Antero Midstream Partners Investor Presentation Deck

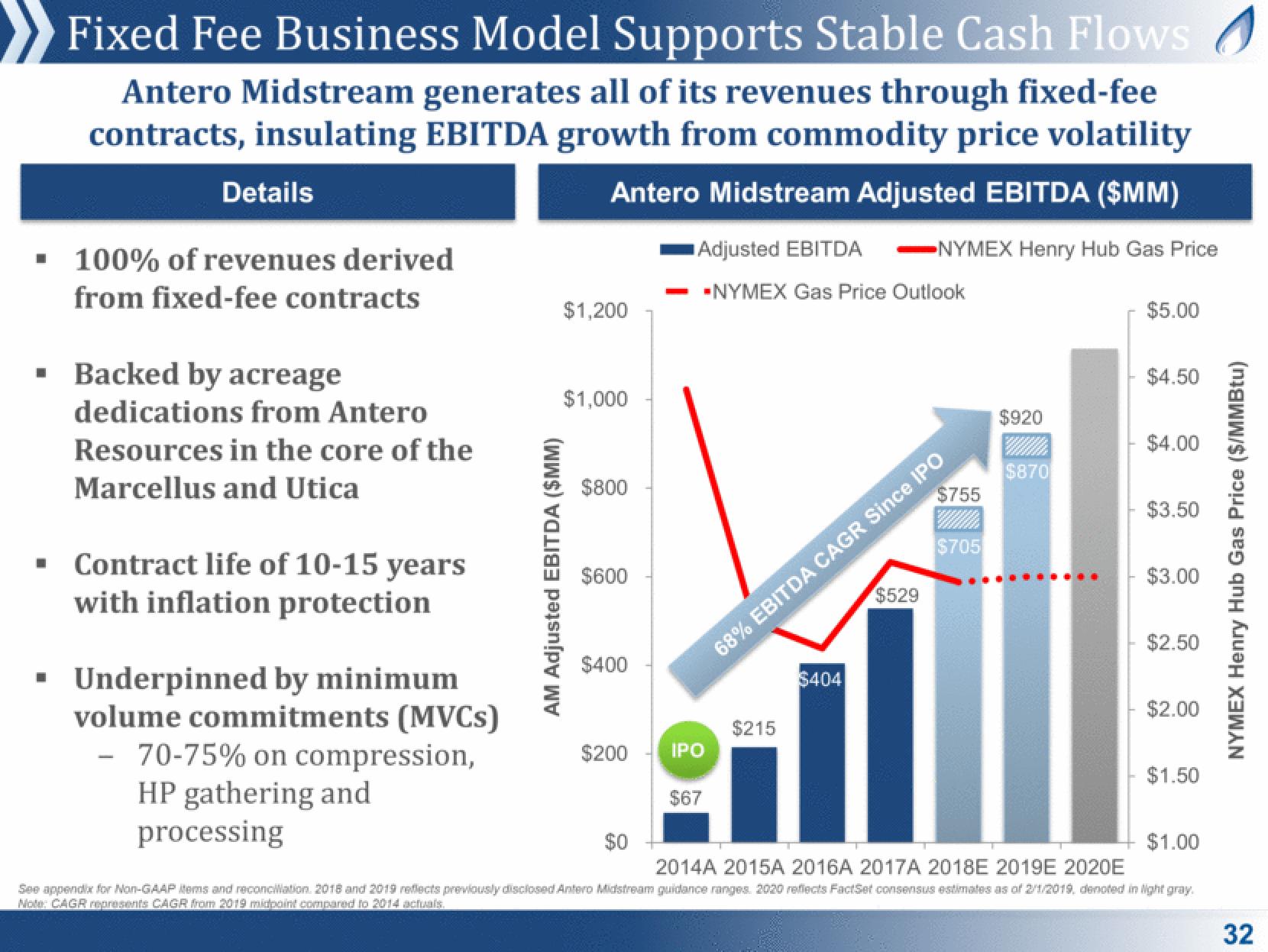

Fixed Fee Business Model Supports Stable Cash Flows

Antero Midstream generates all of its revenues through fixed-fee

contracts, insulating EBITDA growth from commodity price volatility

Antero Midstream Adjusted EBITDA ($MM)

Details

▪ 100% of revenues derived

from fixed-fee contracts

▪ Backed by acreage

dedications from Antero

Resources in the core of the

Marcellus and Utica

▪ Contract life of 10-15 years

with inflation protection

Underpinned by minimum

volume commitments (MVCS)

70-75% on compression,

HP gathering and

processing

-

AM Adjusted EBITDA ($MM)

$1,200

$1,000

$800

$600

$400

$200

$0

Adjusted EBITDA -NYMEX Henry Hub Gas Price

▪NYMEX Gas Price Outlook

IPO

$67

$215

$529

$404

$755

$705

$920

68% EBITDA CAGR Since IPO

$870

$5.00

$4.50

$4.00

$3.50

$3.00

$2.50

$2.00

$1.50

$1.00

2014A 2015A 2016A 2017A 2018E 2019E 2020E

See appendix for Non-GAAP items and reconciation. 2018 and 2019 reflects previously disclosed Antero Midstream guidance ranges. 2020 reflects FactSet consensus estimates as of 2/1/2019, denoted in light gray.

Note: CAGR represents CAGR from 2019 midpoint compared to 2014 actuals.

NYMEX Henry Hub Gas Price ($/MMBtu)

32View entire presentation