Silicon Valley Bank Results Presentation Deck

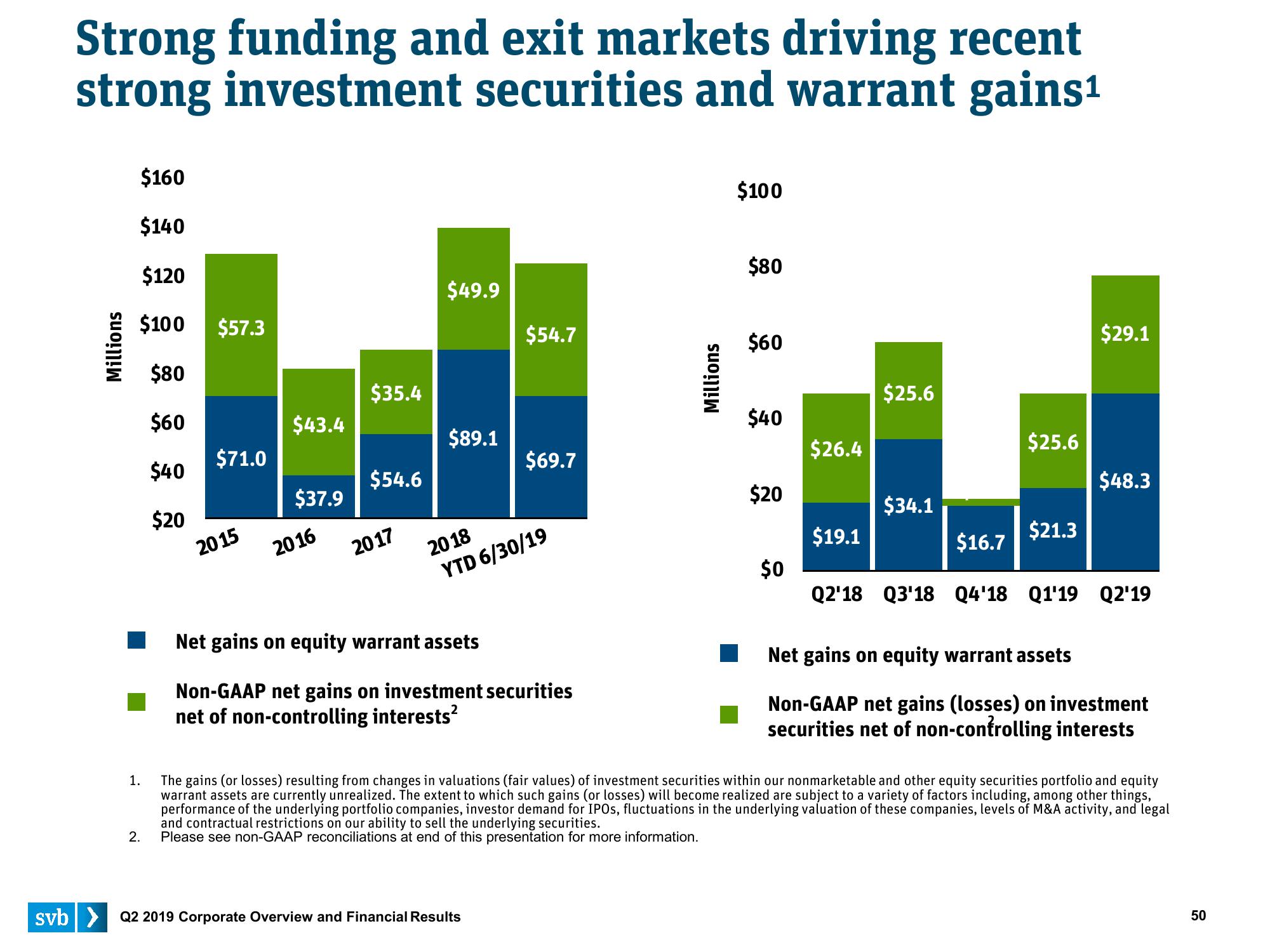

Strong funding and exit markets driving recent

strong investment securities and warrant gains¹

Millions

$160

$140

$120

$100 $57.3

$80

$60

$40

$20

1.

2.

$71.0

2015

$43.4

$37.9

2016

$35.4

$54.6

2017

$49.9

$89.1

$54.7

$69.7

2018

YTD 6/30/19

Net gains on equity warrant assets

Non-GAAP net gains on investment securities

net of non-controlling interests²

svb> Q2 2019 Corporate Overview and Financial Results

Millions

$100

$80

$60

$40

$20

$0

$26.4

$19.1

$25.6

$34.1

$16.7

$25.6

$21.3

$29.1

$48.3

Q2'18 Q3'18 Q4'18 Q1'19 Q2'19

Net gains on equity warrant assets

Non-GAAP net gains (losses) on investment

securities net of non-controlling interests

The gains (or losses) resulting from changes in valuations (fair values) of investment securities within our nonmarketable and other equity securities portfolio and equity

warrant assets are currently unrealized. The extent to which such gains (or losses) will become realized are subject to a variety of factors including, among other things,

performance of the underlying portfolio companies, investor demand for IPOs, fluctuations in the underlying valuation of these companies, levels of M&A activity, and legal

and contractual restrictions on our ability to sell the underlying securities.

Please see non-GAAP reconciliations at end of this presentation for more information.

50View entire presentation