Vale Results Presentation Deck

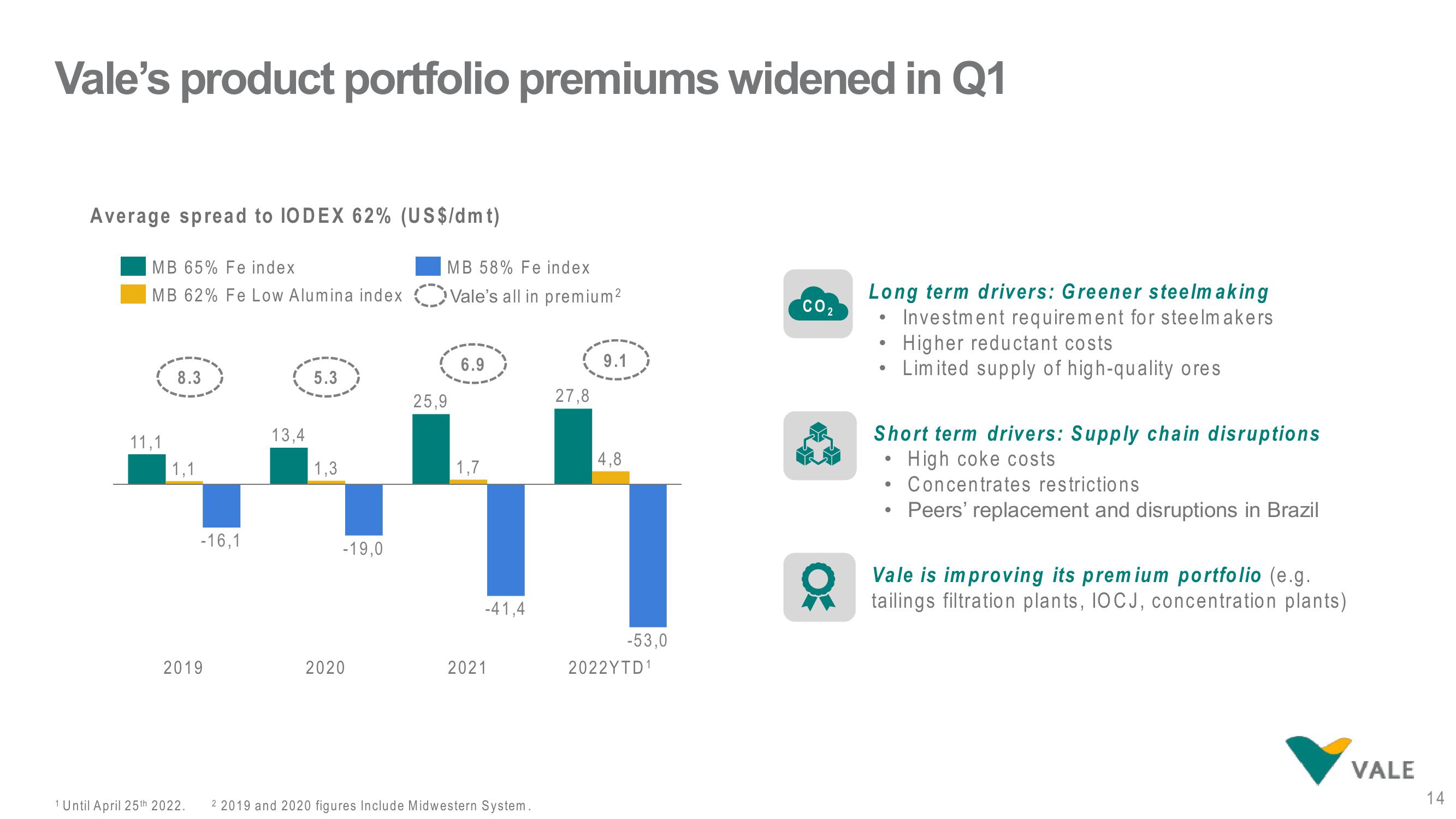

Vale's product portfolio premiums widened in Q1

Average spread to IODEX 62% (US$/dmt)

MB 65% Fe index

MB 62% Fe Low Alumina index

11,1

8.3

1,1

-16,1

2019

13,4

5.3

1,3

-19,0

2020

MB 58% Fe index

Vale's all in premium²

25,9

6.9

1,7

-41,4

2021

1 Until April 25th 2022. 2 2019 and 2020 figures Include Midwestern System.

27,8

9.1

4,8

-53,0

2022YTD¹

CO₂

O

Long term drivers: Greener steelmaking

Investment requirement for steelmakers

●

●

Short term drivers: Supply chain disruptions

High coke costs

Concentrates restrictions

• Peers' replacement and disruptions in Brazil

●

Higher reductant costs

Limited supply of high-quality ores

●

Vale is improving its premium portfolio (e.g.

tailings filtration plants, IOCJ, concentration plants)

VALE

14View entire presentation