Affirm Results Presentation Deck

Transaction Costs

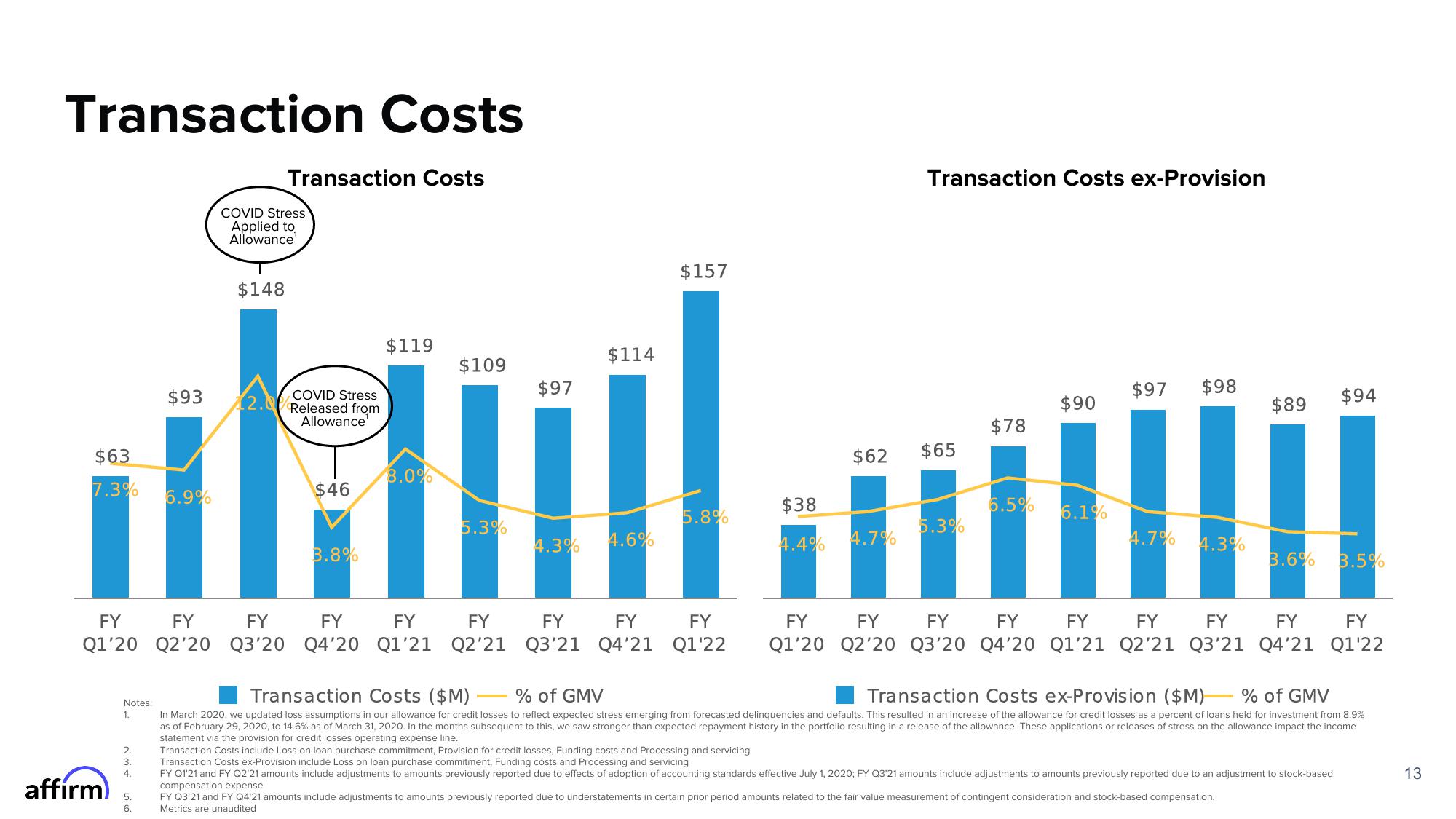

Transaction Costs

$63

7.3% 6.9%

FY

FY

Q1'20 Q2'20

affirm

Notes:

1.

$93

234 56

3.

COVID Stress

Applied to,

Allowance

$148

COVID Stress

2. Released from

Allowance

$46

3.8%

$119

8.0%

$109

5.3%

FY FY FY FY

Q3'20 Q4'20 Q1'21 Q2'21

$97

$114

4.3% 4.6%

$157

5.8%

FY FY FY

Q3'21 Q4'21 Q1'22

Transaction Costs ex-Provision

FY

Q1'20

$62 $65

$38

4.4% 4.7% 5.3%

$78

6.5%

$90

6.1%

$97 $98

4.7%

4.3%

$89

$94

3.6% 3.5%

FY

FY FY FY

FY FY FY FY

Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22

Transaction Costs ($M)

% of GMV

Transaction Costs ex-Provision ($M) % of GMV

In March 2020, we updated loss assumptions in our allowance for credit losses to reflect expected stress emerging from forecasted delinquencies and defaults. This resulted in an increase of the allowance for credit losses as a percent of loans held for investment from 8.9%

as of February 29, 2020, to 14.6% as of March 31, 2020. In the months subsequent to this, we saw stronger than expected repayment history in the portfolio resulting in a release of the allowance. These applications or releases of stress on the allowance impact the income

statement via the provision for credit losses operating expense line.

Transaction Costs include Loss on loan purchase commitment, Provision for credit losses, Funding costs and Processing and servicing

Transaction Costs ex-Provision include Loss on loan purchase commitment, Funding costs and Processing and servicing

FY Q1'21 and FY Q2'21 amounts include adjustments to amounts previously reported due to effects of adoption of accounting standards effective July 1, 2020; FY Q3'21 amounts include adjustments to amounts previously reported due to an adjustment to stock-based

compensation expense

FY Q3'21 and FY Q4'21 amounts include adjustments to amounts previously reported due to understatements in certain prior period amounts related to the fair value measurement of contingent consideration and stock-based compensation.

Metrics are unaudited

13View entire presentation