Vici Investor Presentation

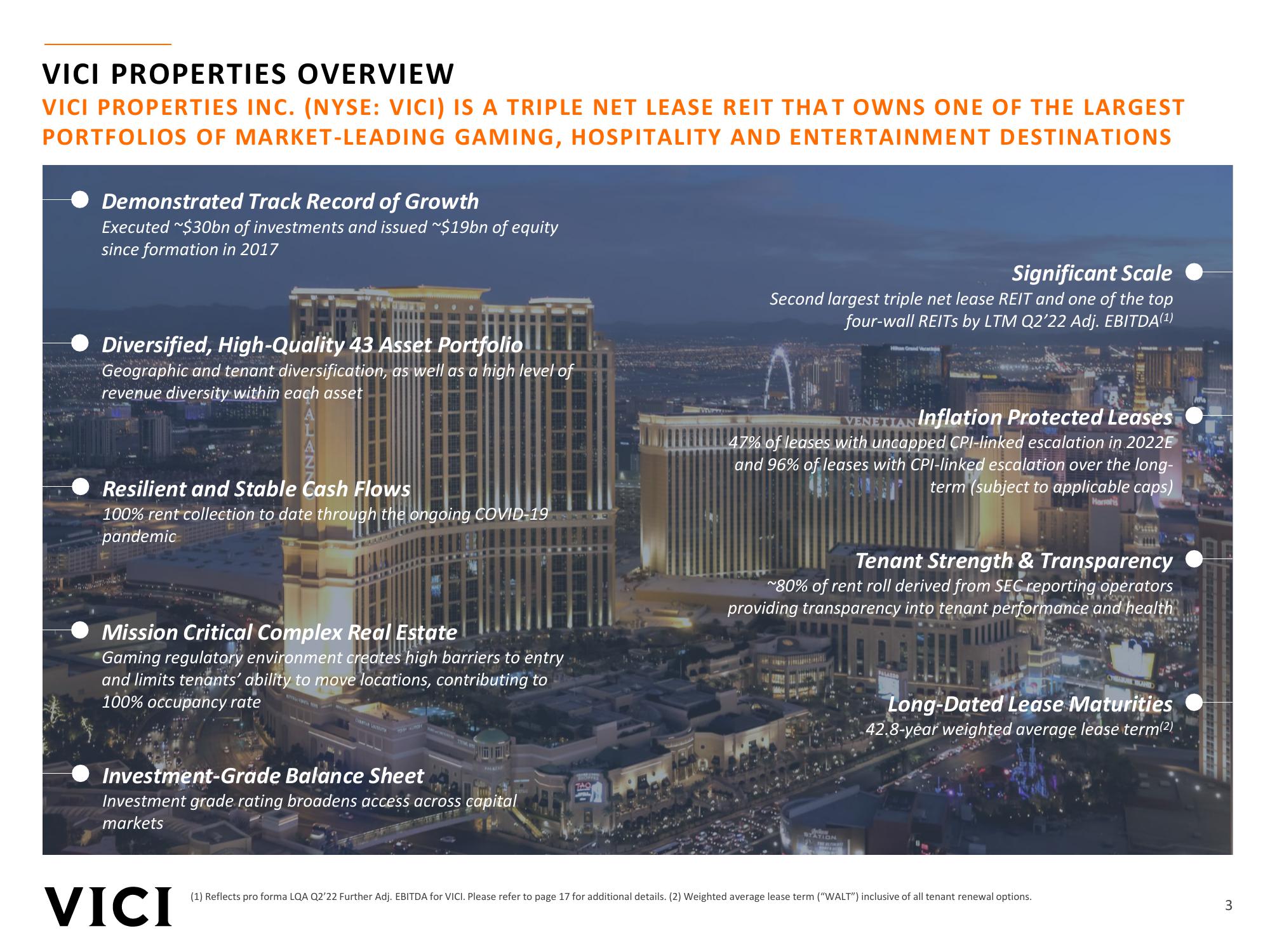

VICI PROPERTIES OVERVIEW

VICI PROPERTIES INC. (NYSE: VICI) IS A TRIPLE NET LEASE REIT THAT OWNS ONE OF THE LARGEST

PORTFOLIOS OF MARKET-LEADING GAMING, HOSPITALITY AND ENTERTAINMENT DESTINATIONS

Demonstrated Track Record of Growth

Executed ~$30bn of investments and issued ~$19bn of equity

since formation in 2017

Diversified, High-Quality 43 Asset Portfolio

Geographic and tenant diversification, as well as a high level of

revenue diversity within each asset

Resilient and Stable Cash Flows

100% rent collection to date through the ongoing COVID-19

pandemic

Mission Critical Complex Real Estate

Gaming regulatory environment creates high barriers to entry

and limits tenants' ability to move locations, contributing to

100% occupancy rate

TORR

VICI

AUDIO

Investment-Grade Balance Sheet

Investment grade rating broadens access across capital

markets

TAQ

Voiree

Significant Scale

Second largest triple net lease REIT and one of the top

four-wall REITS by LTM Q2'22 Adj. EBITDA(¹)

VENETIAN Inflation Protected Leases

47% of leases with uncapped CPI-linked escalation in 2022E

and 96% of leases with CPI-linked escalation over the long-

term (subject to applicable caps)

Harrah

Hi Grand Vera

Tenant Strength & Transparency

~80% of rent roll derived from SEC reporting operators

providing transparency into tenant performance and health

REISH

New

TATION

PALASSO

Long-Dated Lease Maturities

42.8-year weighted average lease term(2)

(1) Reflects pro forma LQA Q2'22 Further Adj. EBITDA for VICI. Please refer to page 17 for additional details. (2) Weighted average lease term ("WALT") inclusive of all tenant renewal options.

3View entire presentation