Cyxtera Investor Presentation Deck

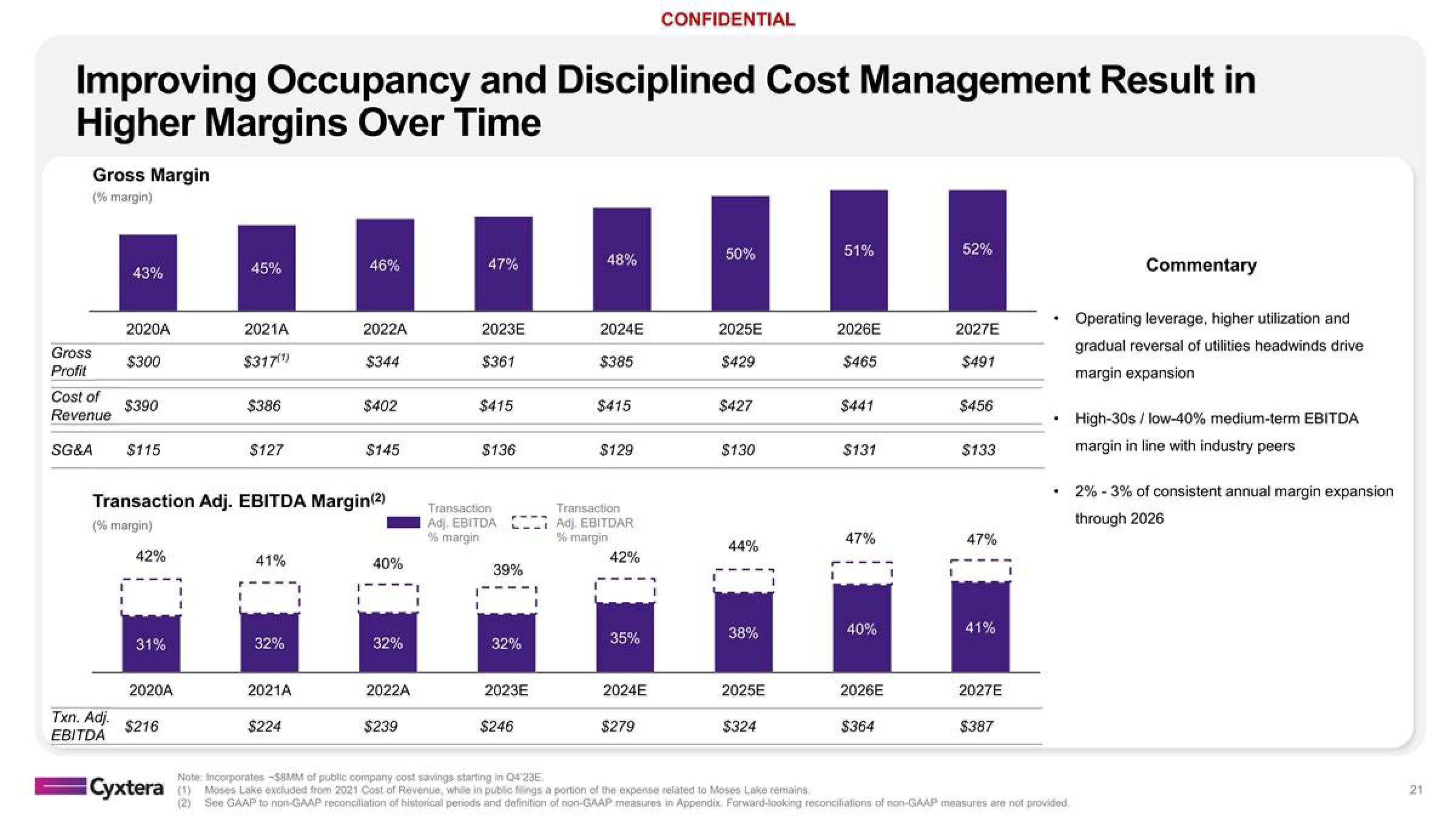

Improving Occupancy and Disciplined Cost Management Result in

Higher Margins Over Time

Gross Margin

(% margin)

Gross

Profit

Cost of

Revenue

43%

2020A

Txn. Adj.

EBITDA

$300

$390

SG&A $115

42%

31%

2020A

45%

$216

2021A

$317(¹)

$386

$127

Transaction Adj. EBITDA Margin(2)

(% margin)

41%

32%

2021A

$224

46%

1

2022A

$344

$402

$145

40%

32%

2022A

$239

I

47%

2023E

$361

$415

$136

Transaction

Adj. EBITDA

% margin

39%

32%

2023E

$246

T

48%

2024E

$385

$415

$129

Transaction

Adj. EBITDAR

% margin

42%

35%

2024E

CONFIDENTIAL

$279

50%

2025E

$429

$427

$130

44%

38%

2025E

$324

I

51%

2026E

$465

$441

$131

47%

40%

2026E

$364

I

52%

SAMSON

2027E

$491

$456

$133

47%

41%

2027E

$387

I

.

.

Note: Incorporates -58MM of public cost savings starting in Q4'23E.

Cyxtera (1) Moses Lake excluded from 2021 Cost of Revenue, while in public filings a portion of the expense related to Moses Lake remains.

(2) See GAAP to non-GAAP reconciliation of historical periods and definition of non-GAAP measures in Appendix Forward-looking reconciliations of non-GAAP measures are not provided.

Commentary

Operating leverage, higher utilization and

gradual reversal of utilities headwinds drive

margin expansion

High-30s / low-40% medium-term EBITDA

margin in line with industry peers

2% -3% of consistent annual margin expansion

through 2026

21View entire presentation