non-current asset investments, payment of Acerta Pharma

share purchase liability and acquisitions of subsidiaries, net of cash acquired. 2. EBITDA adding back the impact of $1,221m 12-month rolling period (FY 2022: $3,484m) unwind of inventory fair value uplift recognised on acquisition of Alexion. AstraZeneca credit

12 ratings: Moody's: short-term rating P-2, long-term rating A3, outlook stable. S&P Global Ratings: short-term rating A-1, long-term rating A, outlook stable. 3. Assuming average June 2023 foreign exchange rates for July to December 2023. EBITDA = earnings before

interest, tax, depreciation and amortisation; CFO = net cash inflow from operating activities; EPS = earnings per share.View entire presentation